MyCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

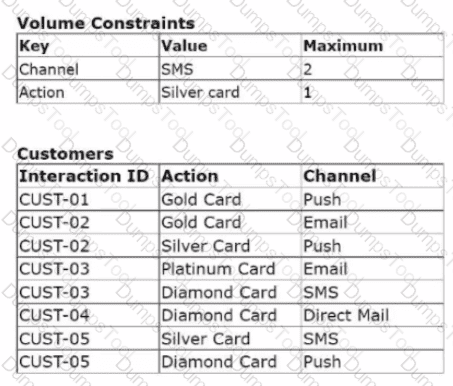

A volume constraint uses the Return any action that does not exceed

constraint mode. The following tables show the configuration of the volume constraints and the list of customers in the outbound segment:

The outbound run selects customers in the following order to apply the volume constraints: CUST-01, CUST-02, CUST-03, and CUST-05.

Based on the configuration of the volume constraints for each channel, which offer does CUST-05 receive?

1yCo, a telecom company, wants to start promoting data plan offers through SMS to qualified customers. The marketing team needs to ensure that the outbound run always uses the latest customer information.

What do you configure to implement this requirement?

A declsioning architect wants to use the customer properties Gender and MonthlyAverageUsage in a Data Join component. Which decision component is required to enable access to these properties?

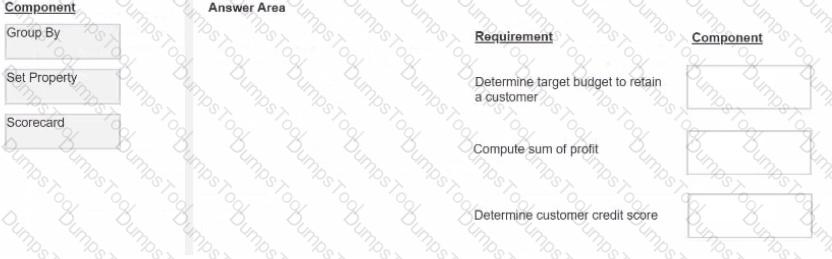

You are a decisioning architect on a next-best-action project and are responsible for designing and implementing decision strategies. Select each component on the leftand drag it to the correct requirement on the right.

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

MyCo, a telecom company, wants to Include offer-related images in the emails that they send to their qualified customers. As a decisioning architect, what best practice do you follow to include images in emails?

U+ Bank implemented a customer journey for Its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the Journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

U+ Bank implemented multiple customer journeys for Its customers. The goal of the bank Is to present the most relevant action for the customer to increase the chance of a positive outcome. U+ Bank is sure that customers see the next best action, regardless of the current journey that they are in.

Which statement is true about customer journeys in Pega Customer Decision Hub?

As shown in the following figure, decision strategy contains 'Green Label' and 'Black Label' Proposition components that point to the "Set Printing Cost' Set Property component that uses 'BaseCost' and "LetterCount." The configuration of the Prioritize component selects the lowest cost. What is the role of the Set Property component in the following decision strategy?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

MyCo,a telecom company, recently introduced a new mobile handset offer, MyFone 14 Pro, for its premium customers. As the bank has financial targets to meet, the business decides to boost the MyFone 14 Pro offer.

As a decisioning architect, how can you ensure that the MyFonel4 Pro offer is prioritized over other offers7

U+- Bank uses Pega Customer Decision Hub'" for their one-to-one customer engagement. The bank now wants to change its offer prioritization to consider both business objectives and customer needs.

Which two factors do you configure in the Next-Best-Action Designer to implement this change? (Choose Two)

A financial services company has implemented always-on outbound campaigns for three credit card offers: Standard card. Rewards card, and Rewards Plus card. The marketing team observes that customers who are qualified for multiple actions receive different numbers of offers, depending on the configuration of the volume constraint mode. To optimize customer engagement, the system administrator must choose between constraint modes.

Which volume constraint mode ensures that customers receive all actions for which they qualify, provided the actions do not reach volume limits?

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

An NBA Specialist Is configuring the engagement policy for a new loan offer and wants to validate the policy. What is the best way for the NBA Specialist to validate the engagement policy?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?

What does a dotted line from a "Group By" component to a "Filter" component mean?

U+ Bank, a retail bank, is facing an unforeseen technical issue with its customer care system. As a result, the bank wants to share the new temporary contact details with all customers over an SMS. All customers must receive this communication regardless of the engagement policy conditions and constraints.

Which type of communication do you configure to implement this requirement?

Regional Bank experiences an unexpected system outage affecting online banking services across multiple locations. The bank needs to immediately inform all customers about the temporary service disruption and provide alternative banking options. The communication must reach every customer simultaneously and should not be repeated.

Which communication approach should the bank use to address this urgent customer notification requirement?

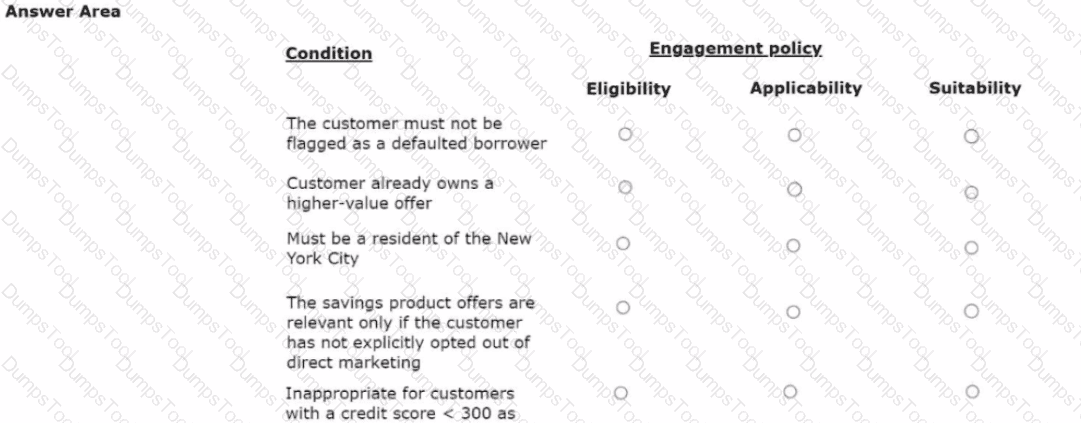

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. The bank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

A customer qualifies for Standard card (priority 60), Rewards card {priority 40), and Premium card {priority 30). Standard card volume is exhausted. Rewards card has remaining volume, and Premium card has remaining volume. The system uses "Return any action that does not exceed constraint" mode.

Which actions does the customer receive in this scenario?