Business process re-engineering typically addresses all of the following EXCEPT the

key processes.

human environment.

organizational mission.

technical environment.

Business Process Re-Engineering (BPR):

BPR focuses onredesigning key processesto achieve dramatic improvements in efficiency, effectiveness, and performance.

It typically involves addressing technical systems, human factors, and process workflows, but it does not involve redefining the organization’s mission, which is a strategic activity outside the scope of BPR.

Explanation of Answer Choices:

A. Key processes: Incorrect. Key processes are the primary focus of BPR.

B. Human environment: Incorrect. BPR often addresses human factors, such as roles and responsibilities.

C. Organizational mission: Correct. The mission is a strategic element and not typically redefined as part of process re-engineering.

D. Technical environment: Incorrect. BPR often involves rethinking technical systems and workflows.

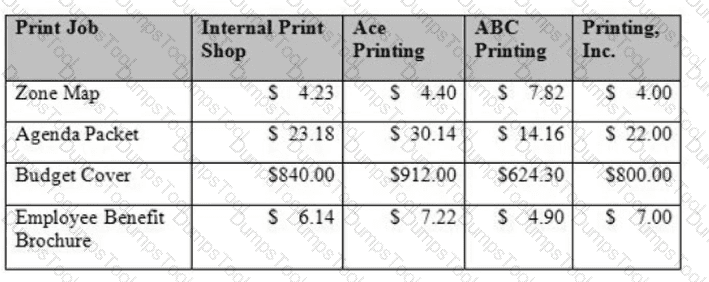

Based on the data below, what can be concluded about outsourcing print job?

It is better to keep the printing in-house.

Outsourcing printing is feasible.

Outsourcing printing is necessary.

ABC Printing should be awarded the outsourcing contract.

Understanding the Scenario:The table compares the costs of four printing jobs performed by an "Internal Print Shop" versus three external vendors (Ace Printing, ABC Printing, and Printing, Inc.). Each vendor's pricing varies by print job type. The task is to evaluate whether outsourcing (hiring external vendors) is a reasonable alternative to keeping the work in-house.

Key Considerations in Outsourcing:According to governmental accounting principles and budgeting practices outlined by theAssociation of Government Accountants (AGA), the decision to outsource should consider:

Cost-effectiveness: Does outsourcing reduce costs without compromising quality or service delivery?

Operational efficiency: Can outsourcing free up internal resources for other priorities?

Comparative pricing: How do external vendor rates compare to internal costs for identical services?

Analysis of the Print Jobs:Let’s break down the cost comparison for each print job:

Zone Map:Internal cost = $4.23.Cheapest vendor = Printing, Inc., at $4.00.Outsourcing is cheaper for this job.

Agenda Packet:Internal cost = $23.18.Cheapest vendor = Printing, Inc., at $22.00.Outsourcing is cheaper for this job.

Budget Cover:Internal cost = $840.00.Cheapest vendor = ABC Printing, at $624.30.Outsourcing is significantly cheaper for this job.

Employee Benefit Brochure:Internal cost = $6.14.Cheapest vendor = ABC Printing, at $4.90.Outsourcing is cheaper for this job.

Conclusion Based on Analysis:

Across all four print jobs, the lowest-cost external vendor always beats the Internal Print Shop's costs.

From abudgetary perspective, outsourcing is feasible as it offers cost savings across all jobs.

Why Not A, C, or D?:

Option A(Keep printing in-house): Incorrect, as in-house costs are consistently higher than the cheapest external vendor.

Option C(Outsourcing is necessary): Incorrect, as feasibility doesn’t mean necessity; internal printing is still an option if other factors (like quality or control) outweigh costs.

Option D(Award contract to ABC Printing): Incorrect, since the best vendor depends on the job (e.g., Printing, Inc. is cheaper for Zone Map and Agenda Packet).

What is the first step on performing a risk assessment under the COSO Internal Control Framework?

identification of risks

defining internal control objectives

review of prior audit findings

setting risk tolerance levels

Risk Assessment Under COSO Framework:

The first step in a COSO-based risk assessment is defining internal control objectives. This establishes what the organization aims to achieve, providing a framework for identifying risks and ensuring controls align with objectives.

Risk assessment focuses on evaluating the likelihood and impact of risks that could hinder these objectives.

Explanation of Answer Choices:

A. Identification of risks: Identifying risks follows the definition of internal control objectives.

B. Defining internal control objectives: Correct. Objectives must be defined first to provide a basis for identifying and assessing risks.

C. Review of prior audit findings: Important, but it’s not the starting point for a risk assessment under COSO.

D. Setting risk tolerance levels: This occurs later, after risks have been identified and evaluated.

The best source for annual liability and cash flow data is a state's

PAR.

ACFR.

appropriations bill.

statement of activities.

Annual Comprehensive Financial Report (ACFR):

TheACFR(formerly CAFR) is the primary source for a state’s annual financial information, including liability and cash flow data.

It provides comprehensive financial statements, including the balance sheet, statement of activities, and cash flow statements.

Explanation of Answer Choices:

A. PAR: ThePerformance and Accountability Report (PAR)focuses on federal agencies and includes performance goals and achievements but lacks detailed liability and cash flow data for states.

B. ACFR: Correct. The ACFR is the best source for detailed liability and cash flow data at the state level.

C. Appropriations bill: Provides legislative authority for spending but does not include detailed financial data.

D. Statement of activities: This is part of the ACFR but does not include all necessary cash flow or liability data.

According to OMB Circular A-50, who holds personal responsibility for ensuring that disagreements with audit

findings and recommendations are resolved?

comptroller general

OMB deputy director for management

inspector general

audit follow-up official

What Does OMB Circular A-50 Require?

OMB Circular A-50establishes policies for resolving and following up on audit findings and recommendations. It assignspersonal responsibilityto anaudit follow-up officialwithin the agency for ensuring that disagreements with audit findings are resolved and that corrective actions are implemented.

Why Is the Audit Follow-Up Official Responsible?

The follow-up official ensures the agency responds appropriately to audit findings, tracks corrective actions, and resolves disagreements in a timely manner. This ensures accountability and compliance with audit recommendations.

Why Other Options Are Incorrect:

A. Comptroller General:The Comptroller General leads the GAO and oversees audits but is not responsible for resolving disagreements within agencies.

B. OMB Deputy Director for Management:Provides guidance on audit policies but does not hold personal responsibility for resolving disagreements.

C. Inspector General:Performs audits and investigations but does not resolve disagreements over audit findings.

References and Documents:

OMB Circular A-50:Specifies that the audit follow-up official holds responsibility for resolving disagreements.

GAO Yellow Book:Discusses the roles and responsibilities of various officials in audit processes.

According to OMB Circular A-11, what analytical method should be used to measure the cost, schedule and performance goals of a capital asset acquisition project?

earned value management

net present value

future value

regression analysis

OMB Circular A-11 and Capital Asset Acquisition:

OMB Circular A-11 mandates the use ofearned value management (EVM)for measuring cost, schedule, and performance goals in capital asset acquisition projects.

EVM integrates project scope, schedule, and cost data to assess project performance and forecast outcomes.

Explanation of Answer Choices:

A. Earned value management: Correct. EVM is the prescribed method for tracking progress on capital projects under OMB Circular A-11.

B. Net present value: Used for financial analysis, such as determining the economic value of future cash flows, but not for tracking project progress.

C. Future value: Measures the value of an investment at a future point, not applicable to project tracking.

D. Regression analysis: A statistical method for identifying relationships between variables, not for measuring project performance.

When reviewing a report on internal control from a shared service provider that noted a weakness, the agency

should

consider the existence of compensating or mitigating controls.

ask the service provider to correct the weakness.

dismiss the weakness.

refer the weakness to the Contracting Officer.

Response to Weaknesses in Shared Service Providers:

Shared service providers often issue reports on internal controls (e.g., SOC 1 or SOC 2 reports).

When a weakness is identified, the recipient agency must evaluate whether compensating or mitigating controls exist to address the risk, ensuring continued reliability.

Explanation of Answer Choices:

A. Consider the existence of compensating or mitigating controls: Correct. This is a standard response to internal control weaknesses, as outlined in auditing and risk management best practices.

B. Ask the service provider to correct the weakness: Incorrect. While this may be appropriate, the recipient agency is ultimately responsible for evaluating and addressing the risk.

C. Dismiss the weakness: Incorrect. Ignoring a weakness can expose the agency to risk.

D. Refer the weakness to the Contracting Officer: Incorrect. This may be part of the process, but the agency must first assess the impact and controls.

Compliance reporting, under government auditing standards, identifies all of the following components EXCEPT

areas of noncompliance.

the auditor's responsibility for tests of compliance.

review of major internal control cycles.

the scope of the compliance testing.

Compliance Reporting Under Government Auditing Standards (GAS):

GAS requires auditors to assess compliance with applicable laws, regulations, contracts, and grant agreements during audits.

Compliance reporting typically includes:

Identifying areas of noncompliance.

Describing the auditor's responsibility for compliance testing.

Outlining the scope of compliance testing.

Explanation of Answer Choices:

A. Areas of noncompliance: Included in compliance reporting to highlight where the entity failed to meet requirements.

B. The auditor's responsibility for tests of compliance: GAS requires auditors to clarify their role in compliance testing.

C. Review of major internal control cycles: Correct. While internal controls may be assessed, reviewing "major internal control cycles" is not a direct component of compliance reporting.

D. The scope of the compliance testing: GAS mandates that the scope of testing be disclosed in the compliance report.

Which of the following includes the aggregate level and types of risks that the organization is willing to assume in

order to achieve its Strategic objectives?

risk register

risk and control evaluation matrix

risk profile

risk and control assessment tool

What Is a Risk Profile?

Arisk profilerepresents the aggregate level and types of risks that an organization is willing to accept in pursuit of its strategic objectives. It aligns with the organization’s risk appetite and tolerance and helps prioritize and manage risks effectively.

This profile typically includes key risks, their likelihood, and potential impact, as well as how those risks align with the organization's mission and strategy.

Why Is Risk Profile the Correct Answer?

The risk profile provides an enterprise-wide view of risks and their potential influence on achieving strategic goals. It aggregates risks across all levels of the organization and ensures that management considers them when making decisions.

Why Other Options Are Incorrect:

A. Risk Register:While a risk register includes detailed descriptions of individual risks, it does not aggregate risk levels or types across the organization.

B. Risk and Control Evaluation Matrix:This tool evaluates specific risks and controls but does not capture the organization’s overall risk appetite or profile.

D. Risk and Control Assessment Tool:This is a generic tool for assessing risks and controls, not for aggregating the overall risk picture.

References and Documents:

OMB Circular A-123:Specifies the need for agencies to maintain a risk profile as part of enterprise risk management.

COSO ERM Framework (2017):Defines a risk profile as central to managing risks in alignment with strategic objectives.

Efficient inventory management will result in

a low inventory turnover ratio.

high write-offs of obsolete inventory.

fewer instances of work stoppage.

high total asset turnover.

What Is Efficient Inventory Management?

Efficient inventory management ensures that an organization has the right amount of inventory at the right time to meet operational needs without overstocking or understocking.

Proper inventory management minimizes disruptions to operations, including work stoppages due to lack of necessary materials or supplies.

Why Is Fewer Instances of Work Stoppage the Correct Answer?

Efficient inventory management ensures that required inventory is available when needed, reducing the risk of work delays or stoppages caused by inventory shortages.

Why Other Options Are Incorrect:

A. A low inventory turnover ratio:A low turnover ratio often indicates overstocking or slow-moving inventory, which is not a sign of efficiency.

B. High write-offs of obsolete inventory:Efficient management reduces obsolete inventory, leading to fewer write-offs, not more.

D. High total asset turnover:While efficient inventory management may contribute to overall asset efficiency, it does not directly result in a high total asset turnover ratio.

References and Documents:

GAO Guide on Inventory Management:Emphasizes the role of inventory management in avoiding operational disruptions.

Best Practices for Inventory Management (AGA):Highlights reduced work stoppages as a key benefit of effective inventory control.

What type of analygis should a finance director use to determine if there will be enough funds available to cover bills

due within the next 30 days?

quick/current ratio

receivables turnover ratio

budgetary cushion ratio

debt burden ratio

Purpose of the Analysis:A finance director needs to assess whether the organization has enough funds available to cover short-term obligations (bills due within 30 days). This requires evaluating liquidity.

Explanation of Key Ratios:

Quick/Current Ratio: Measures an entity’s ability to pay its short-term liabilities using liquid assets.

Current Ratio= Current Assets ÷ Current Liabilities.

Quick Ratioexcludes less liquid assets (e.g., inventory), focusing on assets that can quickly convert to cash.This is the appropriate measure for assessing immediate liquidity.

Receivables Turnover Ratio: Measures how efficiently receivables are collected but doesn’t directly evaluate liquidity for bills due within 30 days.

Budgetary Cushion Ratio: Refers to financial reserves relative to annual spending, not short-term liquidity.

Debt Burden Ratio: Evaluates debt relative to revenues but does not address immediate cash flow needs.

When creditworthiness is a criterion for government loan approval, loan applicants must provide

a credit rating from a major bank.

a satisfactory history of repaying debt.

sufficient capitalization.

a promise to pay interest at the government borrowing rate.

Creditworthiness and Loan Approval:

When creditworthiness is a criterion for government loans, the applicant must demonstrate asatisfactory history of repaying debt, as this reflects their ability to fulfill repayment obligations in the future.

Why a Satisfactory History Is Required:

Past repayment behavior is considered the best indicator of future performance. Government agencies prioritize reducing the risk of defaults by ensuring applicants have a proven history of managing debt responsibly.

Why Other Options Are Incorrect:

A. A credit rating from a major bank:While a credit rating is helpful, it is not typically required for government loans. Instead, creditworthiness is evaluated based on repayment history and other financial factors.

C. Sufficient capitalization:This is important for business loans, but it does not address creditworthiness.

D. A promise to pay interest at the government borrowing rate:A promise is not sufficient to establish creditworthiness.

References and Documents:

OMB Circular A-129:Requires agencies to assess creditworthiness before granting loans.

GAO Loan Management Guide:Highlights repayment history as a key criterion for loan approval.

Using Benford Digital Analysis, an auditor can identify potential fraud when

a higher-than-expected number of payment amounts to one vendor start with the number three.

a large number of contracts are awarded to one vendor.

a large contract is awarded to the director's close relative.

an employee receives kickbacks from real estate developers.

Benford's Law and Fraud Detection:

Benford's Lawis a statistical principle that predicts the frequency of leading digits in naturally occurring datasets.

Deviations from the expected distribution (e.g., a higher-than-expected frequency of a specific leading digit) can indicate manipulation or fraud.

For example, if too many payments start with the number "3," it suggests potential tampering.

Explanation of Answer Choices:

A. A higher-than-expected number of payment amounts to one vendor start with the number three: Correct. This aligns with how Benford’s Law is used to detect anomalies in numerical data.

B. A large number of contracts are awarded to one vendor: While concerning, this is not related to Benford’s Law.

C. A large contract is awarded to the director's close relative: This indicates a conflict of interest but is unrelated to Benford’s Law.

D. An employee receives kickbacks from real estate developers: This is fraud but cannot be identified using Benford’s Law.

The first step when gathering data for making strategic sourcing decisions is

contacting vendors to submit bids under the request for bid process.

researching spend data by category for each business unit.

contacting business units to find out if there are existing purchasing contracts in place.

developing supplier performance measures to add into the purchase agreements.

What Is Strategic Sourcing?

Strategic sourcing is a systematic process aimed at optimizing an organization’s purchasing activities to maximize value and minimize costs. It involves analyzing spending, selecting suppliers, and negotiating contracts strategically rather than reactively.

Why Start with Spend Data?

Analyzing Spend Data:The first step is to understand the organization’s current spending patterns by analyzing spend data by category and by business unit. This helps identify high-cost areas, redundancies, and opportunities for cost savings.

Importance of Data-Driven Decisions:Without knowing where and how money is being spent, it’s impossible to make informed strategic sourcing decisions.

Why Other Options Are Incorrect:

A. Contacting Vendors:Vendors are contacted later in the process after the spend analysis is complete and sourcing strategies are determined.

C. Contacting Business Units:While checking for existing contracts is part of the process, it happens after analyzing spend data.

D. Developing Supplier Performance Measures:This step occurs much later, typically after supplier selection and contract execution.

References and Documents:

GAO Guide to Strategic Sourcing (2013):Recommends starting with a detailed spend analysis as the foundation for effective sourcing decisions.

Which of the following statements from an audit finding is the condition?

We identified multiple credit card purchases without receipts to support them.

Government policy requires a cardholder to submit receipts for all purchases.

Finance Department personnel did not regularly review purchases to ensure compliance.

We recommend that the government implements a timely review of all credit card purchases.

Definition of the Condition in an Audit Finding:

The "condition" describes the actual state observed during the audit. It highlights what occurred in practice, serving as the factual basis for the finding.

In this case, the condition is theabsence of receiptsfor multiple credit card purchases.

Explanation of Answer Choices:

A. We identified multiple credit card purchases without receipts to support them: Correct. This is the observed issue (condition).

B. Government policy requires a cardholder to submit receipts for all purchases: This is the "criteria," which defines the standard or rule being audited against.

C. Finance Department personnel did not regularly review purchases to ensure compliance: This is the "cause," explaining why the condition occurred.

D. We recommend that the government implements a timely review of all credit card purchases: This is the "recommendation," not the condition.

A state transfers cagh to a broker and the broker transfers securities to the state, promising to repay the cash plus

interest in exchange for the return of the same securities. This transaction is an example of

an arbitrage agreement.

a repurchase agreement.

a mutual buy-sell agreement.

a reverse repurchase agreement.

Definition of a Repurchase Agreement (Repo):A repurchase agreement is a short-term financial transaction where one party sells securities to another with an agreement to repurchase them at a later date for a specified price, which includes interest. It functions as a secured loan.

Transaction Description:

The state transfers cash to a broker.

The broker provides securities as collateral and agrees to repay the cash plus interest in exchange for the return of the same securities.This arrangement matches the definition of arepurchase agreement.

Explanation of Answer Choices:

A. Arbitrage agreement: Arbitrage involves exploiting price differences in markets, unrelated to this transaction.

B. Repurchase agreement: Correct, as it fits the definition.

C. Mutual buy-sell agreement: This involves agreements to buy and sell assets, unrelated to this financial transaction.

D. Reverse repurchase agreement: Incorrect, as the state would be the borrower, not the lender, in a reverse repo.

Which of the following would auditors issue an opinion on?

performance audits

compliance audits

financial statement audits

forensic audits

Audit Opinions:

Auditors issue opinions onfinancial statement auditsto provide assurance about whether the financial statements are presented fairly in accordance with applicable accounting standards (e.g., GAAP).

Other types of audits, such as performance or forensic audits, do not typically result in opinions but may provide findings or recommendations.

Explanation of Answer Choices:

A. Performance audits: These assess efficiency, effectiveness, or economy but do not include an opinion.

B. Compliance audits: These assess adherence to laws or regulations and may include findings but not an opinion.

C. Financial statement audits: Correct. These audits include an auditor’s opinion on the fairness of the financial statements.

D. Forensic audits: These focus on fraud investigation and result in findings, not an opinion.

Government entity SEA reporting provides users of general purpose financial reports with an

evaluation of the effects of changes in public policy.

assessment of financial condition and results of operations.

assessment of the accountability of the public administrators.

evaluation of the efficiency and effectiveness of governmental programs.

Service Efforts and Accomplishments (SEA) Reporting:

SEA reporting is designed to providenon-financial performance informationabout the efficiency and effectiveness of government programs.

It evaluates how well resources are being used to achieve desired outcomes, helping stakeholders assess program performance and accountability.

Explanation of Answer Choices:

A. Evaluation of the effects of changes in public policy: Incorrect. SEA reporting does not focus on policy changes but on program performance.

B. Assessment of financial condition and results of operations: Incorrect. This is the role of financial statements, not SEA reports.

C. Assessment of the accountability of the public administrators: Incorrect. While SEA reports indirectly support accountability, their main purpose is to assess program efficiency and effectiveness.

D. Evaluation of the efficiency and effectiveness of governmental programs: Correct. This is the primary focus of SEA reporting.

If a state treasurer wants to evaluate a variety of alternative long-term investments, which financial analysis should

be used?

net present value analysis

regression analysis

horizontal analysis

ratio analysis

What Is Net Present Value (NPV)?

NPV analysisevaluates the profitability of long-term investments by calculating the present value of expected cash inflows and outflows over time, discounted at a specified rate (e.g., the opportunity cost of capital).

It helps decision-makers compare investment options by quantifying their value in today’s dollars.

Why NPV Is Appropriate for Long-Term Investments:

It considers thetime value of money(a dollar today is worth more than a dollar in the future).

NPV helps the treasurer evaluate and prioritize investments based on their overall profitability and financial impact over the long term.

Why Other Options Are Incorrect:

B. Regression Analysis:This statistical method analyzes relationships between variables but is not commonly used for evaluating long-term investments.

C. Horizontal Analysis:Focuses on financial data changes over time (e.g., year-to-year comparisons), not investment decisions.

D. Ratio Analysis:Measures financial performance but does not evaluate the profitability of long-term investment alternatives.

References and Documents:

GAO Guide on Investment Decision-Making:Recommends using NPV for evaluating long-term projects and investments.

OMB Circular A-94:Provides guidelines for using NPV in benefit-cost analysis of federal investments.

The first step in investment management is to

ensure all employees understand their investment options.

develop a consensus among managers of the investment objectives.

develop an investment policy manual.

establish criteria for divesting.

Investment Management Basics:

The first step in investment management is establishing theobjectivesof the investment program. This requires consensus among key stakeholders, such as managers, on what the investment goals are (e.g., risk tolerance, return expectations, liquidity needs).

Without clear objectives, subsequent steps like developing policies or selecting investments cannot be effectively carried out.

Why Consensus Is Important:

Investment objectives must align with the organization’s mission, risk tolerance, and financial goals.

Consensus ensures that all managers are on the same page before developing specific strategies or policies.

Why Other Options Are Incorrect:

A. Ensure employees understand their investment options:Employee understanding is not the first step; it comes later when the investment strategy is implemented.

C. Develop an investment policy manual:This happens after the objectives have been established.

D. Establish criteria for divesting:Divestment criteria are part of the investment policy and are determined later.

References and Documents:

GAO Financial Management Guide:Highlights setting objectives as the first step in investment management.

COSO Framework for Investment Risk Management:Stresses the importance of aligning objectives before policy development.

In relation to financial reporting, who evaluates internal controls to support an opinion on a fair presentation of the financial statements?

management

the independent auditor

the program office

the audit committee

Role of the Independent Auditor in Financial Reporting:

Independent auditors evaluate internal controls as part of their audit procedures to support an opinion on the fair presentation of the financial statements. This includes assessing whether internal controls over financial reporting are designed and operating effectively.

This evaluation helps ensure that financial statements are free of material misstatements, whether due to error or fraud.

Why Management Does Not Do This:

Managementdesigns and implements internal controls but does not evaluate them to support the auditor’s opinion. Management’s responsibility is to certify the accuracy of the financial statements, while the auditor provides an independent opinion.

Why Other Options Are Incorrect:

C. The program office:This entity oversees operations but does not perform evaluations to support an audit opinion.

D. The audit committee:The committee provides oversight of the audit process but does not perform the evaluation itself.

References and Documents:

GAAS (Generally Accepted Auditing Standards):Outlines the responsibilities of independent auditors regarding internal control evaluation.

GAO Yellow Book:Specifies the role of external auditors in evaluating internal controls during financial audits.

What is the basis for determining materiality for financial audits?

The auditee determines what is material based on their understanding of how the financial statements

may be used by third parties.

The auditor establishes materiality based on whether a misstatement would influence the judgement

made by a reasonable user of the financial statements.

The entity's main provider of resources typically sets materiality levels for financial reporting.

The auditor sets a standard percentage for all entities by transaction class.

Definition of Materiality:

In financial audits, materiality is the threshold above which a misstatement or omission could influence the economic decisions of users of financial statements.

Auditors consider theneeds of reasonable userswhen determining materiality, focusing on what would influence their decision-making.

Explanation of Answer Choices:

A. The auditee determines what is material: Incorrect. The auditor, not the auditee, is responsible for determining materiality.

B. The auditor establishes materiality based on whether a misstatement would influence the judgment made by a reasonable user of the financial statements: Correct. This aligns with auditing standards, such as those in the Yellow Book and AICPA guidance.

C. The entity's main provider of resources typically sets materiality levels: Incorrect. Materiality is not determined by resource providers but by the auditor based on the needs of users.

D. The auditor sets a standard percentage for all entities by transaction class: Incorrect. Materiality varies depending on the entity and its financial circumstances.

Which of the following is a forensic technique used to quantify the impact of fraud?

test of controls

computer-assisted audit techniques

data integrity

benchmarking

What Are Computer-Assisted Audit Techniques (CAATs)?

CAATsare specialized tools used in forensic accounting and auditing to analyze large volumes of data for patterns, anomalies, and irregularities that may indicate fraud.

These techniques help quantify the impact of fraud by identifying discrepancies, overpayments, or unaccounted transactions.

Why Are CAATs Used for Quantifying Fraud?

CAATs can efficiently analyze transactional data, calculate losses, and determine the extent of financial damage caused by fraud.

Examples include using software to detect duplicate payments, inflated invoices, or unauthorized transactions.

Why Other Options Are Incorrect:

A. Test of controls:Tests of controls evaluate the effectiveness of internal controls but do not quantify the impact of fraud.

C. Data integrity:Ensuring data integrity is important, but it does not specifically address quantifying fraud.

D. Benchmarking:Benchmarking compares performance metrics but does not analyze or quantify fraud.

References and Documents:

GAO Fraud Prevention Framework:Highlights the use of CAATs in forensic accounting.

AICPA Forensic Accounting Guidelines:Recommends CAATs for fraud detection and quantification.

Auditors may limit their public reporting in attestation engagements when the

auditors detect material fraud.

audit report would compromise ongoing legal proceedings.

auditor detects non-compliance with provisions of law.

entity management fails to satisfy legal requirements.

Limiting Public Reporting in Attestation Engagements:

Government auditing standards allow auditors to limit public reporting in rare cases, such as when disclosing certain information could compromise sensitive or ongoing legal proceedings.

The goal is to protect the integrity of investigations or legal actions while maintaining transparency where possible.

Explanation of Answer Choices:

A. Auditors detect material fraud: Auditors are required to report material fraud to appropriate authorities, not limit reporting unless legal proceedings are affected.

B. Audit report would compromise ongoing legal proceedings: Correct. This is a valid reason to limit public reporting under auditing standards.

C. Auditor detects non-compliance with provisions of law: Non-compliance must be disclosed unless legal considerations warrant confidentiality.

D. Entity management fails to satisfy legal requirements: This would typically be reported, not withheld.

Which action represents an internal control deficiency in an agency responsible for building and maintaining dams?

The agency inspects the completed work to assure compliance with the contract specifications.

The agency releases the contractor's bond only after assuring that all work is performed satisfactorily.

The agency responds to the maintenance needs only as complaints are received or as employees

report problems.

The agency checks the references of bidders.

What Is an Internal Control Deficiency?

Aninternal control deficiencyoccurs when an organization fails to implement controls to prevent or detect risks effectively.

In this case, responding only to maintenance needs when complaints are received demonstrates a lack of proactive controls, increasing the risk of issues going unnoticed or escalating over time.

Why Is Option C Correct?

Proactive maintenance schedules and inspections are essential for ensuring the safety and functionality of critical infrastructure like dams. Relying solely on complaints or employee reports is a reactive approach and represents a deficiency in internal controls.

Why Other Options Are Incorrect:

A. Inspecting completed work:This is a proper control to ensure compliance with contract specifications.

B. Releasing the bond after work completion:This ensures contractual obligations are met and is a good control practice.

D. Checking bidder references:This is part of the procurement process and a valid internal control.

References and Documents:

GAO Standards for Internal Control (Green Book):Emphasizes proactive controls and monitoring for critical operations.

Federal Infrastructure Maintenance Best Practices:Highlights proactive inspections and maintenance as essential controls.

In defining the audit objectives of a performance audit, auditors should evaluate whether the audited entity has

updated its vision and strategic mission statements.

corrective actions to address prior findings and recommendations.

updated its financial reports’ MD&A.

internal controls in place.

Performance Audit Objectives:

Performance audits evaluate whether government entities are operating efficiently, effectively, and in compliance with applicable laws.

A critical aspect is assessing whether the entity has implementedcorrective actionsin response to prior audit findings and recommendations, as this demonstrates accountability and progress.

Explanation of Answer Choices:

A. Updated its vision and strategic mission statements: Incorrect. While strategic planning is important, it is not the primary focus of performance audit objectives.

B. Corrective actions to address prior findings and recommendations: Correct. Addressing prior findings is a key objective to ensure identified issues have been resolved.

C. Updated its financial reports’ MD&A: Incorrect. MD&A (Management’s Discussion and Analysis) is related to financial reporting, not performance audits.

D. Internal controls in place: Incorrect. While internal controls are reviewed, the focus here is on corrective actions to past findings.

Cloud computing includes which of the following services?

satellite-to-satellite

hosted

gateway transmission

mainframe computing

Definition of Cloud Computing:

Cloud computing refers to the delivery of computing services (e.g., servers, storage, databases, networking, software) over the internet.

A common feature of cloud computing is the "hosted" service model, where applications, storage, or infrastructure are hosted and managed by a cloud service provider.

Explanation of Answer Choices:

A. Satellite-to-satellite: This involves communication between satellites, unrelated to cloud computing.

B. Hosted: Correct. Hosted services are a fundamental aspect of cloud computing, where applications or data are stored and accessed on remote servers.

C. Gateway transmission: Refers to communication gateways, unrelated to cloud computing services.

D. Mainframe computing: Mainframes are large on-premises computers, not part of the cloud model.

Who is responsible for resolving single audit findings?

the awarding agency

the recipient agency

the audit committee

the external auditors

Responsibilities in Resolving Single Audit Findings:

Single audits assess compliance with federal program requirements.

Findings often highlight deficiencies or noncompliance issues that must be resolved by the entity receiving the federal funds.

Explanation of Answer Choices:

A. Awarding agency: The agency provides oversight and guidance but does not directly resolve findings.

B. Recipient agency: Correct. The entity receiving the funds is responsible for addressing and resolving findings to comply with federal regulations.

C. Audit committee: May oversee the process but doesn’t take direct responsibility for resolving findings.

D. External auditors: Identify the findings but do not resolve them.

Which of the following acts requires federal agencies to pay interest to state government funds for entitlements that

are not provided in a timely manner?

Debt Collection Improvement Act

CFO Act

Accountability for Tax Dollars Act

Cash Management Improvement Act

What Does the Cash Management Improvement Act (CMIA) Do?

CMIA governs the transfer of federal funds to state governments and ensures timely and efficient use of these funds.

If federal agencies fail to provide funds for entitlements (e.g., Medicaid) in a timely manner, CMIA requires them to payinterestto state governments for the delays.

This ensures states are compensated for any financial burden caused by delayed federal transfers.

Why Other Options Are Incorrect:

A. Debt Collection Improvement Act:Focuses on improving debt collection practices for the federal government, not entitlements or interest payments to states.

B. CFO Act:Improves federal financial management but does not address payment timeliness or interest.

C. Accountability for Tax Dollars Act:Expands audit requirements but does not involve compensation for delays.

References and Documents:

CMIA (1990):Requires federal agencies to pay interest on late entitlement payments to states.

Treasury Financial Manual:Details CMIA interest payment provisions.

TESTED 04 Mar 2026

Copyright © 2014-2026 DumpsTool. All Rights Reserved