IMA Certification Exam CMA-Strategic-Financial-Management has been designed to measure your skills in handling the technical tasks mentioned in the certification syllabus

Discuss whether QDD stock provided a return that was Better, worse, or the same as its investors would have expected using CAPM snow your calculations

Essay

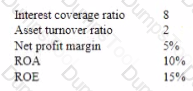

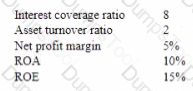

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain me concept of relevant cost in the season-making process and discuss whatever the €200, 000 course development coil is relevant to OLi's price decisions in future years

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.

Identify and explain two ways for AMI to hedge its exchange rate risk.

Essay

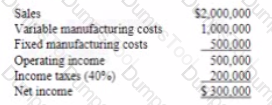

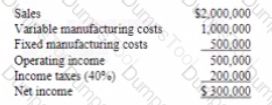

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Identify and explain two risks that Guda may face after it acquires Blue Moon.

Essay

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Define the term structure of interest rates and explain now it could impact QDD's objective of obtaining the lowest coupon rate

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Customers Passed

IMA CMA-Strategic-Financial-Management

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

DumpsTool Practice Questions provide you with the ultimate pathway to achieve your targeted IMA Exam CMA-Strategic-Financial-Management IT certification. The innovative questions with their interactive and to the point content make your learning of the syllabus far easier than you could ever imagine.

DumpsTool Practice Questions are information-packed and prove to be the best supportive study material for all exam candidates. They have been designed especially keeping in view your actual exam requirements. Hence they prove to be the best individual support and guidance to ace exam in first go!

IMA CMA Certification CMA-Strategic-Financial-Management PDF file of Practice Questions is easily downloadable on all devices and systems. This you can continue your studies as per your convenience and preferred schedule. Where as testing engine can be downloaded and install to any windows based machine.

DumpsTool Practice Questions ensure your exam success with 100% money back guarantee. There virtually no possibility of losing IMA CMA Certification CMA-Strategic-Financial-Management Exam, if you grasp the information contained in the questions.

DumpsTool professional guidance is always available to its worthy clients on all issues related to exam and DumpsTool products. Feel free to contact us at your own preferred time. Your queries will be responded with prompt response.

DumpsTool tires its level best to entertain its clients with the most affordable products. They are never a burden on your budget. The prices are far less than the vendor tutorials, online coaching and study material. With their lower price, the advantage of DumpsTool CMA-Strategic-Financial-Management CMA Part 2: Strategic Financial Management Exam Practice Questions is enormous and unmatched!

DumpsTool products focus each and every aspect of the CMA-Strategic-Financial-Management certification exam. You’ll find them absolutely relevant to your needs.

DumpsTool’s products are absolutely exam-oriented. They contain CMA-Strategic-Financial-Management study material that is Q&As based and comprises only the information that can be asked in actual exam. The information is abridged and up to the task, devoid of all irrelevant and unnecessary detail. This outstanding content is easy to learn and memorize.

DumpsTool offers a variety of products to its clients to cater to their individual needs. DumpsTool Study Guides, CMA-Strategic-Financial-Management Exam Dumps, Practice Questions answers in pdf and Testing Engine are the products that have been created by the best industry professionals.

The money back guarantee is the best proof of our most relevant and rewarding products. DumpsTool’s claim is the 100% success of its clients. If they don’t succeed, they can take back their money.

DumpsTool CMA-Strategic-Financial-Management Testing Engine delivers you practice tests that have been made to introduce you to the real exam format. Taking these tests also helps you to revise the syllabus and maximize your success prospects.

Yes. DumpsTool’s concentration is to provide you with the state of the art products at affordable prices. Round the year, special packages and discounted prices are also introduced.