In conjunction with investment objectives, what Know Your Client information is essential to allow an advisor to fulfill suitability assessment obligations?

During the calendar year, Firmansyah received a $1,800 eligible dividend from a large Canadian bank and a foreign, dividend from his The USD/CAD exchange rates is 1.3605.

Firmansyah’s federal marginal tax bracket is 29%. The enhanced dividend gross-up rate is 38% and the federal dividend tax credit rate for eligible dividends is 15%.

What federal tax liability will be due from the investment income?

Which statement regarding the underwriting process and over-the-counter (OTC) markets is CORRECT?

One of your clients, Harry, has heard that he can defer paying tax on capital gains. He wants to know if what he has heard is correct and if so, how to defer paying taxes on capital gains.

What would you tell Harry?

What term applies to unemployment created by a new technology that eliminates the need for subway train drivers?

Julia invested in ERF energy mutual fund three years ago. At that time, the price of the fund was $25.44 per unit. Over time, the unit price has dropped to $19.72, however Julia does not want to consider selling her investment until it returns to $25.44. What bias is she demonstrating?

The Optima Equity Fund has a beta of 1.4. What is the most accurate way to describe the Optima Equity Fund’s relationship to the market as a whole?

Which of the following statements is TRUE about the movement of business cycles in the Canadian economy?

In which of the following situations would the client mobility exemption apply?

Which of the following statements describes a feature of the Home Buyers’ Plan (HBP)?

What party is responsible for ensuring that a public corporation's total number of outstanding common shares does not exceed its total number of authorized shares?

What factor is irrelevant if an investor's primary objective focuses on generating capital gains?

Cristina wants to add a mutual fund to her portfolio offering dividend income. She is considering either a preferred dividend fund or a standard equity fund. What is an important difference for Cristina to consider when comparing these two types of funds?

Ken is a member of his employer’s Defined Benefit Pension Plan (DBPP). Which of the following statements about Ken’s plan is CORRECT?

Salvatore and Harriet recently got married. They are presently renting but are looking forward to buying a new home within 5 years. They both have separate savings established in their respective registered retirement savings plans (RRSPs) of $100,000 each. They have come to Dustin, a Dealing Representative, to open an additional joint investment account to increase their savings to assist with their future plans of buying a new home.

What does Dustin need to ensure about his recommendation?

Barend is a Dealing Representative with Planvest Group Inc., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Which of the following CORRECTLY describes

Barend's obligation for conflicts of interest?

Which drawback of the comparison universe method makes average fund managers look more like underperformers as the comparison period lengthens?

A sample of four portfolios is given below, with an even split between allocations 1 and 2.

Portfolios | Allocation #1 | Allocation #2

Portfolio A

Preferred shares

Common shares

Portfolio B

Treasury bills

Debentures

Portfolio C

Debentures

Common shares

Portfolio D

Treasury bills

Preferred shares

Which portfolio carries the greatest amount of risk?

Josephine is a Dealing Representative with Sunshine Mutual Funds Inc. for over 10 years. Her brother Jonathan has an account with Sunshine Mutual Funds Inc., too. Jonathan wants Josephine to manage his

portfolio and make investment decisions on his behalf. Jonathan trusts his sister to make better investment choices than he can. He also wants to give Power of Attorney (POA) to Josephine so she can have full authority over his account.

How can Josephine respond to her brother's request?

Jack and Jill hold a mutual fund account as tenants in common. What conditions would apply to their account?

Should either die, full ownership of the account would pass to the other

Each would be the owner of 50% of the account’s assets

Either could issue trading instructions on all account assets

Each would be required to provide KYC information

Your client has very limited investment knowledge and is confused about what is meant by "marginal tax rate". What do you tell him?

An employer wants to offer his employees a pension plan. The goal is to provide a simple-to-understand plan that will reward all participants equally, regardless of their income level, and provide a retirement income based on a participant’s years of service with the company. What plan will best meet his requirements?

Your client, Helen, just received her non-registered account statement which states that one of her mutual funds made an interest income distribution during the year. She asks you how she will be taxed on the distribution. What do you tell Helen?

Which exemplifies the tendency of mutual fund companies to shut down poor performing funds?

Frederic recently sold his units in a US dollar (USD) denominated mutual fund. He wants to convert the proceeds back to Canadian dollars (CAD). If he received proceeds of $1,200 USD from the sale and the exchange rate is $1 CAD for $0.99 USD, how much will Frederic receive in Canadian dollars?

What best describes why mortgage funds generally have less sensitivity to changes in interest rates than bond funds?

A mutual fund representative meets with a young family whose net worth/level of wealth is categorized as low, but they have the potential to become wealthy. In general, the family seems susceptible to believing that market events are predictable. Also, the family has a stronger impulse to avoid losses than earn gains. How might the mutual fund representative effectively address each of the two biases, respectively?

Beatrice is looking for comprehensive information regarding the analysis of financial statements and fund management expenses as it relates to her current mutual fund investment.

Which document would provide the information she is looking for?

Bernadette has a high-paying job and is in the top tax bracket. She recently received a payment of $5 million upon the settlement of her uncle's estate. Bernadette would like to invest her inheritance in financial products that would not only grow her money but is also income tax friendly.

Which of the following would provide the most favourable tax treatment?

Zara buys a future contract with an underlying value of $100,000 worth of stocks. She is required to deposit $1,750 of margin. Two weeks later, the underlying value of the stocks is $101,900. What is Zara's total return?

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

Your client contacts you requesting that you purchase a mutual fund based on a “hot tip” from a friend who has been a successful investor. What bias is your client most likely being affected by?

Which newspaper article would be likely to result in foreign capital moving out of a country?

Which of the following money market securities have the highest degree of risk for the investor?

Which of the following statements about registered education savings plans (RESPs) is CORRECT?

What should Rakshana, who just turned 71, do with her RRSP funds to ensure a steady stream of income until her death?

An investor owns equity mutual funds and is concerned about overall fund expenses. She prefers investment options that have lower management expense ratios, along with the opportunity for higher returns. What is the most appropriate fund type for this investor?

A client wishes to deal with one registered representative for both banking services and mutual fund investments. The client would also like advice on determining where best to place their money to enhance their overall tax situation as they approach buying a home. Which individual is best suited for this service if the client's goal is to build a long-term advisor-client relationship?

Which term describes the tendency of a mutual fund manager to move away from the original stated investment objectives by investing in classes of securities different from those named in the fund’s prospectus?

The Mutual Fund Dealers Association of Canada (MFDA) has strict rules concerning conflicts of interest. Which of the following is TRUE?

Natasha currently owns 2 mutual funds: a bond fund and a Canadian equity fund. She would like to use one of them as her registered retirement savings plan (RRSP) contribution for the year. From a tax efficiency perspective, which mutual fund should she contribute?

Evan owns retractable preferred shares of Ingram Corp. Which statement CORRECTLY describes a key feature of Evan's shares?

Which of the following statements about capital gains distributions from mutual fund trusts is correct?

What purpose does it serve for non-money market mutual funds to hold money market instruments?

What information can be found from a simplified prospectus instead of Fund Facts?

What effect does contractionary monetary policy have on money supply and credit in the economy?

Details of a client's investment portfolio appear in the following table:

Type of Funds

Amounts Invested ($)

Canadian equity growth fund

15,000

TSX equity index fund

25,000

Canadian resources fund

75,000

Canadian equity value fund

95,000

What is the primary risk of this investment portfolio?

Based on your discussions with your client Sierra, you believe an asset allocation of 30% fixed income and 70% equities will help her achieve her long-term goals. What type of asset allocation strategy are you implementing?

Your client, Kimberly has investments in both registered and non-registered plans. Which of the following investment strategies is best suited for Kimberly from a tax perspective?

Which of the following statements about total return for money market funds is TRUE?

What type of fixed-income fund would have the most tax-advantaged form of income distribution?

Karen’s know your client (KYC) profile corresponds to someone who has a long time horizon, is comfortable with risk and volatility, and is primarily interested in growth. She watches the daily movements of the Toronto Stock Exchange (TSX) and wants a mutual fund that will closely match what she sees.

What kind of mutual fund would be BEST for her?

Your client’s unused RRSP contribution room is $46,000. He contributes $15,000 in the current taxation year. How much RRSP contribution room can he carry forward?

What type of asset allocation strategy rebalances asset classes to pre-defined corridors?

Seth's brother Keith manages a successful private equity fund. Seth is an investment advisor and has thoroughly evaluated Keith's fund. He believes it would be an excellent investment for some of his clients. If Seth does not disclose his relation to Keith prior to recommending this investment, what value does he stand to breach with his client?

Rank the decisions made by a portfolio manager in order of importance for the success of the portfolio.

The following information is available for Monique:

Number of children

1

Lifetime RESP contributions to date

$45,000

CESG received to date

$7,200

Family income

$120,000

Desired current year contribution

$7,000

What is the maximum RESP contribution that Monique can make this year?

You are comparing the performance of ABC Equity Fund and XYZ Equity Fund to their benchmark. Indicate the correct statement.

Return | Year 1 | Year 2 | Year 3 | 3 Year Compound Return

Benchmark | -2.0% | 12.6% | 20.6% | 10.0%

ABC Equity Fund | -10.0% | 16.0% | 24.0% | 9.0%

XYZ Equity Fund | 8.0% | 9.0% | 10.0% | 9.0%

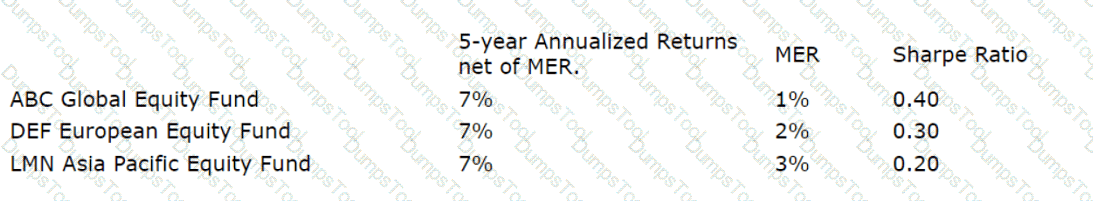

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?

An investor purchases units of an equity fund for $17.60. In which of the following circumstances would an investor potentially owe taxes on capital gains?

An investor with rudimentary investment knowledge is considering various recommendations. Assuming the investor’s risk-return profile suggests risk-seeking interests, which recommendation is most appropriate?

Stan, a portfolio manager, is looking at two steel companies as potential investments. Truesteel Inc. has a current ratio of 2:1 while Strongco Ltd. has a current ratio of 0.8:1.

What could this information indicate?

Which among the following BEST describes a company's retained earnings statement?

Pippa purchased a 15-year bond with a face value of $5,000 and a 7% coupon rate at the time of issuance. The bond is due to mature later this year. The general interest rate climate remained stable for the first 13 years of the bond's term. However, especially over the past 18 months, both inflation and general interest rates have increased more than expected.

What is Pippa likely to experience from her bond?

What type of shares offer its shareholders the opportunity to receive additional dividends if the company’s profit exceeds a stated level?

What equity investment philosophy places greater emphasis on industry weighting than on security selection?

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

What is a statistical measure of price fluctuation that illustrates how a stock's price fluctuates around its average?

Your employer has a contributory group RRSP under which he matches employee contributions, up to a maximum of 5% of salary.

Which of the following statements about a group registered retirement savings plan (RRSP) is CORRECT?

Tony, the investment manager of True North Canadian Equity Fund is deciding on some new investments. He has done an economic analysis of the various provinces and sectors of the Canadian economy and has determined that Nova Scotia and Alberta present the best prospects. He has also identified potential in the oil and gas sector. He narrows down his selection to an oil supply firm in Medicine Hat and a drilling company in Halifax.

What investment approach is Tony employing?

What type of fund offers the highest expected risk and the highest expected return in terms of the risk-return trade-off between different types of mutual funds?

Lydia wants to transfer units of her Sussex Growth Fund to her registered retirement savings plan (RRSP) as her RRSP contribution. The current market value is $10,600 and the cost of the units is $4,500.

Which of the following statements is CORRECT?

What is the most substantial reward for providing excellent customer service as a mutual fund sales representative?

What type of benefit plan has a final benefit that is dependent on the investment returns within the plan?

Your client, Cosmo, recently inherited $50,000 from his uncle. He wants to use this money towards his retirement savings. Cosmo is a 50-year old, self-employed carpenter and he earns on average $65,000

per year. He has a registered retirement savings plan (RRSP) with the bank worth $425,000 and a tax-free savings account (TFSA) worth $46,000. He started saving when he was 25 years old and has always

made his own investment decisions. His money is mostly invested in balanced funds. He feels most comfortable with these types of mutual funds since they offer potential investment growth but without being too aggressive. Cosmo has no other assets.

What additional information do you need about Cosmo to fulfill your know your client obligation?

Your client Charlie is thinking about making a large investment into the Sentinel Canadian Equity Fund on December 15. The ex-dividend date for the mutual fund is December 20. What advice would you give

Charlie to avoid the tax trap?

Your soon-to-be-retired client has accumulated $700,000 in a mutual fund investment. He has consulted with you with respect to systematic withdrawal plans. His other sources of income in retirement are uncertain. He is not interested in leaving a legacy at his death. Which plan would best suit his needs?

What bias results in investors valuing an asset that they own over an asset that another individual owns?

What is the time period during which an individual must complete a training program once she starts acting as a dealing representative?

What statement CORRECTLY describes a key difference between bonds and debentures?

A mutual fund sales representative receives a client’s purchase order for equity mutual funds and confirms that the order is appropriate based on the client’s recorded investment knowledge and risk tolerance. The client explains that she had inherited the funds from a family member. The client states her investment objective to be long term. The representative records this information and processes the order. What the representative doesn’t know is that the client has recently lost her job and is living on unemployment insurance. What step did the representative need to take in order to uphold her duty of care?

Recently interest rates have gone up. Your customer, Mr. Corelli, has asked you how this will affect the value of his mortgage fund. What is the best response to give to Mr. Corelli?

Which index would investors use as a benchmark for doing research on the largest listed public companies in the US marketplace?

All other factors being equal, which fund outperformed the benchmark during this period? The benchmark return is 4.75%.

Fund

Starting NAV ($)

Ending NAV ($)

ABC

21.15

22.09

FED

25.37

26.61

MCQ

30.14

31.55

XYZ

31.00

31.99

Russell is a Dealing Representative with Wealth Quest Strategies Ltd., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Russell is developing his website to

include sales content on a Target Date Fund. Which of the following is Russell permitted to include on his website about the Target Date Fund?

i. the asset mix through the life of the fund until the future date

ii. the expected decline in the fund's risk level as the fund reaches its target date

iii. the guaranteed return that the client will receive on the future date

iv. a graphic illustration of the fund's promised growth on target date

An employee may begin offering mutual fund advice following the completion of which requirement?

Which statement best describes what a rational investor will do when comparing the risk and return of two investments?

Ellen and her only son Jeff live on the family farm with her father George. Jeff is five years old and Ellen has decided that it is time to start saving for Jeff’s post-secondary education. She has called you to ask about registered education savings plans (RESPs).

Which of the following statements is TRUE?

One of your clients, Fernando, is approaching 71 years of age and has a few questions regarding life income funds (LIFs).

Which of the following statements about LIFs is TRUE?

An investor seeks an equity investment that will mirror the performance of the energy sector in Canada. She desires a low-cost, flexible alternative that can quickly be bought or sold. Which product is most suited to her needs?

What decision accounts for most of the success or failure of a portfolio?

Which document contains information regarding the Independent Review Committee compensation?

On January 2nd of this year Evan purchased 500 preferred shares of Ingram Ltd. The preferred shares have a par value of $25 per share and a quarterly dividend of $0.98 per share. They also give Evan the option to sell the shares back to Ingram at par value any time from now until September 1st two years from now. What type of preferred shares does Evan own?

The Corporation Group is seeking financing for the purchase of new equipment for a planned expansion. They want to use the funds for a period of five years. They do not want to pledge any of their existing assets as security or extend shares to any of their debtors. Additionally, they want the privilege of repaying borrowed funds at any time if they so choose. What is the most ideal fixed-income security they should issue to raise this capital?

Last year Peter’s earned income from employment was $50,000.

Last year, after receiving a $2 per share in dividends from 500 shares in ABC Inc., a publicly-traded Canadian corporation, he sold his shares. The sale resulted in a capital gain of $15,000.

Based on the tax rates mentioned above, what is Peter’s net federal tax liability for the year? (Round to 2 decimal places).

Which among the following plans includes a provision that places a maximum limit on the amount that can be withdrawn during a calendar year?

Every February, Reginald, a Dealing Representative, feels pressured by his Manager to generate new registered retirement savings plans (RRSP) and contributions to assist the branch in meeting broader business targets. Reginald is nearing the end of February, and he has a meeting with a new client, Orel. Orel wants to open a tax-free savings account (TFSA) to develop emergency savings because he does not want to worry about his withdrawals being taxed. Reginald suggests that if Orel were to contribute to an RRSP first, then the resulting tax savings could be used to fund a new emergency account.

In relation to account suitability, what can be said about Reginald’s advice?

Janine will celebrate her 71st birthday this year. She currently has a lot of money in a personal registered retirement savings plan (RRSP) and knows there are rules about what she can do with those funds. Which of the following is TRUE?

A sales representative is comparing the performance of a mutual fund with other funds of similar investment mandates. What is this method of relative performance evaluation called?

Throughout the year, the Redwood Global Equity Fund generated the following outcomes:

. $1.00 per unit of interest income from Canadian treasury bills

. $2.50 per unit of dividend income from foreign corporations

. $7.75 per unit of capital gains from the sale of Canadian corporations

. $6.50 per unit of capital gains from the sale of foreign corporations

. $2.00 per unit of capital losses from the sale of foreign corporations

Given that the Redwood Global Equity Fund is structured as a mutual fund trust, which of the following statements is true?

Sylvia decided to use the savings from her bank account to purchase a 5-year bond. The face value of the bond is $10,000, the market price is $9,230 and the coupon rate is 7%.

What is the current yield on the bond? Round to 2 decimal places.

What allocation strategy does an investment advisor apply when adjusting risk and return levels according to behavioural tendencies?

When comparing the current yield and yield-to-maturity of a bond, which statement applies?

When selecting an investment to add to a portfolio, what feature would reduce the overall risk?

Douglas, aged 73, won a lottery prize of $100,000 last week. Today he contacted Vincent, his Dealing Representative, with instructions to contribute the winnings to his registered retirement income fund (RRIF) account.

Which of the following statement about RRIF is CORRECT?

Tristan is evaluating different mutual fund options for his client. What mutual fund option would be the most expensive to buy in dollar terms?

Which form of investment income is taxed at an investor’s marginal tax rate?

Daisy is a Dealing Representative registered in the province of Saskatchewan only. Daisy’s client, Orville, a resident of Lloydminster, Saskatchewan is a retiree who presently has a $1,000,000 with her dealer, Easy Ride Financial. Orville is now planning to move to Vegreville, Alberta next month. Easy Ride Financial is registered in Alberta and Saskatchewan. Neither Easy Ride Financial nor Daisy have any clients who are resident in Alberta.

Which of the following should Daisy do if she wants to continue to service Orville’s account?

What type of transaction must be reported under current anti-money laundering and terrorist financing legislation?

If an investor believes markets are efficient, how should they manage their portfolio?

David is reviewing a simplified prospectus and is particularly interested in one of the funds. The investment objective stated for this fund is to provide dividend income, capital preservation, and some potential for capital gains. What fund is David interested in?

You ask a new client, Brad, "what are your financial obligations and what are your assets?" What information are you trying to gather in order to comply with the know your client (KYC) rule?

At 4:00 p.m. Eastern Time on July 6, the following information is collected for the Marigold Canadian Dividend Fund:

What is the net asset value per unit NAVPU for the Marigold Canadian Dividend Fund for July 6?

What type of risk is the fundamental risk factor for fixed-income securities?

Over the course of a couple of weeks and several appointments, Harold was finally able to provide an investment solution for his new client, Felicia. It was a lump sum investment where they plan to see her

money grow for the next 5 years.

With regards to Know Your Client (KYC) requirements, what are Harold's responsibilities moving forward?

The portfolio manager of the High Income Fund has 90% of the mutual fund invested in bonds. What is a reason for holding bonds in a mutual fund portfolio?

Your client, Rinaldo, wants to know more about the fees associated with his mutual funds. What can you tell him about a mutual fund’s management expense ratio (MER)?

Portia is a Dealing Representative with Highview Wealth Inc., a mutual fund dealer. Portia recommends the Stature Growth Fund to her client Clive. Which of the following CORRECTLY describes what Portia must do in order to satisfy her obligations under the Client Relationship Model (CRM) and Client Focused Reforms (CFR)?

Joanne’s earned income last year was $45,000 and her pension adjustment was $2,500. She has $2,000 in carry-forward registered retirement savings plan (RRSP) room for the current taxation year. What is Joanne’s maximum tax-deductible RRSP contribution amount for the current year?

Maalik opens an account for a new client, John. During the new account process, Maalik determines that he will need to confirm John’s identity. Which of the following statements about Maalik’s identification requirements is CORRECT?

Fund A has a 5-year average return of 10% and a standard deviation of 5%. Fund B has a 5-year average return of 8% and a standard deviation of 2%. Select the most accurate statement about Funds A and B.

Gregory is a conservative investor who wants to hold a portfolio of equity securities that would fall less than the overall market in a downturn.

Which of the following portfolios would you advise Gregory to invest in?

Louis is the portfolio manager for Quattro Fund. The mandate of the mutual fund is to invest in a combination of cash, fixed income, and equity securities; however, Louis has the ability to adjust the portfolio according to market conditions. If Louis feels that interest rates will fall, he could invest the whole portfolio in equities. If he feels the market is too high, he could take profits and sit totally in cash. What type of mutual fund is Quattro Fund?

The following data is available for an investment:

Purchase value

$125

End of the year value

$133

Quarterly dividend amount

$1

What is the annual return for this investment if held for one year?