A manufacturing company is in the process of introducing just in time (JIT) and total quality management (TQM) into every aspect of its value chain.

Which TWO of the following are appropriate changes to make to the support activities in the organization's value chain?

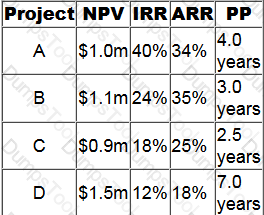

Four mutually exclusive projects have been appraised as follows using net present value (NPV), internal rate of return (IRR), accounting rate of return (ARR) and payback period (PP).

Recommend which of the projects should be chosen.

An organization wishes to achieve cost reductions for a product it already has in production without affecting the customer's perception of the product.

It has decided to carry out a systematic examination of the factors affecting the cost of the product in order to identify ways of achieving the specified purpose at lower cost while maintaining the required standard and quality.

Which of the following correctly identifies the activity that the organization is undertaking?

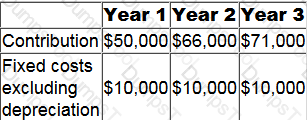

The following forecast data relate to the first three years of a five year project.

The project will require an initial investment of $30,000 in non-current assets.

All revenue will be received in the year it is earned and all operating costs will be paid in the year they are incurred. Tax will be paid in the following year.

Tax depreciation will be 25% per annum of the reducing balance.

The taxation rate will be 30% of taxable profits.

What is the forecast after tax cash flow for year 3 (to the nearest $10)?

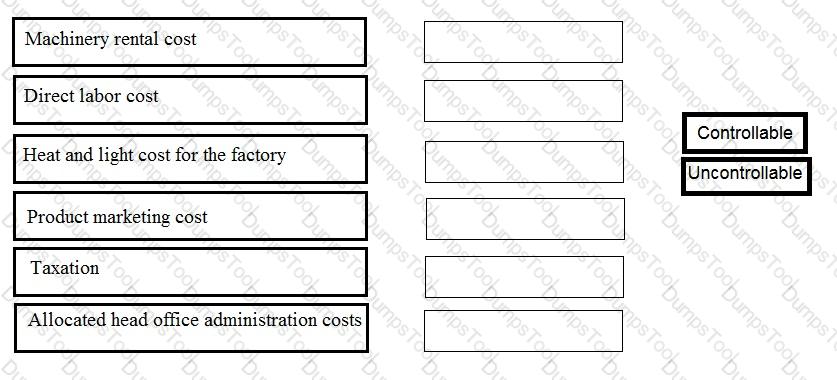

A company classifies its main factory as an investment centre. Categorise each of the following costs as either controllable or uncontrollable by the investment centre manager.

A company is considering investing $680,000 in a machine to manufacture a new product. A consultant has been appointed to advise on the investment and the company is committed to paying $10,000 to the consultant in year 1, even if the project does not go ahead.

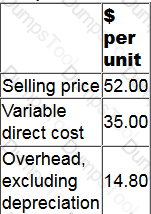

300,000 units of the new product will be produced and sold each year. Unit cost and revenue information based on this level of output is as follows.

60% of the overhead cost is variable. Of the remainder, 10% consists of allocated head office overheads.

The selling price will increase by 2% each year in line with inflation, beginning in year 2. Fixed price contracts mean that all unit costs will remain unaltered.

Taxation information:

• 100% first year allowance will be available for the purchase of the machinery.

• The taxation rate is 30% of taxable profits, payable in the year after that in which the liability arises.

For the purpose of deciding whether to proceed with the investment, what is the relevant cash flow in year 2?

A positive net present value (NPV) has been calculated for a project to launch a new product. An additional calculation is required to identify the sensitivity of the NPV to changes in the forecast total sales volume.

The present value of which of the following would be used in the calculation?

A long established organization has recognised the need to make urgent changes to the way it operates in order to remain competitive. The organization wishes to dramatically improve its performance through a fundamental rethinking and radical redesign of its existing activities.

Which of the following techniques should be used to achieve this?

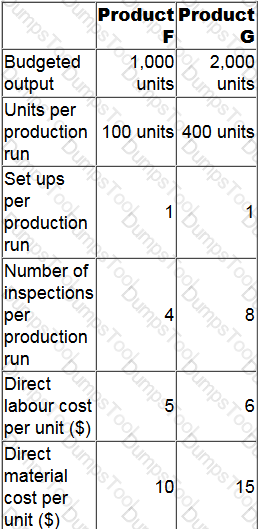

A company uses activity based costing. The total production overheads of $16,050 for the next period are for set up costs of $6,450 and quality inspection costs of $9,600. The company produces two products, Product F and Product G. Details relating to the next period are as follows:

A new customer has offered to purchase Product F for $28.00 per unit. The only costs incurred would be those shown above.

What is the profit per unit of Product F that would be gained by accepting the offer? Give your answer to two decimal places.

The discount rate at which the net present value (NPV) is zero is known as the

An organization wishes to make its investment decisions on the basis of more than simply a financial appraisal. Which of the following will assist it to take into account both qualitative and quantitative factors?

Which of the following factors would prevent a learning curve being observed for a task?

Which basis of transfer pricing retains the full autonomy of divisional managers?

K Supermarket spends $80,000 per year on checking and processing receipts of inventory. Annual warehouse costs are a further $70,000 per year. These costs are currently treated as fixed overheads in the company's costing system.

As an experiment, the company is preparing a direct profitability analysis of a small range of products, including fresh grapes.

K Supermarket receives a total of 3,600 deliveries every year. 20% of these deliveries are of perishable goods such as grapes. It takes twice as long to process a delivery of perishable goods compared to a normal delivery because perishable goods have to be checked more carefully.

Half of the warehouse costs are for the chilled store that is used to store perishable goods. At any time, the chilled store has 800 kilos of perishable goods in stock.

K Supermarket receives 150 deliveries of grapes every year. Each delivery is for 100 kilos of grapes. The grapes spend an average of two days in the chilled store before they are sold.

Calculate the total cost per kilo of checking, processing and storing grapes that should be taken into account in determining the profitability of grapes.

Give your answer to the nearest whole cent.

LL produces an item, the Z, for which the demand curve is estimated to be:

P = 10 - 0.0001Q

where, P is the unit price in $ and Q is the annual sales volume in units;

Marginal revenue (MR) = 10 - 0.0002Q

The variable cost of producing the Z is $2 per unit. The annual fixed costs of production are $110,000.

What is the profit maximizing output level?

Which of the following statements is TRUE about the activity based costing system when compared to absorption costing method?

In order to support decision making, management accounting information categorizes costs in a variety of ways.

Responsibility accounting primarily distinguishes between costs on the basis that they are either:

A company's competitor has just launched a rival product at a selling price of $38 per unit. Until now the company's selling price of $41.60 per unit has achieved a 30% mark-up on the product's unit cost. The company proposes to use a target costing approach to pricing to remain competitive.

Management has decided to match the competitor's selling price and has set a target cost to achieve a 20% return on the target price.

What is the cost gap?

Which of the following statements are fundamental concepts that underlie the Beyond Budgeting approach?

1. Use traditional budgeting in conjunction with other techniques.

2. Use adaptive management processes rather than the more rigid annual budget.

3. Move towards devolved networks rather than centralized hierarchies.

4. Move towards centralized hierarchies rather than devolved networks.

Which of the following statements regarding multinational transfer pricing is INCORRECT?

Which TWO of the following conditions are necessary for a learning curve to apply?

If transfer prices are set at variable costs, the supplying division does not cover its fixed costs.

Which of the following does NOT resolve this problem?

A new product is being manufactured for the first time. The first unit required 600 minutes of labor to manufacture. It is expected that there will be a 90% learning curve for the first 20 units.

The learning index for a 90% learning curve is - 0.152.

Calculate the expected labor time to manufacture the 10th unit.

Your answer should be given to the nearest whole minute.

In an organization's transfer pricing system the selling division and the purchasing division each record a different price for the same transaction.

This is known as a: