A Discretionary Trust can be formed for the benefit of ________________________

Which of the following device(s) may prove useful in reducing the tax incidence in the case of HUF?

In US for 2013, the amount of the standard deduction is ______ for single individuals and married individuals filing separate returns.

Under provisions of _________________ it is provided that the profits and gains of business of a private trust is chargeable to income tax at the maximum marginal rate with effect from Assessment Year 1985-1986.

The Gift Tax Act came into force on _________________ and was deleted vide the Finance Act,__________.

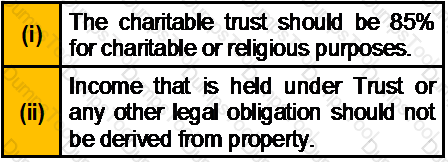

Which of the following is an essential condition for obtaining exemption of the income of a Charitable Trust?

A person purchased certain property in the name of his minor son and subsequently resold it while the son was minor. This sale is ___________________

As per Gift Tax Act of 1958, a gift in excess of _________ received by anyone who is not your blood relative is taxable.

Under _______________ of the Transfer of Property Act, a transfer of property can legally be made for the benefit of an unborn person.

Pushkar completed the construction of a house property on 14.8.2008 with borrowed capital of Rs.8,00,000 @ 12%. The loan was taken on 1.4.2006 and is still outstanding. The house was used for his own residence during the entire FY 2012-13. Deduction U/S 24(B) for interest on borrowed capital for PY shall be

Private Companies have a minimum paid up capital of _______________ or such higher capital as may be prescribed.

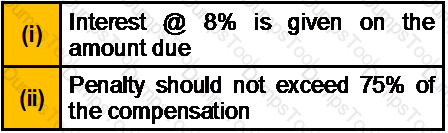

As per Workmen’s Compensation Act, in case there is default in paying compensation .

__________ is a arrangement wherein lessee and lessor agree to a payment schedule where for a set period of time, there is no payment and penalty.

Private Sector hospitals, which are formed under a trust as a society, would be exempt from the tax if the annual receipts of such hospital or institution do not exceed _______________ as per Section 10(23(C).

Saptarshi acquired shares of G Ltd. on 15.12.98 for Rs. 5 lacs which were sold on 14.6.11 for Rs. 19 lacs.

Expenses on transfer of shares Rs. 40,000. He invests 8 lacs in the bonds of Rural Electrification. Corporation Ltd. on 16.10.2011. Compute capital gain for the assessment year 2012-13.

The Hindu Succession (Amendment Act),2005 amended ____________ of the Hindu Succession Act,1956 allowing daughters of the deceased equal rights with the sons.

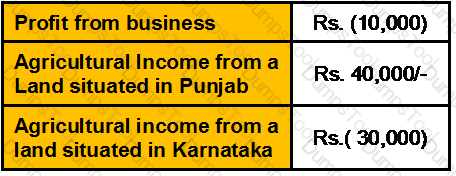

Compute Gross Total income and amount of loss allowed to be carried forward to next year:

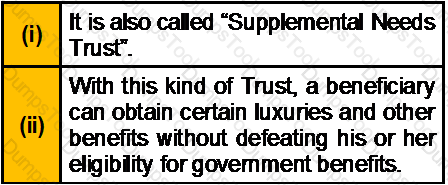

Which of the following statement(s) about “Special Needs Trust” is/are correct?

The employer had purchased a car for Rs. 3,00,000 which was being used for official purposes. After 2 year 6 months of its use, the car is sold to R, the employee, for Rs. 1,20,000. The value of this perquisite shall be __________.

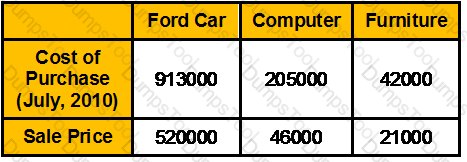

Find out the taxable value of perquisite from the following particulars in case of an employee to whom the following assets held by the company were sold on 1.8.2012.

The assets were put to use by the company from the day they were purchased.

Short-term capital gain arising for the transfer of equity shares and units of equity oriented fund shall be taxable

Dharampal has let out his house property at monthly rate of Rs. 12000. He has paid Rs.3500 as annual municipal tax. He wants to know the Net Annual value of his house at Bhuj for AY 2011-12. The Municipal value of the house is Rs. 90,000, Fair rent Rs. 1,40,000, Standard rent Rs. 1,20,000. The house was vacant for one month during the previous year 2010-11 and the rent has not changed since then.

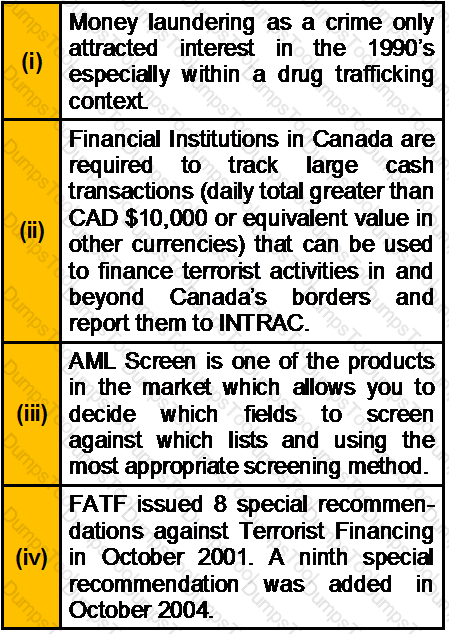

Which of the following statement(s) about Money Laundering is/are correct?

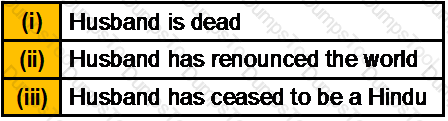

As per Hindu Adoptions and Maintenance Act,1956 a female Hindu can make adoption in which of the following cases

X Ltd. has failed to remit the tax deducted at source from annual rent of Rs. 6,60,000 paid to Mr. A for its office building. The said rent is

Money laundering Process has ____________ stages. The Financial Action Task Force on Money Laundering was formed in __________ by the G7 countries.

One person is said to be ____________ of other if the two are related by blood or adoption but not wholly through males.

________________ is validated by attaching an affidavit which is signed by the witnesses in the front of Notary Public.

In order that a claim for partition has to be recognized under the Income Tax Act, the claim for partition must fulfill the condition as laid down in ____________ of Hindu Succession Act,1956.

Singapore personal tax rates are capped at _________ for residents and a flat rate of ________ for non-residents.

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

In Singapore, If an individual does not agree with the assessment raised, he she have to lodge an objection in writing within ________from the date of issue of notice of assessment; otherwise the assessment will automatically become final. Singapore has entered into tax treaties with _____________.

High Net Worth Individuals can dispose of their money in______ ways. From the standpoint of the wealth holder,__________ is the most important of all.

Registration of Power of Attorney is __________in India. If Power of Attorney is in respect of immovable property of value more than __________ it must be registered.

__________ is an influential person who knows you favorably and agrees to introduce or recommend you to others.

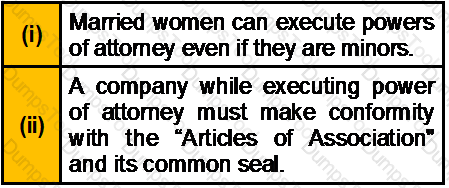

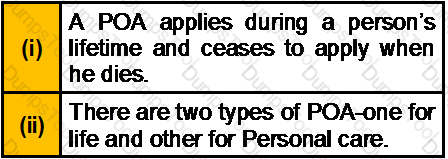

Which of the following statement(s) about Power of Attorney is/are correct?

Which of the following statement(s) about Power of Attorney (POA) is/are correct?

As per the ESI Act, the monthly wage limit for coverage is _____________ per month.

You are an Estate Planner. Mr. Arun Mittal, a HNI client asks you to explain him the number of ways to dispose of his wealth. You explain to him about the three ways of disposing wealth. He further asks you to give ranking to the methods-from most preferred to least preferred. You tell Mr. Arun that the correct order is _________________.

As per Payment of Gratuity Act, Gratuity shall be payable to an employee after he has rendered continuous service for not less than __________

___________ is the submission of a disputed matter to an impartial person.

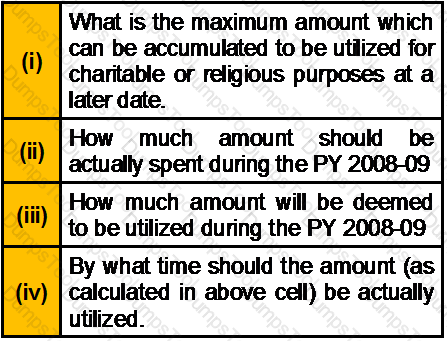

During the PY 2008-09 a charitable trust earned an income of Rs. 5 lakh out of which Rs. 3 lakh was received during the PY 2008-09 and the balance Rs. 2 lakh was received during the PY 2010-2011.To claim full exemption of Rs. 5 lakh in the PY 2008-09, state:

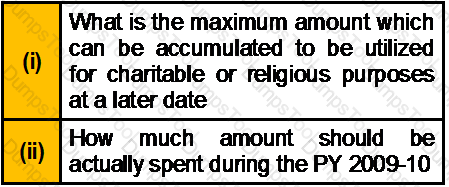

"During the PY 2009-10 a Poonawala Charitable Trust earned an income of Rs. 7 lakh out of which Rs.5 lakh was received during the PY 2009-10 and the balance Rs. 2 lakh was received during the PY 2011-2012.In order to claim full exemption of Rs. 7 lakh in the PY 2009-10:

A Hindu coparcenary consists of a common male ancestor and his linear descendants in the male line within _______ degrees. ___________ is the state in which HUF is not recognized.

________________ is a popular mode of transfer of property to God or Almighty, under the Mohammedean Law.

___________ is appropriate for donors who want to see their charitable dollars at work during their lifetimes.