Which of the following actions should XY's management take in order to reduce its investment in working capital?

AB, a listed entity, prepared its financial statements to 31 December 20X7, in accordance with international accounting standards.

Which THREE of the following were disclosed as related parties of AB in its financial statements?

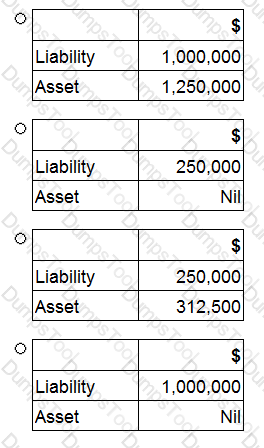

EF obtained a government licence, free of charge, to operate a silver mine in 20X7 and $5 million was spent on preparing the site. The mine commenced operation on 1 January 20X8. The licence requires that at the end of the mine's useful life of 20 years, the site above ground must be reinstated to its original position.

EF estimated that the cost in 20 years' time of this reinstatement will be $3 million, which has a present value of $1 million at 1 January 20X8.

Which THREE of the following describe how the cost of the reinstatement of the site should be treated in the financial statements of EF in the year ended 31 December 20X8?

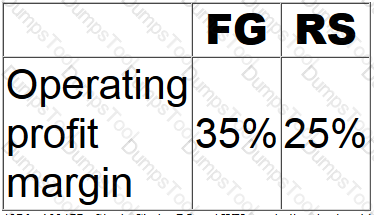

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

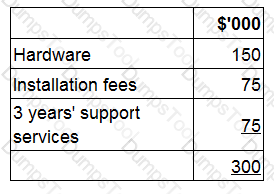

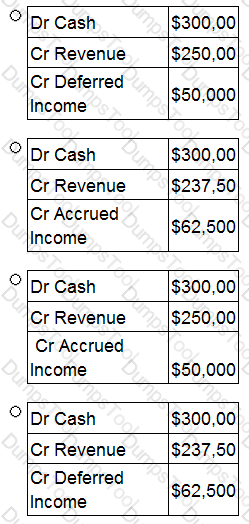

PQ entered into a $300,000 contract on 1 January 20X9 to provide computer hardware to WX with support services for the 3 years from the date of installation.

The contract is made up as follows:

The hardware was delivered to WX on 1 January 20X9 and installed immediately. WX paid the full value of the contract on 30 June 20X9.

What journal entry records PQ's revenue from this contract for the year ended 31 December 20X9?

AB acquired an investment in a debt instrument on 1 January 20X5 at its nominal value of $25,000, which it intends to hold until maturity. The instrument carried a fixed coupon interest rate of 5%, payable in arrears. Transactions costs of $5,000 were paid in respect of this investment. The effective interest rate applicable to this instrument was estimated at 9%.

Calculate the value of this investment that AB will include in its statement of financial position at 31 December 20X5.

Give your answer to the nearest whole number.

$ ?

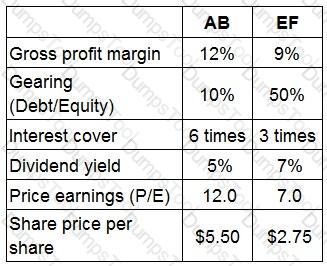

AB and EF are located in the same country and prepare their financial statements to 31 October in accordance with International Accounting Standards. EF supplies AB with a component that is vital to AB's product range. AB is considering acquiring a controlling interest in EF by 31 December 20X4 in order to guarantee future supply. The Board of EF has indicated that such an approach would be postively considered. AB would use its control to make AB the sole customer of EF.

The Finance Director of AB has been granted access to EF's management accounts and has conducted some initial analysis from the financial press. The results togther with comparisons for AB for the year to 31 October 20X4 are presented below:

AB and EF are forecasting revenues of S1,500,000 and $700,000 respectively for the year ended 31 October 20X5.

AB's Finance Director met with one of the directors of EF to discuss the potential impact of the acquisition.

Which of the director's statements below is correct?

LM is preparing its consolidated financial statements for the year ended 30 April 20X5. During the year LM acquired 30% of the equity shares of AB giving it significant influence over AB.

LM conducted ratio analysis comparing the financial performance of the group for 30 April 20X4 and 20X5.

Which of the following ratios would not be comparable as a result of the acquisition of AB?

The dividend yield of ST has fallen in the year to 31 May 20X5, compared to the previous year.

The share price on 31 May 20X4 was $4.50 and on 31 May 20X5 was $4.00. There were no issues of share capital during the year.

Which of the following should explain the reduction in the dividend yield for the year to 31 May 20X5 compared to the previous year?

GG's gearing is currently 50% compared to the industry average of 40% (both measured as debt/equity). GG's debt is all in the form of a single bank loan that is repayable in five years' time. The directors of GG are seeking to raise finance for a new project and they are considering an additional bank loan from the same bank.

Which of the following would prevent the bank from lending the finance for the project in the form of a new bank loan?

Information from the financial statements of an entity for the year to 31 December 20X5:

The gearing ratio calculated as debt/equity and interest cover are:

Which TWO of the following are relevant ethical considerations when selecting an accounting policy?

The IAS definitions of financial instruments dictate their classification between debt and equity. Which of of the following factors might this classification impact?

Select ALL that apply.

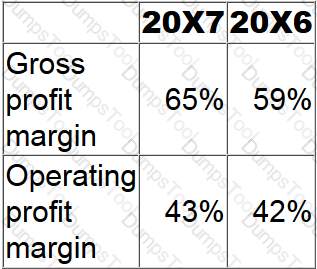

Ratios calculated from the financial statements of ST Group for the years ended 31 August 20X7 and 20X6 are as follows:

Which of the following would have contributed to the movements in these ratios?

W and Y are very similar entities with the same level of profit before interest and tax. However, W has gearing of 95% and Y has gearing of 30%.

Which of the following statements is true?

How would KL account for its investment in MN in its consolidated financial statements for the year to 31 December 20X9?

CD has 200,000 equity shares with a current market value of $2.50 each. The annual dividend of $0.50 a share is about to be paid.

CD also has redeemable debt with a nominal value of $100,000. This is currently trading at $90 for each $100 of nominal value.

The cost of equity is 20% and the post tax cost of debt is 6%.

What is CD's weighted average cost of capital?

Give your answer in % to one decimal place.

? %

LM acquired 15% of the equity share capital of ST on 1 January 20X6 for $18 million. LM acquired a further 50% of the equity share capital of ST for $50 million on 1 January 20X7 when the fair value of ST's net assets was $82 million. The original 15% investment in ST had a fair value of $20 million at 1 January 20X7. The non controlling interest in ST was measured at its fair value of $30 million at the date control in ST was acquired.

Calculate the goodwill arising on the acquisition of ST that LM included in its consolidated financial statements at 31 December 20X7.

Give your answer to the nearest $ million.

$ ? million

FG acquired 75% of the equity share capital of HI on 1 September 20X3.

On the date of acquisition, the fair value of the net assets was the same as the carrying amount, with the exception of a contingent liability disclosed by HI and relating to a pending legal case. At 1 September 20X3, the contingent liability was independently valued at $1.2 million.

At the current year end, 31 March 20X5, the legal case is still outstanding. The fair value of the liability has now been estimated at $1.4 million, and the case is expected to be resolved in the forthcoming financial year.

How should this contingent liability be recorded in the consolidated financial statements for the year ended 31 March 20X5?

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

LM is a car dealer that is supplied inventory by car manufacturer SQ. Trading between LM and SQ is subject to a contractual agreement. This agreement states the following:

• Legal title of the cars remains with SQ until they are sold by LM to a third party.

• Upon notification of sale to a third party by LM, SQ raises an invoice at the price agreed at the original date of delivery to LM.

• LM has the right to return any car at any time without incurring a penalty.

• LM is responsible for insuring all of the cars on its property.

When considering how these cars should be accounted for, which THREE of the following statements are true?

Which of the following would cause a deferred tax balance to be included in the statement of financial position for an entity?

Which THREE of the following statements are true in relation to financial assets designated as fair value through profit or loss under IAS 39 Financial Instruments: Recognition and Measurement?

MNO is listed on its local stock exchange. It has a high level of gearing compared to the industry average as a result of rapid expansion funded by debt. The directors of MNO would like to reduce the level of gearing by raising equity to fund the next expansion project. The directors are considering whether to use a placing of new shares or a rights issue.

Which of the following statements is true?

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to poor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31 December 20X7 would recognise deferred tax balances of:

XY has a weighted average cost of capital (WACC) of 10% based on its gearing level (measured as debt/debt+equity) of 40%. It is considering a signficant new project.

In which of the following situations would it be appropriate to appraise this project using XY's existing WACC of 10%?

ST acquired two financial investments in the year to 31 December 20X8. One of these investments was initially classified as held for trading, the other as available for sale. ST remeasured both investments at fair value at 31 December 20X8 in accordance with IAS 39 Financial Instruments: Recognition and Measurement. The resulting gains were calculated as follows:

• Gain on held for trading investment $50,000

• Gain on available for sale investment $40,000

What was the value of the gain that ST presented in its other comprehensive income when it prepared its financial statements for the year to 31 December 20X8?

Give your answer to the nearest $000.

$ ? 000

Which of the following taken independently would explain the reduction in the profits as highlighted by the Chairman's press release?

Which of the following statements is true in respect of ST's gross profit margin based on the information given?

XY acquired 75% of the equity shares of LM on 31 December 20X3. LM acquired 60% of the equity shares of JK on 31 December 20X4 for $950,000. XY measured the non controlling interest in JK at the date of acquisition using the proportionate share of the fair value of the net assets acquired. The fair value of JK's net assets was $850,000 at 31 December 20X4.

What is the value of goodwill that XY will include in its consolidated statement of financial position at 31 December 30X4 in respect of JK as a result of gaining indirect control?

GH's financial statements show the following:

What is the value of the dividend received from the associate to be included in GH's consolidated statement of cash flows for the year?

Give your answer to the nearest $000.

$ ? 000

RS has issued an instrument with a nominal value of $1 million, at a discount of 2.5%, and a coupon rate of 6%. The terms of the issue are that the instrument must either be redeemed at par, at the option of the holder, in three years' time, or alternatively converted into equity shares in RS.

The characteristics of this instrument taken as a whole indicates that it would be classifed as which of the following?

EF acquired a copy machine under a three-year operating lease. EF will pay nothing in year one and then will pay $6,000 in years two and three. The estimated economic useful life of the machine is six years.

Which THREE of the following statements are true in respect of how EF will account for its use of the machine and the associated operating lease payments?

LK acquired 100% of the equity shares of TU on 1 January 20X4. LK disposed of 60% of TU for £2,400,000 on 30 September 20X4. The sale proceeds reflected the fair value of TU's shares on that date.

The remaining 40% shareholding gave LK the ability to exercise significant influence over the activities of TU. TU reported profit of $1,800,000 for the year ended 31 December 20X4 and this accrued evenly throughout the year.

Calculate the investment in associate that will be presented in LK's consolidated statement of financial position as at 31 December 20X4.

Give your answer to the nearest whole $'000.

$ 000