The following information relates to ABC.

Which of the following would be a reason for the movement in the trade receivable days?

BC manufactures product X and on 1 February 20X4 started a project to develop a new material for use in its production. The development project is due to be completed by 31 December 20X4 with the new material being used in production from 1 January 20X5. The development project costs have been reliably estimated at $200,000 and it is anticipated that the new material will increase the margin achieved on product X by 20%.

You are a CIMA accountant within BC and are considering how to treat the development costs of $200,000 in the financial statements for the year ended 31 December 20X4.

In accordance with the ethical principle of professional competence and due care, which of the following statements correctly explains how these costs should be accounted for?

KL has just completed their inventory count and has ascertained that the cost value of the inventory is $460,000; this was made up of 10,000 units of component part FF.

A week before the year end the FF components were moved to a temporary warehouse.

Two weeks later they were inspected and found to have been damaged by the damp conditions in the temporary warehouse.

Of the 10,000 units 2,500 of them were damaged. After remedial work of $5.00 per unit KL anticipates they will be able to sell the damaged parts for $32.00 per unit.

What is the value for closing inventory to be included in the financial statements of KL?

Give your answer to the nearest $.

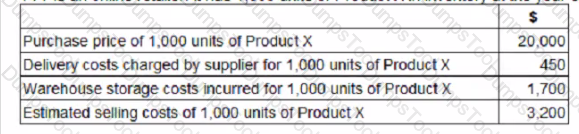

T T T is an online retailer. It has 1,000 units of Product X in inventory at the year end. The following information relates to Product X:

c

c

What is the amount that should be included in the cost of TTT's inventory of Product X?

An entity had a current tax liability of $187,000 in its statement of financial position as at 30 September 20X5. It was subsequently negotiated and eventually agreed with the tax authorities that the entity would pay $192,000 and this was paid on 6 January 20X6.

The entity's management estimate that the tax due on profits for the year to 30 September 20X6 is $231,000.

Calculate the entity's corporate income tax expense included in its statement of profit or loss for the year ended 30 September 20X6.

Give your answer to the nearest whole $000.

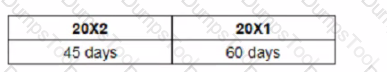

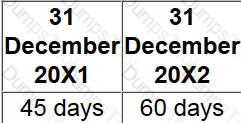

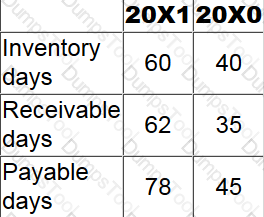

EFG prepares financial statements to 31 December each year. EFG has the following receivable days based on the year end receivable balances:

Which of the following would be a reason for this decrease in receivable days?

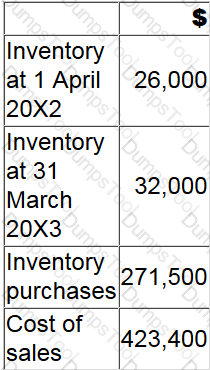

The following data has been extracted from GH's accounting records:

What is GH's average inventory days for the year ended 31 March 20X3?

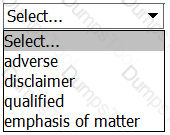

The auditor has identified a material but not pervasive mis-statement whilst undertaking the external audit of an entity's financial statements.

This will result in a modified audit report with the opinion being .

DE purchased an asset on 1 January 20X1 for $60,000 with a useful economic life of six years and a residual value of $3,000.

DE uses straight line depreciation for this asset.

On 31 December 20X3 the asset has a value in use of $ $28,000 and a fair value of $26,000.

Which of the following values should be used for the asset in DE's statement of financial position as at 31 December 20X3?

An entity bought a capital item for $110,000 on 1 March 20X4 incurring legal fees at the date of purchase of $2,500.

On 1 May 20X4 additional costs classified as capital expenditure by the tax rules of the country of $25,000 were incurred in respect of the asset. On 1 June 20X4 repairs not classified as capital expenditure were incurred at a cost of $15,000.

The asset was sold for $250,000 on 30 November 20X8 and costs to sell were incurred of $4,300.

Calculate the chargeable gain on the disposal.

Give your answer to the nearest $.

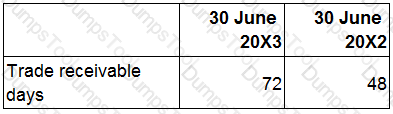

AB has been asked to analyze the receivables days of an entity with a view to improving the working capital cycle.

The following results have been produced for receivable days:

Which of the following is NOT an explanation of why the days have increased?

Which of the following would be capitalized as an intangible asset in accordance with IAS 38 Intangible Assets?

An entity opens a new factory and receives a government grant of $25,000 towards the cost of new plant and equipment. This new plant and equipment originally costs $100,000.

The entity uses the net cost method allowed by IAS 20 Accounting for Government Grants and Disclosure of Government Assistance to record government grants of this nature. All plant and equipment is depreciated at 20% a year on a straight line basis.

Calculate the amount of depreciation to be included for this plant and equipment in the statement of profit of loss for the factory's first year of operation.

Give your answer to the nearest whole $.

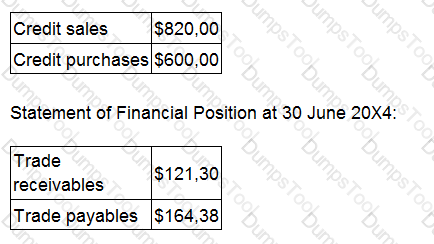

The following data relates to Company AB.

Statement of Profit or Loss for the year ended 30 June 20X4:

During the year ending 30 June 20X4, which was not a leap year, the average stock holding period was 102 days.

Calculate the working capital cycle in days.

Give your answer to the nearest full day.

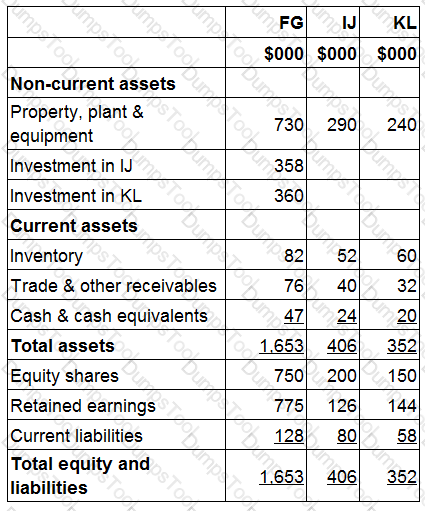

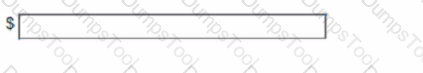

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the value of property, plant and equipment to be recognized in FG's consolidated statement of financial position at 31 December 20X5.

Give your answer to the nearest whole $.

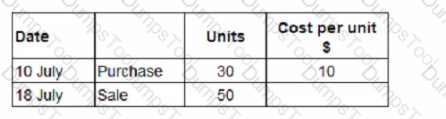

On 1 July 20X8 JKL has 100 units of inventory, which cost $8 each. The following transactions arose during the month of July:

JKL values inventory using the first in. first out method.

What is the value of JKL's inventory at 31 July 20X8?

Give your answer to the nearest $.

Which THREE of the following are principles identified by the Code of Ethics?

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the amount of retained earnings that will be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

An entity has a number of subsidiary and associate investments.

Which of the following must be disclosed in the entity's separate financial statements if it is exempt from presenting consolidated financial statements?

Which of the following is NOT a reason why financial reporting information needs to be regulated?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31 December 20X4 in relation to Interest and Corporate income tax?

On 1 January 20X6 PQR leases equipment for 3 years to use on a construction project. The total lease payments are $360,000 divided into 36 monthly instalments of $10,000 On 1 January 20X6 the present value of the lease payments is $270,000 and initial direct costs of $3,000 were incurred.

Which THREE of the following statements are true?

XY is an entity incorporated in Country B but operates in several countries. Monthly management meetings to decide on strategic matters take place in Country A, where the majority of its production happens. XY sells most of its goods to Country C.

In accordance with the Organization for Economic Co-operation and Development (OECD) rules on corporate residence which of the following statements is true?

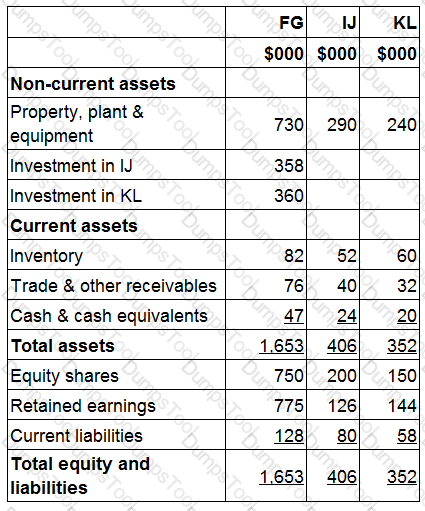

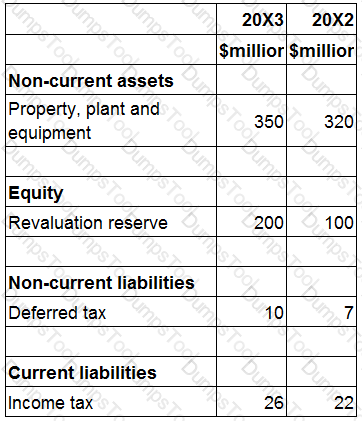

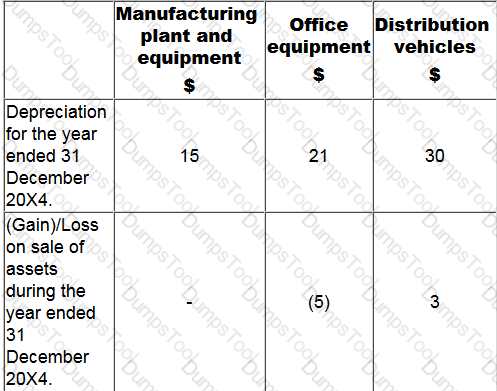

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What figure should be included for corporate income tax paid in order to arrive at the net cash flow from operating activities?

Give your answer to the nearest $ million.

It costs PWR £7.50 to produce product H, per product. Product H is typically sold for £89.99. It costs £5.00 to package product H and £15 to deliver product H to customers.

PWR is currently selling faulty versions of product H from a defunct batch, (let's call this version product I), for 25% of the original price.

Which of the below options represent the correct inventory price for product I?

YZ has $40,000 of plant and machinery which was acquired on 1 June 20X1.Tax depreciation rates on plant and machinery are 25% reducing balance. All plant and machinery was sold for $24,000 on 1 June 20X3.

Calculate the tax balancing allowance or charge on disposal for the year ended 31 May 20X3 and state the effect on the taxable profit.

PZ has the following working capital ratios:

Which of the following could be the reason for the movements?

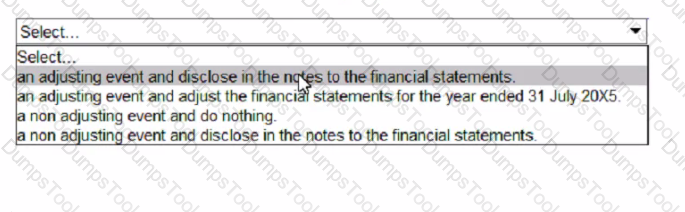

AB has prepared its financial statements for the year ended 31 July 20X5. On 15 September 20X5 a major fraud was uncovered by the external auditors which had taken place during the year to 31 July 20X5 The financial statements have not yet been authorised

In accordance with IAS 10 Events After the Reporting Period, AB should treat the fraud as:

Which of the following would NOT be a source of taxation rules for a country?

UV's financial statements for the year ended 31 March 20X8 were approved for publication on 30 June 20X8.

In accordance with IAS 10 Events After the Reporting Period, which of the following material events would have been classified as a non-adjusting event in these financial statements?

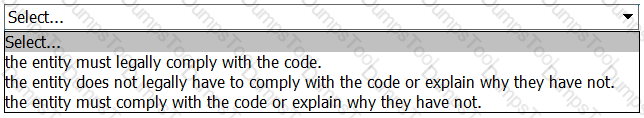

The United Kingdom (UK) uses a principle based approach to corporate governance which means:

EF purchased an asset on 1 September 20X4 for $800,000, exclusive of import duties of $30,000. EF is resident in country Y where indexation is allowed on purchase costs when the asset is disposed of.

EF sold the asset on 31 August 20X9 for $1,500,000 incurring transaction charges of $20,000. The indexation factor increased by 40% in the period from 1 September 20X4 to 31 August 20X9.

Capital gains are taxed at 30%.

What is the tax due on disposal of the asset?

Which THREE of the following statements about government grants are INCORRECT?

Which TWO of the following are functions of the International Financial Reporting Standards (IFRS) Advisory Council?

From the list below identify the item that appears in the statement of financial position.

Entity RH has an recognised a taxable profit of $1.Smillion for 20X1'. In Entity RH's resident country. Country M, depreciation charges and entertaining expenses are disallowed expenses. Below is some information on

Entitry RH's outgoings for the period:

Depreciation charged on PPE: $450,000

Political donations: $155,000

Staff parties: $3,200

Cost of updating assets: $10,000

Other expenses: $83,500

In Country M, there is a standard corporation tax of 12% charged on all corporation profits. What is Entity RH's total tax liability for this period?

The external auditors have completed their audit and have discovered a material but not pervasive error in the financial statements of JK.

The directors of JK have refused to change the financial statements.

What type of modified audit report should be issued?

STU commenced trading on 1 January. Total sales for the month of January were $250,000. which were 75% on credit and 25% for cash. Sales are expected to increase by 10% a month Irrecoverable debts are estimated to be 5% of credit sales Of the credit sales expected to pay, 50% pay in the month following the sale and the remaining 50% the month after.

The cash expected to be received in February is:

HI commenced business on 1 April 20X3. Sales in April 20X3 were $30,000. This is forecast to increase by 2% per month.

Credit sales accounted for 50% of sales. Credit sales customers are allowed one month to pay; 75% of April credit customers paid on time. A further 20% are expected to pay after more than one month, but before two months. The remaining 5% are not expected to pay. All these percentages are expected to continue in the near future.

Calculate the total amount of cash HI should forecast to be received in June 20X3.

Give your answer to the nearest whole $.

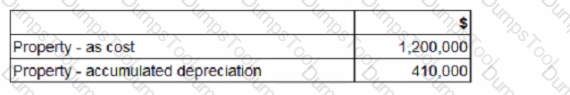

At 31 December 20X4 the directors of MNO decide to revalue its property. Before revaluation adjustments the balances relating to property are as follows:

The property has been revalued at $1,600,000.

How much will be included within MNO's statement of financial position at 31 December 20X4 for revaluation surplus?

KL has S90.000 of plant and machinery which was acquired on 1 June 20X4. Tax depreciation rates on plant and machinery are 20% reducing balance. All plant and machinery was sold for 560,000 on 1 June 20X6

Calculate the tax balancing allowance or charge on disposal tor the year ended 31 May 20X7 and state the effect on the taxable profit.

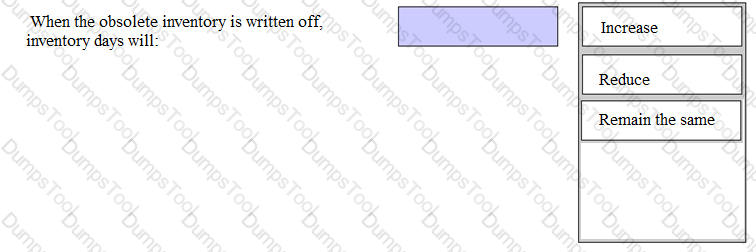

An entity's inventory days are 45 days.

An entity ceased to manufacture a product in 20X4. Raw materials used solely in the manufacture of that product are still held in inventory at 31 December 20X4.

Place the appropriate response below to show how inventory days will be affected if this raw material inventory is written off as obsolete.

LM is preparing its cash forecast for the next three months.

Which of the following items should be left out of its calculations?

For the year ending 31 March 20X2, MN made an accounting profit of $120,000. Profit included $8,500 of political donations which are disallowable for tax purposes and $8,000 of income exempt from taxation.

MN has $15,000 of plant and machinery which was acquired on 1 April 20X0 and purchased a new machine costing $25,000 on 1 April 20X1. This new machine is entitled to first year allowances of 100% instead of the usual tax depreciation of 20% reducing balance. All plant and machinery is depreciated in the accounts at 10% on cost.

MN also has a building that cost $120,000 on 1 April 20X0 and is depreciated in the accounts at 4% on a straight line basis. Tax depreciation is calculated at 3% on a straight line basis.

Calculate the taxable profit.

Give your answer to the nearest $.

Why are excise duties an attractive method of raising tax for governments?

Select TWO that apply.

EF has been offering its customers a 60 day credit period, but now wants to improve its cash flow.

EF is proposing to offer a 2% discount for payment in 15 days.

Assume a 365 day year and an invoice value of $100.

Which of the following is the effective annual interest rate EF will incur for this action?

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered in the Statement of Profit or Loss for the year ended 31 December 20X4 in relation to Administration and Distribution costs?

Which of the following is an effect of using equity accounting to include an entity in the consolidated statement of financial position of a group?

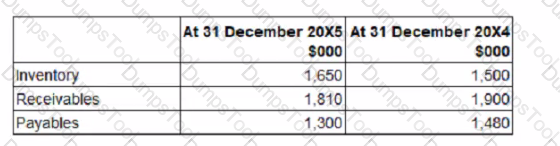

The following information has been extracted from GHI's statement of financial position:

Which of the following is the total cash flow for working capital changes to be recorded in GHI's statement of cash flows for the year ended 31 December 20X5?

The following information relates to a single asset:

*Original cost of $186,000

*Estimated residual value of $6,000

*Expected useful life of 10 years

*Accumulated depreciation at 31 December 20X5 of $66,960

*Annual depreciation rate of 20% on a reducing balance basis

Calculate the amount of depreciation that should be charged to profit or loss for the year ended 31 December 20X6.

Give your answer to the nearest whole number.

Which of the following methods could be used by a tax authority to reduce tax evasion and avoidance?

JKL prepares its financial statements to 31 December each year. For the year ended 31 December 20X5 inventory was held for 76 days on average.

The directors of JKL decide to reduce the average inventory level to $6.5 million from 1 January 20X6 JKL's revenue for 20X6 is $54 million on which a gross profit margin of 20% is earned.

Assuming that the average receivables and payables days remain constant what will be the effect of the expected reduction in inventory on JKL's working capital cycle for the year ended 31 December 20X6?

EFG purchased an asset on 1 January 20X5 for $24,000. On that date its useful life was 5 years and residual value was expected to be nil. EFG calculates depreciation on a pro-rata basis.

The asset is reclassified as held for sale on 1 October 20X8 and is unsold on 31 December 20X8.

It is expected that the asset will be sold for S6;300 and that selling costs will be S500

What is the amount that this asset will be included at in EFG's statement of financial position at 31 December 20X8?

Give your answer to the nearest $.

While conducting their audit, auditor 0 did not encounter issues which significantly limited the scope of their audit, however they did run into problems in that they disagreed with the management on facts in the

statements.

These disagreements were somewhat material, but they did not affect the auditor's overall opinion of the business. Which of the following statements should auditor 0 issue?

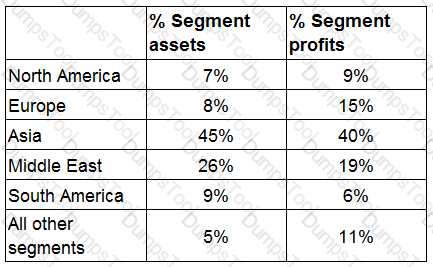

OP has five main geographic segments and reports segmental information in accordance with IFRS 8 Operating Segments.

Which THREE of the following would be regarded as operating segments of OP in accordance with IFRS 8?

MN recently took out a 5 year term loan to buy raw materials to take advantage of a supplier's bulk discount that had been offered to them.

What approach to financing working capital has MN undertaken?

BCD owns an item of plant which cost $20,000 and at the time of purchase was assessed to have a useful economic life of 8 years and a residual value of $2,000

The carrying amount of the plant at 1 January 20X8 is $11,000. On that date BCD's directors estimate that the plant's remaining useful life is now 6 years The residual value remains unchanged at $2,000

What is the depreciation charge for this plant for the year ended 31 December 20X8?

Give your answer to the nearest $.

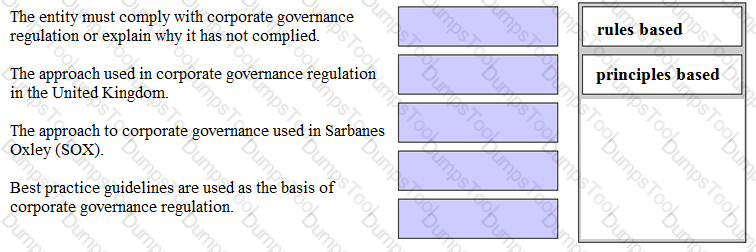

There are two main approaches that a country could adopt in respect of corporate governance regulation - a rules based approach and a principles based approach. Match the following statements with the appropriate approach by placing either rules based or principles based against each of them.

Which of the following statements about trade payables management is false?

ST has an asset that was classified as held for sale at 30 June 20X4. The asset's carrying value was $230,000 and its fair value $210,000.

The cost of disposal was estimated to be $15,000.

In accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations, which of the following values should be used for the asset in the statement of financial position as at 30 June 20X4?

In accordance with IFRS 3 Business Combinations, acquisition accounting of an investment in another entity within the consolidated statement of financial position means that the: