Mahesh earns 1,20,000 pa. He has total debt of Rs. 2,00,000 and have two dependants. Interest rate is 7%, and assumes 80% of his pre-death salary is the estimated requirement to maintain his family after paying the loan. Calculate the life insurance cover needed under multiple approach method.

A portfolio manager is considering buying Rs. 1,00,000 worth of Treasury bills for Rs. 96,211 versus Rs. 100,000 worth of commercial paper for Rs. 95,897. Both securities will mature in nine months. How much additional return will the commercial paper generate over the Treasury bills?

Mr. D'suza is a operations manager in a private company college in Hyderabad. During the previous year 2011-12, he gets the following emoluments:

He gets Rs. 17,500 as reimbursement from his employer in respect of medical expenditure incurred on treatment of his wife in a private clinic. Besides, he gets Rs.12, 300 as reimbursement from the employer in respect of books and journals purchased by him in discharging his official work.

He contributes 11% of his salary to statutory provident fund to which a matching contribution is made by the employer. During the year, he spends Rs.17, 000 for maintaining a car for going to the college. Determine his net income under the head salaries.

Which of the following Mutual Funds was not set up within the Phase 2: 1987-1993 ?

You bought a stock for Rs. 28.29 that paid the following dividends

After the third year, you sold the stock for Rs. 35. What was the annual rate of return?

What is the effective rate of interest for 10% compounded monthly, quarterly, semi-annually?

Sujoy has purchased shares of Rs.12500 of common stock in Hindustan Unilever . He has recently sold investment to the tune of Rs.15000 & received Rs 2500 as cash dividends during the holding period of 4 years. He paid a total of Rs 250 in commissions. What is CAGR on the investment?

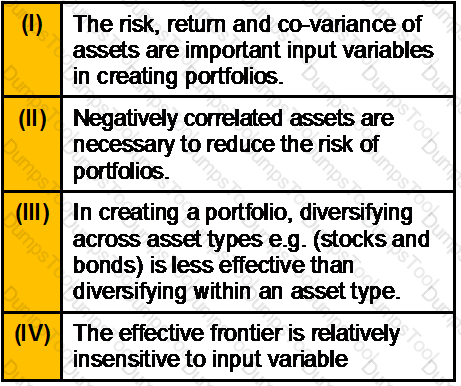

Modern “Asset Allocation” is based upon the model developed by Harry Markowitz. Which of the following statement is/are correctly identified with this Model?

Rahul had invested in an open ended Mutual Fund when the NAV of the fund was Rs. 10. After 6 months the NAV was Rs. 12. Calculate the annualized percentage change in the fund ignoring all charges.

Mr. Vivek Kalra deposits Rs.11,00,000 today in an investment that would pay after 6 years Rs. 1,00,000 per year for 5 years and Rs. 1,50,000 for the next 5 years. What would be the balance in the account after the last payment is made if the ROI is 18% per annum compounded annually.?

Yash pays health insurance premiums for himself, his wife and his two children aged 13 and 8. Premiums for which of these individuals will qualify as deductible from Yash’s taxable income?

If one earns 10% on investment but inflation is 2%, real rate of return is

In book building method, if floor price is set at 100, what can be the maximum price of the cap?

Mr. Rajesh was the owner of an uninsured property. But unfortunetaly the property caught fire because of which he suffered severe financial losses. The reason Mr. Rajesh suffered losses as he did not cover:

The markets for funds traded in currencies other than the currency of the trading country are referred to as

Asit an industrialist wants to buy a car presently costing Rs. 10,00,000/- after 5 years. The cost of the car is expected to increase by 10% pea for the first 3 years and by 6% in the remaining years. Asit wants to start a SIP with monthly contributions in HDFC Top 200 Mutual Fund. You as a CWM expect that the fund would give an average CAGR of 12% in the next 5 years. Please advise Asit the monthly SIP amount starting at the beginning of every month for the next 5 years to fulfill his goal of buying the Car he desires.

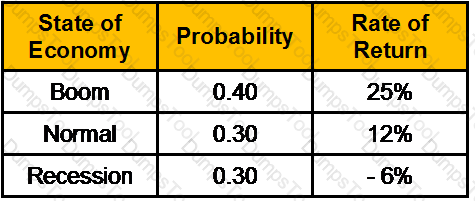

The probability distribution of the rate of return on ABC stock is given below:

What is the standard deviation of return?

Ankur Kalra is 33 years old finance professional. The house hold expenditure of Mr. Kalra is 20,000/- p.m. to maintain his current living standard. He assumes that his living standard will increase 1.5% annually until his retirement at 60. His life expectancy is 70 years. At retirement he needs 75% of his last year’s expenses. Inflation rate for the next 45 years is expected to be 4% p.a.

Calculate how much would Mr. Kalra require in the first year after his retirement, and how much he has to save at end of every year to accumulate this corpus, if the return on investment is 7% p.a.?

If the rates of return from a security are not at all related to the market returns, then the beta for that security will be:

Sum received by an individual as a member of an HUF from the family income is:

Under the efficient market hypothesis, which of the following term best describes the movement of stock prices?

According to the capital asset pricing model, fairly priced securities have __________.

The income received by the approved superannuation fund on the investments made by the fund is

Portfolio A had a return of 12% in the previous year, while the market had an average return of 10%. The standard deviation of the portfolio was calculated to be 20%, while the standard deviation of the market was 15% over the same time period. If the correlation between the portfolio and the market is 0.8, what is the Beta of the portfolio A?

Expenses are 10% of the gross (office) premium. Pure premium is Rs. 200. Calculate office premium.

The second pillar in the Basel framework seeks to help participants to assess which of the following information?

Mr. Kishan owns a factory producing some small spare parts.Under which policy he can get cover against the claim for paying damages and legal costs arising from any bodily injury or damage in the premises of his property ?

Under the Workmen Compensation Policy, when the employment injury results in death, the insurance company pays 40 % of the monthly wages of the deceased multiplied by the relevant factor or Rs. _________ whichever is more.

What is the future value of Rs. 5000 at the end of 5 years at 8% compounded annually?

Accrued Interest on loan for self occupied property is Rs.110000 till 31 March 2010. Loan was taken for construction on 31/07/2006 and construction completed on 03/04/10. Interest for the year 2010-11 is Rs 22000. Determine what interest shall be allowed u/s 24(b) for AY 2011-12

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 50000 at the end of 24 months, if the bank pays 8% annually?

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

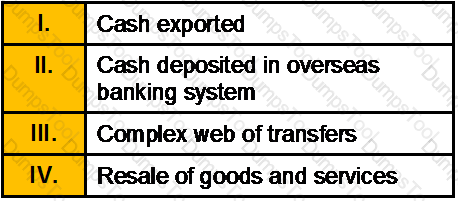

Which of the following transaction /transactions is/are an example of the Layering Stage of Money Laundering?

A central bank sale of ________ to purchase ________ in the foreign exchange market results in an equal rise in its international reserves and the monetary base.

As a CWM you are considering the following bond for inclusion in the fixed income portfolio of your client:

What will be the duration of this bond? and What will be the effect of the changes on the duration of the bond if the coupon rate is 6% rather than 9%?

Which of the following is an inferential data (i.e. data which may not be correctly obtained by simply asking a direct question)?

You have Rs.500,000 available to invest. The risk-free rate as well as your borrowing rate is 8%. The return on the risky portfolio is 16%. If you wish to earn a 22% return, you should __________.

Mr. Dinesh is aged 35 years and has a wife aged 30 years old and two small children. His parents are also dependent on him and has a house against which he has taken a housing loan. What is the most important insurance cover required by him at this stage?

Mr. Hitesh Shah has a portfolio with 23 different equities. The portfolio increased by 20% and has a beta of 1.50. Utilizing the Capital Asset Pricing Model, compute by what percent the market changed (round to nearest 0.5%) (Assume risk free rate of 5%)?

Wills which are not valid in India except in case of privileged wills or in case of Mahomadans are called as:

Rs. 1.50 lakh settled on a trust for the benefit of Akash and Bina for life. They share the income in proportion of 3:2.Their ages on valuation date are 20 years and 16 years. The average annual income for the last three years on the valuation date is Rs. 15,000/-. Find out the value of life interest of Akash and Bina if the value of life interest of Re 1/- at the age of 20 years is 12.273 and at the age of 16 years is 12.534.

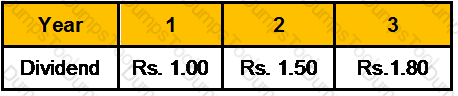

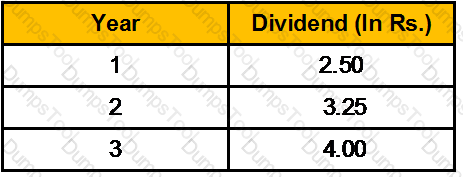

Management has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Pankaj is an employee of a private company in Jabalpur. He draws an amount of Rs 36,000pm as basic salary. He also receives Rs 8000 as HRA. He has taken a house on rent from 1st October and pays Rs 10,000pm as rent for his house accomodation. What would be the taxable HRA?

According to the capital asset pricing model, the expected rate of return on any security is equal to __________.

If POA in respect of in moveable property of value more than ………………….it must be registered

The assessed is charged to income-tax in the assessment year following the previous year:

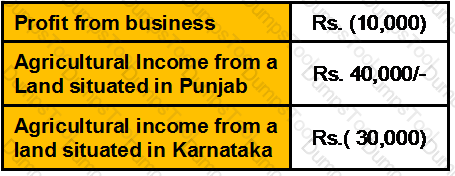

Compute Gross Total income and amount of loss allowed to be carried forward to next year:

The correlation coefficient between returns on stock of M/s X Ltd and the market returns is 0.3. The variance of returns on M/s X Ltd. is 225(%)2 and that for the market returns is 100(%)2 . The risk-free rate of return is 5% and the market return is 15%. The last paid dividend is Rs. 2 and the current purchase price is Rs. 30. The growth rate for the company is 10%. The required rate of return on the security as per the Capital Asset Pricing Model is:

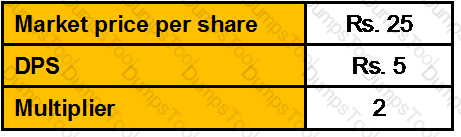

The following information regarding the equity shares of M/s V Ltd. is given

Calculate the EPS of M/s V Ltd. according to the traditional approach

Mr. Munjal has got her daughters son admitted to a dental college today, where he has to pay a fee of Rs. 1.5 Lac today i.e. at the time of admission. Then Rs. 1.75 lacs after 1 year, Rs. 2.5 lacs after 2 years and Rs. 3.25 lacs after 3 years. He wants to set aside the amount required today itself in the form of a Bank FDR.So how much he needs to put aside today if ROI is 8% for 1 year, 8.5% for 2 years and 9% for 3 years, all compounded Quarterly?

What is the surrender value, if the sum assured is Rs. 100,000/-, DOC is 01/01/1997, endowment with profit 25 years, due date of last premium paid 01/01/2010. Premium to be paid semi-annually. Accrued bonus is 500 per thousand of SA. Surrender value factor is 19% ?

A Portfolio manager is holding the following portfolio:

The risk free rate of return is 6% and the portfolio’s required rate of return is 12.5%. The manager would like to sell all of his holdings in stock A and use the proceeds to purchase more shares of stock D. What would be the portfolio’s required rate of return following this change?

Alok a 28 years old person has joined SABH on 1/07/2006. His monthly salary (net salary) after deduction is payable Rs. 22500/. His monthly expenses details are as follows:

Assume Alok takes a flat on rent from 01 /07/2006. On 01 /07/2006 he has cash in hand Rs. 1450/-. He starts paying insurance premium from October @ Rs. 2500/- pm. His investments in Mutual fund SIP are Rs. 3000/- pm for a 6 month period. What will be his cash in hand on 31/03/2007.?

You are considering an investment with the following cash flows. Your required return is 8%, you generally require a payback of 3 years and a discounted payback of 4 years. If your objective is to maximize your wealth, should you take this investment?

Vishal is working with Amex Ltd since October 1, 1997. He is entitled to a basic salary of Rs. 6,000 pm.Dearness Allowance is 40% of Basic Salary for retirement benefits. He retired from his job on December 1,2010 (4 months before the end of F.Y 2010-11) and shifted to his village. He is entitled to the following benefits at the time of retirement. Gratuity = Rs. 98,000. Pension from December 1, 2008 = Rs. 2,000 per month. Payment from recognized PF = Rs. 3,00,000. Encashment of earned leave for 150 days = Rs. 36,000. He was entitled to 40 days leave for every completed year of service. He got 50% of his pension commuted in lump sum w.e.f March 1, 2011 and received Rs. 1,20,000 as commuted pension. Vishal contributes Rs. 900 per month to RPF to which his employer contributes an equal amount. What will be the amount of un-commuted pension for Vishal that will form part of his total income for the A.Y. 2011-12?

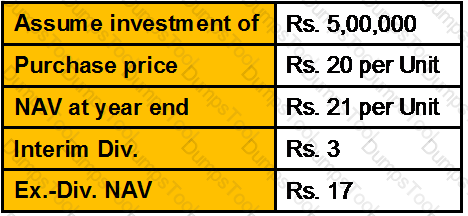

Calculate the total return on the mutual fund investment with the below mentioned information:

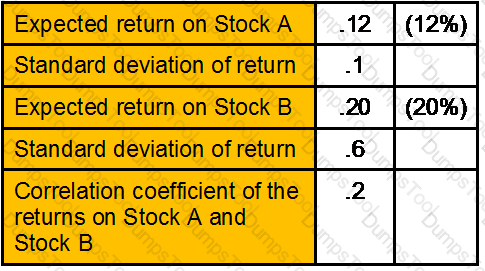

Given the following information:

What is the expected return and standard deviation of the portfolio if 50% of funds invested in each stock? What would be the impact if the correlation coefficient were 0.6 instead of 0.2?

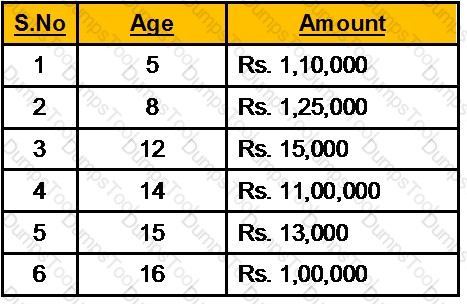

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

R purchased a house property for Rs. 26,000 on 10-5-1962. He gets the first floor of the house constructed in 1967-68 by spending Rs. 40,000. He died on 12-9-1978. The property is transferred to Mrs. R by his will. Mrs. R spends Rs. 30,000 and Rs. 26,700 during 1979-80 and 1985-86 respectively for renewals/reconstruction of the property. Mrs. R sells the house property for Rs. 11,50,000 on 15-3-2007, brokerage paid by Mrs. R is Rs. 11,500. The fair market value of the house on 1-4-1981 was Rs. 1,60,000. Find out the amount of capital gain chargeable to tax for the assessment year 2007-08.

Akash owns a piece of land situated in Kolkata ( Date of acquisition : March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.75 lakh. And X files an appeal under the Stamp Act and Stamp duty valuation has been reduced to Rs. 4.90 lakh by the Kolkata High Cout. [CII-12-13: 852,11-12: 785,10-11:711]

If a testator makes a will ‘to induce another person to make him comply with his (testators) wish’ but does not have any testamentary operation or intention, then this will is called as

What is the prudent practice for parking emergency fund for a working young couple?

Which of the following costs best describes the cost of foregone income that results from making an economic decision to use funds to purchase a piece of equipment?

"A borrower defaults on a secured loan of Rs. 50,000. The underlying security is worth Rs. 60,000. Which of the following is true? "

All stock market indexes are most accurately characterized by which of the following statements about the degree to which they co-vary together?

At the beginning of 2006 you have invested Rs 2000 in 40 Shares of ABC Ltd. During the year you received dividends @ 7 per share. At the end of 2006 you expect to sell share for Rs. 59. Compute return?

Which of the following is not true about traditional defined benefit plans?

Difference between coparceners & member is that coparcener can demand partition of an HUF

Manish has two house properties. Both are self occupied. The annual value of:

Which of the following taxes are allowed as deduction while computing the business income?

If you have deposited Rs.4000 with a company and the company wishes to prepay the deposit at the contracted rate of interest after a period of 3.5 years and offers you Rs.4985, what is the effective rate of interest if it is accounted half yearly?

Calculate the Net worth of Mr. Surinder Nath with the following financial details as:

Calculate premium payable for term insurance policy of Rs. 10 lacs, for a group of 278 people of 39 years of age. The Mortality Table shows that in this age group 2,681 people die every year in a group of 12,50,000.

Ranbir deposits Rs. 80000 as a lump sum amount in a immediate annuity. He will receive annuity on a monthly basis for next one year. Determine the monthly amount he is entitled to receive. The rate of interest is 15%

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

A doctor has taken a professional indemnity Policy on 01/06/2003 and has been continuously renewing it. In August, 2006 he operated on an infant child. But that operation failed. The parent of child filed a law suit against doctor in Sept, 2006. Which of the following statement is true in respect of the claim?

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be

Intermediaries who are agents of investors and match buyers with sellers of securities are called

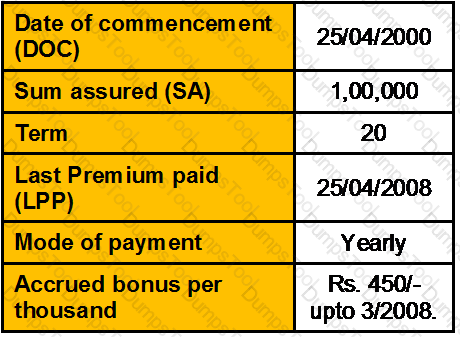

From the following information:

The Surrender value is 43% of the paid up value and loan is available at 85% of surrender value.

Calculate paid up value, surrender value, and loan value

Tushar owns a piece of land situated in Patna (Date of acquisition: March 1, 1983, Cost of acquisition Rs. 20,000/- value adopted by Stamp duty authority at the time of purchase Rs. 45,000/-) On March 30, 2012 the piece of land is transferred for 4 lakh. Find out the capital gains chargeable to tax if the value adopted by the Stamp duty authority is 5.60 lakh. And X does not challenges it under the Stamp Act. However, he claims before the Assessing Officer that Rs. 5.60 lakh is more than the fair market value of the land. The assessing Officer refers it to the valuation Officer who determines Rs. 6.10 lakh as fair market value. [CII-12-13: 852,11-12: 785,10-11:711]

Mahesh has invested Rs. 72,000/- @ 5% p.a. in a bank deposit. After 7 years ROI changes 5% p.a. computed half yearly. After further period of 3 years rate again changes to 6% p.a. compounded quarterly. What will he get after 15 years of commencement?

In case of a defined benefit plan where the benefit payable is based on the terminal salary, an increase in of 10% of the wages of the employees would increase the contribution to be made by the employer for the benefit by

A trust is created by a son, the Settlor, for the survival expenses of his retired parents each having equal beneficial interest. Both husband and wife have separate fixed pension of Rs.35,000 per month and Rs. 20,000 per month, respectively. The trust property has generated a net annual value of Rs. 5.12 lakh in the previous year 2012-13. The trustee as well as the Settlor is in the 30% tax bracket. Find the tax payable by the trustee as representative assessee.

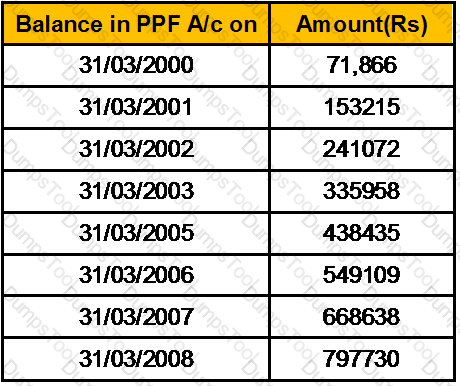

Dinesh has opened his PPF account on 19/11/1999, Calculate the amount he can avail as the first withdrawal facility from the details below?

The relevant banking ombudsman for filing a complain regarding credit card with central processing is the one under whose jurisdiction __________.

Mr. Shivam Sharma expects to receive Rs 25000 in net receipts each year for five year and to sell the property for Rs 350,000 at the end of the five-year period, if Mr. Sharma expects a 15% return, what would be the value of the property?

If a Rs. 100 par value preferred stock pays an annual dividend of Rs. 5 and comparable yields are 10 percent, the price of this preferred stock will be

The difference between aggregate disbursements net of debt repayments and recovery of loans and revenue receipts and non debt capital receipts is called:

_______________ and _______________ mandates are two kinds of service level contracts

Performance measurement by benchmarking normally refers to comparing performance of a fund to

Minimum number of independent directors on the board of Asset Management Company is

Under which of the following steps does the wealth manager develops a SWOT chart for the client

A situation in which an owner of more than 50% of voting shares can elect the entire board of directors is known as

What is the minimum number of members required, to form a society under section 20 of the Societies Registration Act, 1860?

Aditya’s father has given him general power of attorney what does this mean?

How much amount should be invested by Mr. Batra today to get a maturity value of Rs. 90,368.50 after 6 years, if available ROI is 10% and compounding is Quarterly for first 2 years, Half Yearly for next 2 years and Monthly for last 2 years?

Miss. Nidhi Gupta has sold 600 calls on DR. REDDY’S LAB at a strike price of Rs.992 for a premium of Rs.25 per call on April 1, 2007. The closing price of equity shares of DR. REDDY’S LAB is Rs.994 on that day. If the call option is assigned against her on that day, what is her net pay off?

Ram deposits Rs. 12,500 in an account that pays a ROI of 20% pea compounded annually on 5th. Of March 2010. Calculate the date on which the balance in his account would be Rs.35,338/-.

Minimum number of employees in an establishment for it to come under the purview of the Payment of Gratuity act is ______

Which annuity provides for regular payments, which stop on the first death among of the covered lives?

If a typical market basket of goods and services cost Rs 120 in 1975, the base year, and Rs 180 in 1985, the price index in 1985 would be__________

Whom should an individual apply intending to be appointed as director of a company?