A surplus on the current account of the balance of payments can be financed by

Which ONE of the following is NOT required in calculating the EPS of ABC plc?

All of the following items would appear as a credit on the current account of a country's balance of payments accounts except which one?

If, when the price of a good increases, the total revenue received by the supplier decreases, then

All of the following are sources of finance for business except which one?

Every year a household allows its bank account to become overdrawn for 3 months to pay for its annual holiday. Which one of the following statements correctly describes this?

Which of the following functions is not performed by investment exchanges such as NASDAQ, the London Stock Exchange or the New York Stock Exchange?

Which ONE of the following statements best describes the impact of a government price floor (minimum price) set below free market price?

If the price of a good is held above the equilibrium price, the result will be

Which of the following are known as automatic stabilizers because they tend to reduce the fluctuations in economic activity associated with the business cycle?

(i). Progressive income taxes

(ii). Unemployment benefits

(iii). Means-tested welfare benefits

(iv). Regressive taxation

Porter describes differentiation as a firm having a unique product or service that is valued by the customer. Which ONE of the following is NOT a factor in the higher prices and profits from differentiated products?

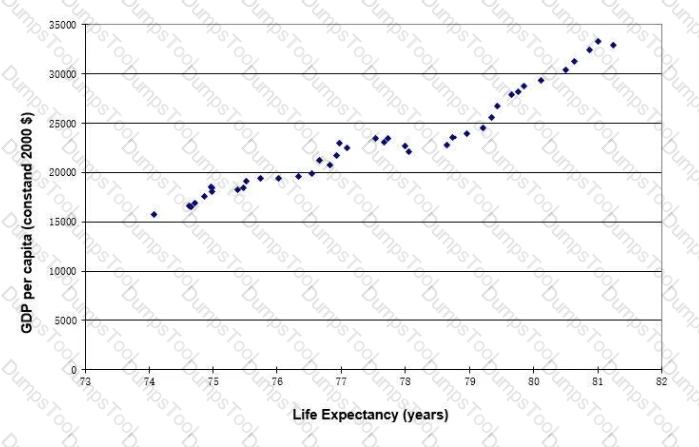

The following scatter diagram displays the total life expectancy in years on the X axis and GDP per capita (constant 2000 S) on the Y axis, in Country S for the past 40 years. Which of the following statements is true in respect of the graph?

Total economic welfare derived from an activity will be maximized if the activity is undertaken up to the point at which

A firm is considering a large capital investment project. It is considering delaying it in case the government introduces special tax breaks for investment that will reduce the tax the firm pays. In which stage of the trade cycle is the government least likely to reduce taxation?

Which of the following would result from a depreciation in the exchange rate for a country's currency?

i. A fall in the foreign exchange price of that country's exports.

ii. A rise in the foreign exchange price of that country's imports.

iii. A rise in production costs for businesses using imported inputs.

iv. A worsening in that country's terms of trade.

v. A fall in the domestic prices of that country's imports.

vi. A rise in the domestic price of that country's exports.

The demand for salt is generally regarded as price inelastic. Which ONE of the following factors would not contribute to making demand for salt price inelastic?

Based on the past twenty months, an event decorating company develops a trend equation for forecasting sales revenue (y) where y = 4.38 + 1.32x.

If month 21 has a seasonal factor of times 1.07, then what is the forecast for the month, using a multiplicative model? Give your answer to two decima places.

For a typical business, which of the following is NOT a potential benefit of globalisation?

Which of the following is correct regarding data?

Data can be recorded as:

(1) numbers.

(2) symbols.

(3) raw facts.

Which ONE of the following was NOT a consequence of the Global Banking Crisis that began in 2007?

A business sells 10,000 units of its product pet month at a unit price of $10 It reduces the pnce to $88,000 per unit As a result its total reviewed $88,000 per month. What is the price elasticity of demand for this product?

The government of Country Z imposes a tariff on all imports of coal from other countries Which THREE of the following are possible effects of this decision in Country?

A market is in equilibrium. If the government imposes a minimum price above the equilibrium price, there will be:

If a central bank wished to increase the supply of money and credit in the economy it would:

A government may try to reduce a balance of payments deficit on current account by using either expenditure-reducing policies or expenditure-switching policies.

Which of the following is an expenditure-reducing policy?

In a fully employed economy, which one of the following would lead to demand pull inflation?

Which of the following influences explains why the average costs of a firm will rise in the short run?

Identify which of the following features does not distinguish redeemable debt apart from equity:

Which of the following is not a source of long-term capital for a company?

Which of the following is most likely to increase rather than to reduce market imperfections?

When the government intervenes in the market economy to correct a market failure

All of the following factors contribute to the instability of agricultural prices except which ONE?

All of the following are features of an economic union (for example, the European union) except which one?

Which of the following best describes a project that has a negative Net Present Value?

RubTech has decided to build a new rubber production facility just outside the semi-rural town of Pettisbury. The majority of workers at the plant are to be sourced from abroad.

Which of the following could potentially be negative externalities of the decision to build the production facility?

The company flowbo Ltd. currently owns 25 bonds with a total nominal value of £1,000. The bill rate is currently 7%. The market value of the bonds is currently 14.5% higher than the nominal value of each individual bond

plus the bill rate.

Which of these is the difference between the nominal value of the bonds plus the bill rate payout and the market value of each bond?

Express your answer in whole pounds.

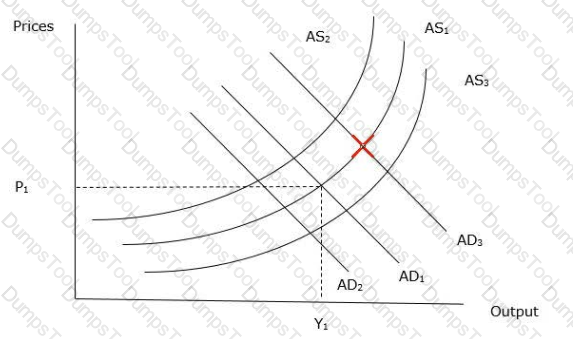

The economy of Country V is initially in equilibrium at a level of national income and employment denoted by Y, at price level denoted by P If there is an increase in aggregate demand, indicate on the graph below the new equilibrium point in the economy.

Company X's government has seen the the balance of payments deficit steadily rising while they have been in power.

Which of the following would be a good policy to implement to counteract this?

Golden Crisp Cereals has calculated that its demand price elasticity is -1.4. It wants to expand in order to produce more cereal and hence increase its sales.

Which of the following are ways in which Golden Crisp Cereals could expand in the short run?

Select ALL that apply.

The interest rate at TrowBank is currently running at 7%. The number of customers borrowing to invest has fallen drastically.

Which of the following explains why this is the case?

Select ALL that apply.

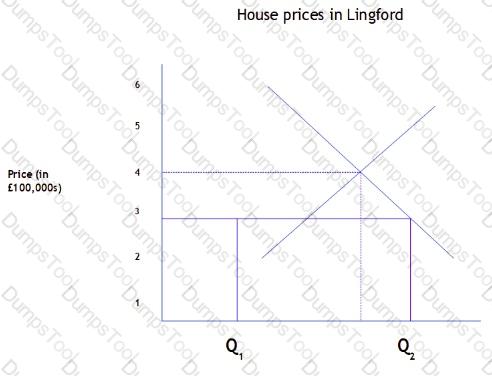

The government has set a maximum house price due to a massive house price rise in the last decade. This is denoted by the line Q1Q2 on the graph.

Which of the following may occur in light of the introduction of the maximum house price as it appears on the graph?

Select ALL that apply.

'The £ has risen against other currencies since August, defying forecasters who thought that the UK's widening trade deficit must cause the £'s exchange rate to fall.'

From the above information, it can be concluded that, since August

Betsy's Fish Foods Pic. has issued shares in a prospectus.

Which of the following are benefits of selling shares in this manner?

Select ALL that apply.

The government of Vencia has set out in its Budget a restrictive set of fiscal policies. These include raising VAT and the basic rate of income tax to 25%. The Bank of Vencia must now implement this Budget as monetary

policy.

Which of the following best outlines how the Bank of Vencia might do this?

West Morton Rail has calculated that the number of passengers travelling on their railway increases during school holidays, while the inverse is true for most other railways in the country.

Which of the following is the most likely reason for this unusual correlation?

The Lingford Miracle Association is a registered charity. It is closely associated with Lingford General Hospital. The charity has a number of goals.

Which of the following could potentially be goals set out by the Lingford Miracle Association given the information about the organisation that has been outlined?

Beth wants to take out an annuity in order to be able to leave more money to her children when she passes away. She has looked at three annuities with different payout rates.

Annuity A pays out £5340 each year over 14 years

Annuity B pays out £4900 each year over 9 years

Annuity C pays out £5445.64 each year over 20 years

The current interest rate is 8%.

Of these, which annuity would have the highest net present value and hence pay out more money for Beth over its lifetime?

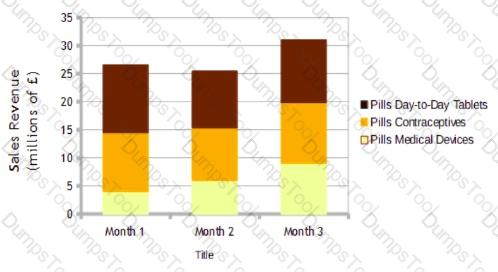

The component bar chart displaying sales revenues for different types of product sold by Pills Pharmaceuticals shows that the poorest performing products are its medical devices.

Which of the following may be reasons for this?

Select ALL that apply.

The World Bank is an international financial institution, controlled by governments, that lends money to developing nations to allow them to afford to build infrastructure and industries that will enable them to become richer countries over the following decades.

Identify the function being performed by the World Bank.

The consequences of globalization for national economies include all of the following except which one?

Identify from the list below the financial instrument that is not a method of government borrowing:

What is described by the following definition 'the total accumulated amount the state owes to lenders in its own country and internationally'?

A business has a short-term problem with its payments exceeding its receipts. Which TWO of the following would be appropriate for meeting this financial shortfall?

Which of the following describes the effect an interest rate rise may have on a company?

Which of the following are the likely consequences, in the domestic of a county, of an increase in interest rates?

1. A rise in demand for capital goods

2. A fall in demand for consumer good.

3. A fall in demand for housing

4. A rise in the exchange rate.

Following the emergence of the global banking crisis in 2007 many central banks undertook quantitative easing through purchasing bonds back from banks with new money. Which function of a central bank does this describe?