Depositors that fail to deposit the entire amount of tax required by the due date, without reasonable cause for the failure, are subject to a failure-to-deposit penalty of 5% of the undeposited amount if it is:

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

When an employer engages with a leasing company to lease an employee, the employer does NOT:

The reconciliation of an employee federal income tax withholding account occurs when which type of account is balanced?

Which organization should be contacted when placing a stop payment on a check?

All of the following standards demonstrate effective communication techniques EXCEPT:

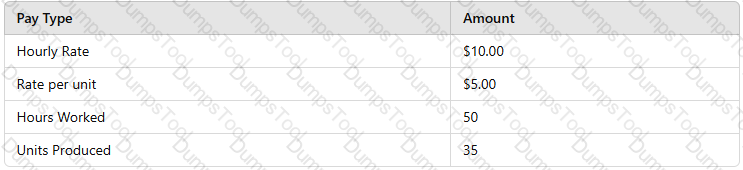

Based on the following information, calculate the employee's gross wages for the workweek under the FLSA.

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

When providing wage data for a workers’ compensation audit, which of the following wage types would be included as compensation?

Which of the following record-keeping storage methods does NOT offer increased confidentiality?

Which of the following amounts is subject to federal income tax withholding?

A company has engaged an individual to write a sales contract. The individual receives a flat amount for the task and has an assigned time frame for completion. This individual is classified as a(n):

Which test is used to determine if an employer-employee relationship exists?

Which of the following general ledger accounts should normally maintain a credit balance?

Specifying a defined response time for an employee's payroll-related question is a component of a Payroll Department’s:

Under the CCPA, use the following information to calculate the MAXIMUM child support order deduction allowed for an employee supporting a second family and in arrears.

Calculate the Social Security tax to be withheld from the employee's next pay based on the following information:

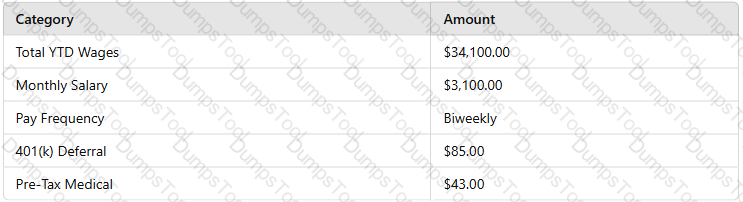

Using the following information, calculate the social security tax to be withheld.

Failure to create a payroll ACH file is a violation of which customer service principle?

When an information return is filed after August 1st of the same year, the penalty amount per form is:

An employee has YTD wages in the amount of $250,000.00 and receives a $1,753.00 bonus payment. Using the optional flat rate method, calculate the federal income tax withholding from the bonus payment.

When an employer allocates tips, which of the following statements is TRUE?

All of the following statements are correct regarding independent contractors EXCEPT that they:

To identify an out-of-balance general ledger account, all of the following documents should be used EXCEPT:

An employee clocked in for work at 8:07 a.m. and out at 4:08 p.m. According to the DOL policy on rounding work hours, which of the following recorded hours are CORRECT?

To optimize customer service, policies should include attributes which are:

Which of the following circumstances would cause a breach of confidentiality?

Which of the following statements about payments made under workers' compensation benefits is FALSE?