CIMA Certification Exam F2 has been designed to measure your skills in handling the technical tasks mentioned in the certification syllabus

W and Y are very similar entities with the same level of profit before interest and tax. However, W has gearing of 95% and Y has gearing of 30%.

Which of the following statements is true?

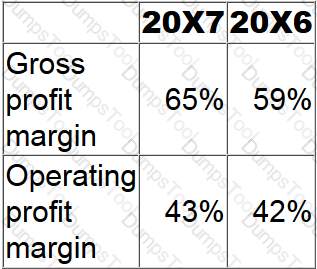

Ratios calculated from the financial statements of ST Group for the years ended 31 August 20X7 and 20X6 are as follows:

Which of the following would have contributed to the movements in these ratios?

The IAS definitions of financial instruments dictate their classification between debt and equity. Which of of the following factors might this classification impact?

Select ALL that apply.

Which TWO of the following are relevant ethical considerations when selecting an accounting policy?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

Customers Passed

CIMA F2

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

DumpsTool Practice Questions provide you with the ultimate pathway to achieve your targeted CIMA Exam F2 IT certification. The innovative questions with their interactive and to the point content make your learning of the syllabus far easier than you could ever imagine.

DumpsTool Practice Questions are information-packed and prove to be the best supportive study material for all exam candidates. They have been designed especially keeping in view your actual exam requirements. Hence they prove to be the best individual support and guidance to ace exam in first go!

CIMA CIMA Management F2 PDF file of Practice Questions is easily downloadable on all devices and systems. This you can continue your studies as per your convenience and preferred schedule. Where as testing engine can be downloaded and install to any windows based machine.

DumpsTool Practice Questions ensure your exam success with 100% money back guarantee. There virtually no possibility of losing CIMA CIMA Management F2 Exam, if you grasp the information contained in the questions.

DumpsTool professional guidance is always available to its worthy clients on all issues related to exam and DumpsTool products. Feel free to contact us at your own preferred time. Your queries will be responded with prompt response.

DumpsTool tires its level best to entertain its clients with the most affordable products. They are never a burden on your budget. The prices are far less than the vendor tutorials, online coaching and study material. With their lower price, the advantage of DumpsTool F2 F2 Advanced Financial Reporting Practice Questions is enormous and unmatched!

DumpsTool products focus each and every aspect of the F2 certification exam. You’ll find them absolutely relevant to your needs.

DumpsTool’s products are absolutely exam-oriented. They contain F2 study material that is Q&As based and comprises only the information that can be asked in actual exam. The information is abridged and up to the task, devoid of all irrelevant and unnecessary detail. This outstanding content is easy to learn and memorize.

DumpsTool offers a variety of products to its clients to cater to their individual needs. DumpsTool Study Guides, F2 Exam Dumps, Practice Questions answers in pdf and Testing Engine are the products that have been created by the best industry professionals.

The money back guarantee is the best proof of our most relevant and rewarding products. DumpsTool’s claim is the 100% success of its clients. If they don’t succeed, they can take back their money.

DumpsTool F2 Testing Engine delivers you practice tests that have been made to introduce you to the real exam format. Taking these tests also helps you to revise the syllabus and maximize your success prospects.

Yes. DumpsTool’s concentration is to provide you with the state of the art products at affordable prices. Round the year, special packages and discounted prices are also introduced.