Alpha Bank estimates that the annualized standard deviation of its portfolio returns equal 30%; The daily volatility of the portfolio is closest to which of the following?

What is a common implicit assumption that is made when computing VaR using parametric methods?

A customer of EtaBank, Alfred Fall, fell on the marble floors of the bank and sustained substantial injuries. Subsequently, he won a personal injury claim of $50,000 against EtaBank. How should EtaBank's operational loss data event information database categorize this event?

Bank Milo has $4 million in cash and $5 million in loans coming due tomorrow with an expected default rate of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On what days does the bank face negative cumulative liquidity?

Which of the following statements about implementation of a successful RCSA program is correct?

Gamma Bank is operating in a highly volatile interest rate environment and wants to stabilize its net income by shifting the sources of its earnings from interest rate sensitive sources to less interest rate sensitive sources. All of the following strategies can help achieve this objective EXCEPT:

If the yield on the 3-month risk free bonds issued by the U.S government is 0.5%, and the 3-month LIBOR rate is 2.5%, what is the TED spread?

What are some of the drawbacks of correlation estimates? Which of the following statements identifies major problems with correlation calculations?

I. Correlation estimates are not able to capture increases in factor co-movements in extreme market scenarios.

II. Correlation estimates tend to be unstable.

III. Historical correlations may not forecast future correlations correctly.

IV. Correlation estimates assume normally distributed returns.

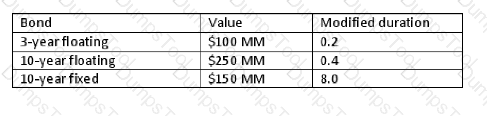

A portfolio consists of two floating rate bonds and one fixed rate bond.

Based on the information below, modified duration of this portfolio is

While contractually, depositors are not required to keep liquid funds on deposit for very long, in fact they tend to leave their deposits for longer periods of time, even if interest rates rise and the bank does not raise its deposit interest rate. What does a bank consider these deposits to be?

Unico Delta stock is trading at $20 per share, its annualized dividend yield is 5% and the 12-month LIBOR is 3%. Given these statistics, the 12-month futures contact will trade at:

To estimate the required risk-adjusted rate of return on a highly volatile energy stock, a risk associate compiled the following statistics:

Risk-free rate = 5%

Beta = 2.5

Market Risk = 8%

Using the Capital Asset Pricing Model, she estimates the rate of return to be equal:

For a bank a 1-year VaR of USD 10 million at 95% confidence level means that:

James manages a loans portfolio. He has to evaluate a large number of loans to choose which of them he will keep in the bank's books. Which one of the following four loans would he be most likely to sell to another bank?

A portfolio manager is interested in computing risk measures for his bond investment portfolio. Which of the following measures the sensitivity of duration to interest rates?

Which one of the following four exercise features is typical for the most exchange-traded equity options?

A governance, risk, and compliance strategy can help a bank to avoid:

I. Incomplete analysis of risks

II. Misperception of risk exposures

III. Duplication of effort

IV. Contradictory reporting

Which one of the following four statements represents a possible disadvantage of using total return swap to manage equity portfolio risks?

If a bank is long £500 million pounds, short £300 million in delta-equivalent pound options, and long £100 million in pound-denominated stocks, what is the amount of pound exposure that would be shown in the aggregated risk reports?

Which of the following statements regarding CDO-squared is correct?

I. CDO-squared use other CDOs and CMOs as collateral.

II. Risk assessment of CDO-squared is almost impossible due to their complexity.

III. CDO-squared have lower credit risk than CMOs but higher than CDOs.

Why is economic capital across market, credit and operational risks simply added up to arrive at an estimate of aggregate economic capital in practice?

Normally, commercial banking can be viewed as a fixed income carry trade since

Which one of the following four statements about equity indices is INCORRECT?

In additional to the commodity-specific risks, which of the following risks represent the main commodity derivative risks?

I. Basis

II. Term

III. Correlation

IV. Seasonality

BetaFin, a financial services firm, does not have retail branches, but has fixed income, equity, and asset management divisions. Which one of the four following risk and control self-assessment (RCSA) methods fits the firm's operational risk framework the best?

AlphaBank's management is evaluating how changes in its business environment could materially impact risk categories. As a result, bank's management decides to implement the structure, which facilitates the discussion in an integrative context, spanning market, credit, and operational risk factors, and encourages transparency and communication between risk disciplines. Which one of the following four approaches should the management choose to achieve this strategic goal?

Mega Bank has $100 million in deposits on which it pays 3% interest, and $20 million in equity on which it pays no interest. The loan portfolio of $120 million earns an average rate of 10%. If the rates remain the same, what is the net interest income of Mega Bank?

Which of the following bank events could stress the bank's liquidity position?

I. Maturing of bank debt

II. Repurchase agreements

III. Futures margins

IV. Staff turnover

Bank Muri has $4 million in cash and $5 million in loans coming due tomorrow with an expected default rate of 1%. The proceeds will be deposited overnight. The bank owes $ 9 million on a securities purchase that settles in two days and pays off $8 million in commercial paper in three days that is not expected to renew. On day 2, $1 million in loans is coming in with an expected default rate of 1% and on day 3, $2 million in loans is coming in with expected default rate of 2%. How much should the bank plan to raise in order to avoid liquidity problems?

Banks duration match their assets and liabilities to manage their interest risk in their banking book. Currently, the bank's assets and liabilities both have a duration of 10. To hedge against the risk of decreasing interest rates, the bank should

I. Increase the duration of the liabilities

II. Increase the duration of the assets

III. Decrease the duration of the liabilities

IV. Decrease the duration of the assets

BetaFin has decided to use the hybrid RCSA approach because it believes that it fits its operational framework. Which of the following could be reasons to use the hybrid RCSA method?

I. BetaFin has previously created series of RCSA workshops, and the results of these workshops can be used to design the questionnaires.

II. BetaFin believes that using the questionnaire approach should be more useful.

III. BetaFin had used the questionnaire approach successfully for certain businesses and the workshop approach for others.

IV. BetaFin had already implemented a sophisticated RCSA IT-system.

An asset-sensitive bank will have a ___ cumulative gap and will benefit from ___ interest rates.

Gamma Bank has $300 million in loans and $200 million in deposits. If the modified duration of the loans is estimated to be 2, and the modified duration of the deposits is estimated to be 1, then the change in Gamma Bank's equity value per 1% change in yield will be:

Unico Bank, concerned with managing the risk of its trading strategies, wants to implement the trading strategy that exposes the bank to the lowest market risk. Which one of the following four strategies should Unico take to limit its risk exposure?

Gamma Bank has a significant number of retail customers and finds its balance sheet shape and structure difficult to manage. Which one of the following characteristics of a bank with wide retail operations is INCORRECT?

The Basel II Accord's operational risk definition excludes all of the following items EXCEPT:

Which one of the following is an advantage of using a daily decay factor when forecasting tomorrow’s P&L?

Which one of the following market risk measures evaluates the bank's earnings sensitivity?

In order to comply with key risk indicator (KRI) standards, a data analyst will set the following criteria for each indicator except:

Which among the following are shortfalls of the static liquidity ladder model?

I. The static model gives a liquidity estimate only after the bank faces the liquidity problem.

II. The static model can only make projections over a few days.

III. The static model does not incorporate uncertainty in the analysis.

James Johnson has a $1 million long position in ThetaGroup with a VaR of 0.3 million, and $1 million long position in VolgaCorp with a VaR of 0.4 million. The returns of the two companies have zero correlation. What is the portfolio VaR?

Which one of the following four statements describes the advantage of using delta-gamma method of mapping options positions over delta-normal method?

Delta-gamma method

Which one of the following four statements presents a challenge of using external loss databases in the operational risk framework?

Sam has hedged a portfolio of bonds against a small parallel shift in the yield curve using the duration measure. What should Sam do to ensure that the portfolio is hedged against larger parallel shifts in the yield curve?

The main building blocks of an operational risk framework include all of the following options EXCEPT:

Which of the following statements about parametric and nonparametric methods for calculating Value-at-risk is correct?

Which one of the following four factors typically drives the pricing of wholesale products?

Which one of the four following statements about the Risk Adjusted Return on Capital (RAROC) is correct?

RAROC is the ratio of:

The pricing of credit default swaps is a function of all of the following EXCEPT:

A bank customer expecting to pay its Brazilian supplier BRL 100 million asks Alpha Bank to buy Australian dollars and sell Brazilian reals. Alpha bank does not hold reals so it asks for a quote to buy Brazilian reals in the market. The market rate is 100. The bank quotes a selling rate of 101 to its customer and sells the reals at this quoted price. Then the bank immediately buys the real at the market rate and completes foreign exchange matched transaction. What is the financial impact of this transaction for Alpha bank?

Which one of the following four statements on factors affecting the value of options is correct?

Which one of the following four statements about the relationship between exchange rates and option values is correct?

Which of the following statements about the interest rates and option prices is correct?

According to the largest global poll of foreign exchange market participants, which one of the following four global financial institutions was the most active participant in the global foreign exchange market?

Which one of the following four variables of the Black-Scholes model is typically NOT known at a point in time?

Which one of the following four models is typically used to grade the obligations of small- and medium-size enterprises?

What is the explanation offered by the liquidity preference theory for the upward sloping yield curve shape?

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. What interest rate should Alpha Bank charge on the no-payment loan to Delta Industrial Machinery Corporation?

To estimate a partial change in option price, a risk manager will use the following formula:

In the United States, during the second quarter of 2009, transactions in foreign exchange derivative contracts comprised approximately what proportion of all types of derivative transactions between financial institutions?

Typically, which one of the following four option risk measures will be used to determine the number of options to use to hedge the underlying position?

Gamma Bank is active in loan underwriting and securitization business, and given its collective credit exposure, it will be typically most interested in the following types of portfolio credit risk:

I. Expected loss

II. Duration

III. Unexpected loss

IV. Factor sensitivities

Counterparty credit risk assessment differs from traditional credit risk assessment in all of the following features EXCEPT:

Altman's Z-score incorporates all the following variables that are predictive of bankruptcy EXCEPT:

For which one of the following four reasons do corporate customers use foreign exchange derivatives?

I. To lock in the current value of foreign-denominated receivables

II. To lock in the current value of foreign-denominated payables

III. To lock in the value of expected future foreign-denominated receivables

IV. To lock in the value of expected future foreign-denominated payables

When looking at the distribution of portfolio credit losses, the shape of the loss distribution is ___ , as the likelihood of total losses, the sum of expected and unexpected credit losses, is ___ than the likelihood of no credit losses.

Which one of the following four statements correctly defines chooser options?

Which one of the following four options is NOT a typical component of a currency swap?

Which one of the following four options does NOT represent a benefit of compensating balances to the bank?

As Japan ___ its budget deficits and ___ its dependence on debt, the Japanese currency, JPY, would ___ in value against other currencies.

A credit portfolio manager analyzes a large retail credit portfolio. Which of the following factors will represent typical disadvantages of market-linked credit risk drivers?

I. Need to supply a large number of input parameters to the model

II. Slow computation speed due to higher simulation complexity

III. Non-linear nature of the model applicable to a specific type of credit portfolios

IV. Need to estimate a large number of unknown variable and use approximations

An options trader is assessing the aggregate risk of her currency options exposures. As an options buyer, she can potentially ___ lose more than the premium originally paid. As an option seller, however, she has a ___ risk on the contract and always receives a premium.

Which one of the following four statements correctly defines an option's delta?

A risk manager is analyzing a call option on the GBP with a vega of 0.02. When the perceived future volatility increases by 1%, the call option

A credit rating analyst wants to determine the expected duration of the default time for a new three-year loan, which has a 2% likelihood of defaulting in the first year, a 3% likelihood of defaulting in the second year, and a 5% likelihood of defaulting the third year. What is the expected duration for this three-year loan?

All of the four following exotic options are path-independent options, EXCEPT:

A bank customer chooses a mortgage with low initial payments and payments that increase over time because the customer knows that she will have trouble making payments in the early years of the loan. The bank makes this type of mortgage with the same default assumptions uses for ordinary mortgages, thus underestimating the risk of default and becoming exposed to:

Of all the risk factors in loan pricing, which one of the following four choices is likely to be the least significant?

A large energy company has a recurring foreign currency demands, and seeks to use options with a pay-off based on the average price of the underlying asset on either a few specific chosen dates or all dates within a specific pricing window. Which one of the following four option types would most likely meet these specific foreign currency demands?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan is collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be?

Which one of the following four statements correctly describes an American call option?

To hedge a foreign exchange exposure on behalf of a client, a small regional bank seeks to enter into an offsetting foreign exchange transaction. It cannot access the large and liquid interbank market open primarily to larger banks. At which one of the following exchanges can the smaller bank trade the currency futures contracts?

I. The Tokyo Futures Exchange

II. The Euronext-Liffe Exchange

III. The Chicago Mercantile Exchange

Which one of the following four formulas correctly identifies the expected loss for all credit instruments?

Which one of the following four global markets for financial assets or instruments is widely believed to be the most liquid?

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan is collateralized with $55,000. The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's exposure at default (EAD) be?

A credit risk analyst is evaluating factors that quantify credit risk exposures. The risk that the borrower would fail to make full and timely repayments of its financial obligations over a given time horizon typically refers to:

Gamma Bank provides a $100,000 loan to Big Bath retail stores at 5% interest rate (paid annually). The loan also has an annual expected default rate of 2%, and loss given default at 50%. In this case, what will the bank's expected loss be? What is the expected loss of this loan?

All of the following performance statistics typically benefit country's creditworthiness EXCEPT:

A risk manager has a long forward position of USD 1 million but the option portfolio decreases JPY 0.50 for every JPY 1 increase in his forward position. At first approximation, what is the overall result of the options positions?

Which one of the following four statements correctly defines credit risk?

From the bank's point of view, repricing the retail debt portfolio will introduce risks of fluctuations in:

I. Duration

II. Loss given default

III. Interest rates

IV. Bank spreads

Alpha Bank determined that Delta Industrial Machinery Corporation has 2% change of default on a one-year no-payment of USD $1 million, including interest and principal repayment. The bank charges 3% interest rate spread to firms in the machinery industry, and the risk-free interest rate is 6%. Alpha Bank receives both interest and principal payments once at the end the year. Delta can only default at the end of the year. If Delta defaults, the bank expects to lose 50% of its promised payment. Hence, the loss rate in this case will be

Which of the following statements regarding bonds is correct?

I. Interest rates on bonds are typically stated on an annualized rate.

II. Bonds can pay floating coupons that are directly linked to various interest rate indices.

III. Convertible bonds have an element of prepayment risk.

IV. Callable bonds have an element of equity risk.

A financial analyst is trying to distinguish credit risk from market risk. A $100 loan collateralized with $200 in stock has limited ___, but an uncollateralized obligation issued by a large bank to pay an amount linked to the long-term performance of the Nikkei 225 Index that measures the performance of the leading Japanese stocks on the Tokyo Stock Exchange likely has more ___ than ___.

What is generally true of the relationship between a bond's yield and it's time to maturity when the yield curve is upward sloping?

Which one of the following four options correctly identifies the core difference between bonds and loans?

Which one of the following four alternatives lists the three most widely traded currencies on the global foreign exchange market, as of April 2007, in the decreasing order of market share? EUR is the abbreviation of the European euro, JPY is for the Japanese yen, and USD is for the United States dollar, respectively.

A credit analyst wants to determine a good pricing strategy to compensate for credit decisions that might have been made incorrectly. When analyzing her credit portfolio, the analyst focuses on the spreads in each loan to determine if they are sufficient to compensate the bank for all of the following costs and risks EXCEPT.

A credit analyst wants to determine if her bank is taking too much credit risk. Which one of the following four strategies will typically provide the most convenient approach to quantify the credit risk exposure for the bank?

Which one of the following four model types would assign an obligor to an obligor class based on the risk characteristics of the borrower at the time the loan was originated and estimate the default probability based on the past default rate of the members of that particular class?

According to a Moody's study, the most important drivers of the loss given default historically have been all of the following EXCEPT:

I. Debt type and seniority

II. Macroeconomic environment

III. Obligor asset type

IV. Recourse

In the United States, foreign exchange derivative transactions typically occur between

Which one of the following four statements regarding counterparty credit risk is INCORRECT?

Which one of the following four exotic option types has another option as its underlying asset, and as a result of its construction is generally believed to be very difficult to model?

ThetaBank has extended substantial financing to two mortgage companies, which these mortgage lenders use to finance their own lending. Individually, each of the mortgage companies has an exposure at default (EAD) of $20 million, with a loss given default (LGD) of 100%, and a probability of default of 10%. ThetaBank's risk department predicts the joint probability of default at 5%. If the default risk of these mortgage companies were modeled as independent risks, what would be the probability of a cumulative $40 million loss from these two mortgage borrowers?

Which one of the following statements about futures contracts is correct?

I. Futures contracts are subject to the same risks as the underlying instruments.

II. Futures contracts have additional interest rate risk die to the future delivery date.

III. Futures contracts traded in a clearinghouse system are exposed to credit risk with numerous counterparties.