Section C (4 Mark)

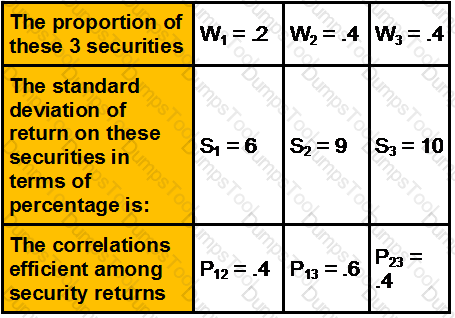

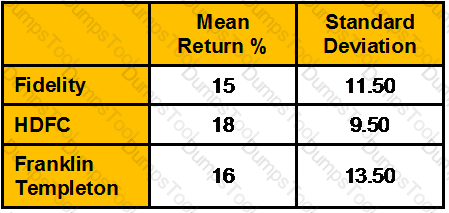

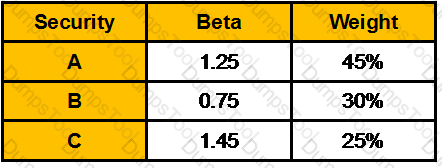

A portfolio consists of 3 securities.

What is the standard deviation of the portfolio?

Section B (2 Mark)

Mr Dixit is considering purchasing an office building for Rs. 2,500,000. He expects the potential gross income (PGI) in the first year to be Rs. 450,000; vacancy and collection losses to be 9 percent of PGI; and operating expenses to be 42 percent of effective gross income (EGI). What is the (effective) gross income multiplier?

Section C (4 Mark)

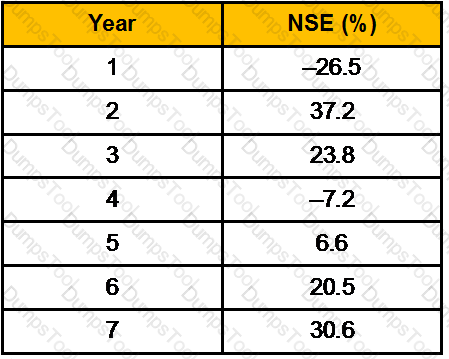

You are given the following set of data:

Historical Rate of Return

Determine the arithmetic average rates of return and standard deviation of returns of the NSE over the period given.

Section B (2 Mark)

Resident but not ordinary resident (RNOR) is ____________ on Indian Income and ___________ on Foreign Income.

Section A (1 Mark)

During “Financial Independence” life stage, typical asset allocation should be

Section B (2 Mark)

Reliable ltd. has current earnings per share of Rs. 5. Assume a dividend – payout ratio of 50 percent. Earnings grow at a rate of 9 percent per year. If the required rate of return is 14 percent, what is its current value?

Section A (1 Mark)

Which of the following is an effective strategy in times of falling interest rates?

Section B (2 Mark)

Regular collateralized debt obligations (CDO) have been surpassed by:

Section A (1 Mark)

A(n) _____________ is an over-the-counter agreement offering protection against loss when default occurs on a loan or other debt instrument.

Section B (2 Mark)

Which of the following portfolios falls below the Markowitz Efficient Frontier?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Interest Rate in Mauritius is charged at:

Section A (1 Mark)

__________ is a tangible company asset that can (and should) be inventoried and managed.

Section B (2 Mark)

Vikrant Juneja gifted his house property to his wife in year 2007. Mrs. Juneja then lets out this house @ Rs. 5000 per month. The income from such house property will be taxable in the hands of:

Section A (1 Mark)

Why have consumers/customers been so hyper-aware and so nervous?

Section B (2 Mark)

Ramesh living in Kolkata is a trustee for Brijesh living in Mumbai, Ramesh remits trust funds to Brijesh by bills drawn by a person of high creditworthiness in favor of the trustee as such and payable at Mumbai. The bills later got dishonored. Is Ramesh bound to make good the loss?

Section C (4 Mark)

An investor purchased on margin Alpha Computer for Rs. 30/- a share. The stock's price subsequently rose to Rs. 50/- a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on the investor's funds (excluding commissions)? What would have been the return if the investor had not bought the stock on margin?

Section A (1 Mark)

Short-term to medium-term loans repayable in two or more consecutive payments are known as:

Section A (1 Mark)

The principle that people do not buy or rent real estate, but judge properties as different sets of benefits and costs is called

Section A (1 Mark)

Unabsorbed depreciation can be carried forward for ____________.

Section A (1 Mark)

Mansi deposits Rs. 50,000/- in a bank account which pays interest @ 10 % per annum. How much can be withdrawn at the beginning of each year for 5 years if first withdrawal is 6 years from now?

Section A (1 Mark)

____________ is defined as a dollar per thousand dollars of assessed value of property and is used to calculate a property owner's tax bill.

Section B (2 Mark)

If an investor determines that next year’s earnings estimate is Rs2.00 per share and the company subsequently falters, the investor may not readjust the Rs2.00 figure enough to reflect the change because he or she is “anchored” to the Rs2.00 figure. This is not limited to downside adjustments—the same phenomenon occurs when companies have upside surprises

Which of the following Biases have been exhibited by the investor?

Section A (1 Mark)

__________refers to responding to a positive action with another positive action, rewarding kind actions.

Section A (1 Mark)

Which of the following industry categories is said to be “bought to be sold?”

Section C (4 Mark)

Rate of 15% p.a compounded annually will be equal to ---------------- % per month.

Section A (1 Mark)

Dividend received by a shareholder from an Indian company the whole of whose income is agricultural income shall be treated as:

Section B (2 Mark)

Mr.Dinesh is transferred to Delhi and is paid a shifting allowance of Rs.20000 by his employers out of which he spends Rs.18000 for shifting his family and personal effects. Which of the following is true?

Section B (2 Mark)

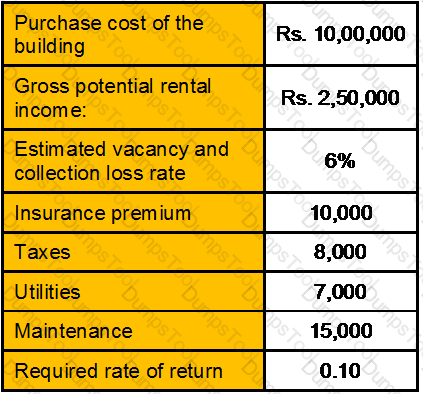

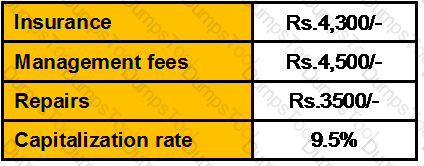

An investor is considering the purchase of a small office building and, as part of his analysis, form the following given data calculate the appraised value of the property using the Income Approach.

Section C (4 Mark)

A trader buys three-month put options on 1 unit of gold with a strike of Rs.17000/10 gms at a premium of Rs.70. Unit of trading is 1kg. On the day of expiration, the spot price of gold is Rs.16800/10 gms. What is his net payoff?

Section B (2 Mark)

How much should one deposit today in a bank account paying interest compounded quarterly if you wish to have Rs. 10000 at the end of 3 months, if the bank pays 5% annually?

Section B (2 Mark)

As per Double Taxation Avoidance Agreement, the Royalties in Mauritius is charged at:

Section A (1 Mark)

Which of the following is not one a part of the primary stage in the Francis Buttle model?

Section C (4 Mark)

Ramesh aged 50 could not save for his retirement till date but now decides to save Rs. 50000 per month till his retirement age of 65. He anticipates that the return in the first 5 years would be 13% p.a. next 5 years 10% and in the last 5 years 8% p.a. He wants to accumulate a corpus of Rs. 1.50 Crores till his retirement. Calculate the surplus or shortfall he would have on his retirement.

Section C (4 Mark)

Mudra Financial is a large financial firm which owns several mutual funds. The funds are managed individually by portfolio managers but it has an investment committee that overseas all of the funds. This committee is responsible for evaluating the performance of the funds relative to the appropriate benchmark and relative to stated investment objectives of each individual fund. During a recent investment committee meeting, the poor performance of Its Equity Funds were discussed. In particular, the inability of the portfolio managers to outperform their benchmarks was highlighted. The net conclusion of the committee was to review the performance of the manager responsible for each fund and dismiss those managers whose performance had lagged substantially behind the appropriate benchmark.

The fund with the worst relative performance is the Mudra Large Cap Fund which invests in large cap stocks. A review of the operations of the fund found the following:

• The turnover of the fund was almost double that of other similar style mutual funds

• The fund’s portfolio manager solicited input from her entire staff prior to making any decision to sell an existing holding

• The beta of the Mudra Large Cap Fund’s portfolio was 65% higher than the beta of other similar style mutual funds

• The portfolio manager refuses to increase the Capital Goods sector weighting because of past losses the fund incurred in the sector

• The portfolio manager sold all the fund’s Oil Marketing Companies stocks as the price per barrel of oil rose above $105. He expects oil prices to fall back to the $80 to $85 per barrel

• No stock is considered for purchase in the Large Cap Fund unless the portfolio manager has 10 years of financial information on that company.

The underweighting of the Capital Goods sector and selling off Oil Marketing Stocks could be best described as an example of:

Section B (2 Mark)

Which of the following statements is/are correct with respect to Mental Accounting?

Section A (1 Mark)

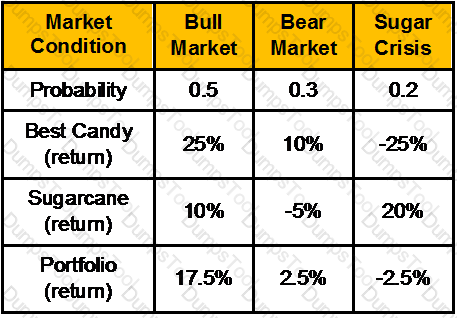

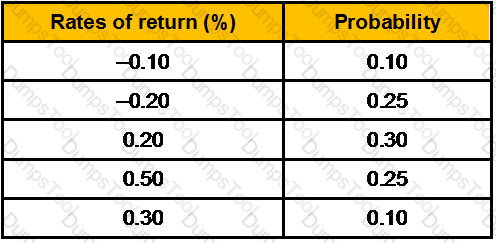

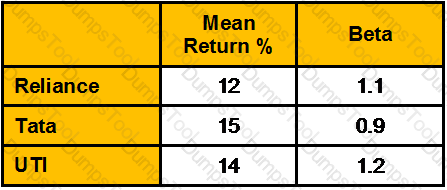

Given below is the portfolio return; calculate the expected portfolio rate of return:

Section C (4 Mark)

Tom dies in January of the current year and leaves his wife Jeanne a $50,000 insurance policy. Jeanne elects to receive the proceeds at $10,000 per year plus interest, for five years. In the current year, she receives $12,000 ($10,000 plus $2,000 interest).

How much must Jeanne include in her gross income?

Section A (1 Mark)

Aditya’s father has given him general power of attorney what does this mean?

Section A (1 Mark)

Depending on how questions are asked, ___________ can cause investors to communicate responses to questions about risk tolerance that are either unduly conservative or unduly aggressive.

Section C (4 Mark)

Read the senario and answer to the question.

Assuming his son gets average marks in class 10th when he was just 15 years old, his father decided to send him abroad for further studies at age 21.calculate the amount that Mr. Mehta requires to invest in excess of the amount accumulated in previous question during next six years to accumulate a fund of Rs. 500000?

Section C (4 Mark)

Read the senario and answer to the question.

Raman’s company has made plans for the next year for a new project. It is estimated that the company will employ total assets of Rs. 900 lakh, 75% of the assets being financed by borrowed capital at an interest cost of 6% per year. The direct costs are estimated at Rs. 530 lakh. All other operating expenses are estimated at Rs. 95 lakh. The goods will be sold to customers at 150% of the direct costs. Income tax rate is assumed to be 30%. Calculate net profit margin and return on owners’ equity.

Section A (1 Mark)

The strategies of convertible arbitrage, emerging markets, equity market neutral and fixed income arbitrage are categories of which alternative investments class?

Section A (1 Mark)

A financial contract that obligates one party to exchange a set of payments it owns for another set of payments owned by another party is called a

Section A (1 Mark)

We divide phenomena into different departments and try to optimize each department rather than the whole. Which of the following is most likely consistent with this bias?

Section B (2 Mark)

R acquired shares of G Ltd, on 15/12/1998 for Rs. 5 lakh which were sold on 15/5/2011 for Rs. 18.50 lakh. Expenses of transfer were Rs. 20,000/-. He invests Rs. 6 lakh in the bonds of NHAI on 16/10/2011. Compute the capital gain for the assessment year 2012-13.

Section C (4 Mark)

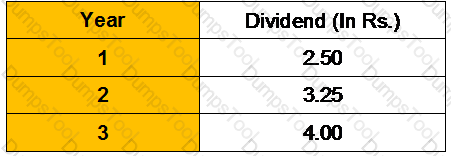

Singhvi group has recently announced that expected dividends for the next three years will be as follows:

For the subsequent years, management expects the dividend to grow at 5% annually. If the risk-free rate is 4.30%, the return on the market is 10.30% and the firm’s beta is 1.40. What is the maximum price that you should pay for this stock?

Section B (2 Mark)

Withholding Tax Rates for payments made to Non-Residents are determined by the Finance Act passed by the Parliament for various years. The current rates for Dividends are:

Section A (1 Mark)

Under which of the following categories of General Warranty Deed does the buyer is guaranteed that the title will be good against third parties attempting to establish title to the property?

Section A (1 Mark)

A “Family Office” segment client has investible assets worth of

Section C (4 Mark)

Sunil has an investment portfolio of Rs.100000; the initial portfolio mix is Rs.50000 in stocks, Rs.30000 bonds and Rs.20000 in bank. If market goes up by 10% and the value of bonds decreases by 10%, what should Sunil do under the constant mix policy?

Section B (2 Mark)

What is the correlation coefficient between the companies A and B, if their covariance is 23 and their standard deviation is 8 and 7 respectively?

Section B (2 Mark)

You purchased one XYZ March 50 call and sold one XYZ March 55 call. Your strategy is known as

Section C (4 Mark)

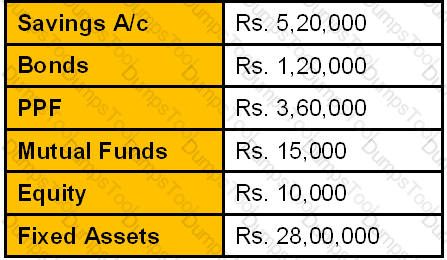

Mr. Bhatia, aged 43 is practicing as a Doctor at Nasik. His wife Mrs. Bhatia is a social worker. They reside in a flat they own along with their daughter Neena aged 9. Mr. Bhatia’s elder sister is residing in Canada whom he has not met since last 5 years. His another elder sister resides in USA whom he has not met since last 8 years. Mr. Bhatia will continue active practice upto the age of 75. Looking at the history of his family life expectancies, Mr. Bhatia believes he would survive upto 85. His gross monthly income currently is Rs. 1, 45,000. Their monthly expenses are Rs. 25,000/-(including Personal expenses Rs. 5000) and they save about Rs. 35,000/- every month. Mr. Bhatia has total assets of Rs. 38.25 lacs and total outstanding liability for Medical Equipment and car of Rs. 12.45 lacs, which gives Mr. Bhatia net worth of Rs. 25.80 lacs estimated as on March 2008. His current investments are as follows:

Mr. Bhatia is a moderate risk taker and minimizes his tax through various schemes. He has a minimal exposure to equity instruments, as substantial portion of his investments is locked in Debt instruments. But he is aware of the fact that capital growth without investing in direct equity or equity mutual funds is difficult. In the current scenario, the economy is positive, with a growth of more than 9% and hence equity will yield excellent returns.

Objectives:

1.Mr. Bhatia and his wife would like to start saving for their daughter Neena’s educational needs. They require Rs. 1,00,000 at her age of 15, 2 lacs when she is 16, and 8 lacs when she is 18 and 25 lacs when she is 21.

2.To provide Rs. 50 lacs for Neena’s wedding at the age of 25.

3.To provide for vacations with the family to US & Canada, Middle East and Europe.

4.To provide a retirement corpus for a period of 10 years

5.Purchase a new car worth Rs. 15 lacs in nest 6 months.

6.To buy a property worth Rs. 1 crore nearby of RML hospital.

Section B (2 Mark)

An asset may be purchased for Rs 10,00,000. It is expected to generate Rs 10,000 annual income for 10 years after which it is expected to sell for Rs. 1,20,000. What is the rate of return expected from this investment?

Section C (4 Mark)

Read the senario and answer to the question.

If Mrs. Deepika, a conservative investor, has Rs. 50, lakhs today that she could invest for the next three months in a three month bank CD or in a stock .The bank CD offers a guaranteed return 6 % over the three-month period. Alternatively she thinks the price of the stock will rise by 5% over the next months. She is confused in taking the decision. Guide her in trade off between return and risk so that she makes a decision in choosing investments?

Section B (2 Mark)

Mr. A gifted debenture of Rs. 100000 to his wife. She received Rs. 10000 interest which she reinvests and earns Rs. 1000. This Rs. 1000 will be taxable in the hands of

Section A (1 Mark)

Acquiring the Right Customers, based on known characteristics, which drives growth and increased profit margin, is a benefit of __________

Section A (1 Mark)

Which of the following types of income is received by individuals without deduction of basic rate tax?

Section A (1 Mark)

………………………arises by operation of law eg trust created under MWP Act

Section B (2 Mark)

If the currency of your country is depreciating, the result should be to ______ exports and to _______ imports.

Section B (2 Mark)

Ram born in 1950 has a life expectancy at birth of 65 years. Sita his wife born in 1955 has a life expectancy at birth of 70 years. Assuming that the life expectancies have not changed. Ram is planning to buy an annuity to be paid to him or his wife till anyone of them is alive. Assuming Ram will retire on attaining age 58 i.e. in 2008, what should be the time period of the annuity?

Section C (4 Mark)

The assumptions concerning the shape of utility functions of investors differ between conventional theory and prospect theory. Conventional theory assumes that utility functions are __________ whereas prospect theory assumes that utility functions are __________.

Section A (1 Mark)

Single men trade far more often than women. This is due to greater ________ among men.

Section C (4 Mark)

Rhona has a daughter Zena five years old. She wants to plan for Zena’s education and has found out that she would be requiring 2,75,000 at her age 18 and another 4,50,000 on her age 25. She also wants to have Rs. 10,00,000 for Zena’s Marriage which she expects at the age of 28. She wants to deposit the entire amount for these expenses today in an account that pays a ROI of 15% per annum compounded annually. What would this amount be?

Section B (2 Mark)

Mr.Neeraj has a portfolio consisting of two stocks A & B has a standard deviation of 5% while stock B has a standard deviation of 15%. Stock A comprises 40% of the portfolio and stock B consists of 60%. If the correlation of returns of A and B is 0.5, the variance of return on the portfolio is_______

Section A (1 Mark)

Data for five comparable income properties that sold recently are shown below:

What is the indicated overall rate (RO)?

Section A (1 Mark)

Conservative retirees likely have ____ than they did early in their careers.

Section A (1 Mark)

In case of non-resident, who is carrying on shipping business, his Indian income shall be presumed to be:

Section C (4 Mark)

Suppose Sunil visits his favorite coffee shop and encounters his good friend Rohit. Rohit raves about his stockbroker, whose firm employs an analyst who appears to have made many recent successful stock picks. The conversation goes something like this:

SUNIL: Hi, Rohit, how are you?

ROHIT: Hi, Sunil. I’m doing great! I’ve been doing superbly in the market recently.

SUNIL: Really? What’s your secret?

ROHIT: Well, my broker has passed along some great picks made by an analyst at her firm.

SUNIL: Wow, how many of these tips have you gotten?

ROHIT: My broker gave me three great stock picks over the past month or so. Each stock is up now, by over 10 percent.

SUNIL: That’s a great record. My broker seems to give me one bad pick for every good one. It sounds like I need to talk to your broker; she has a much better record!

Which of the following biases have been exhibited by Gaurav?

Section B (2 Mark)

How much interest is paid in total on a 3-year loan for Rs27 400? The interest rate is 8.6% compounded monthly and the payments are monthly?

Section A (1 Mark)

The organizations make their special offer to the customers who will provide the highest profit margins, greatest response rate and __________.

Section B (2 Mark)

A bank has a long term relationship with a particular business customer. However, recently the bank has become concerned because of a potential deterioration in the customer's income. In addition, regulators have expressed concerns about the bank's capital position. The business customer has asked for a renewal of its Rs25 million dollar loan with the bank. Which credit derivative can help this situation?

Section A (1 Mark)

Garima deposits Rs. 2,000/- every month in an account and is getting interest @ 12 % per annum compounded monthly. How much will be her nest egg after 10 years ?

Section C (4 Mark)

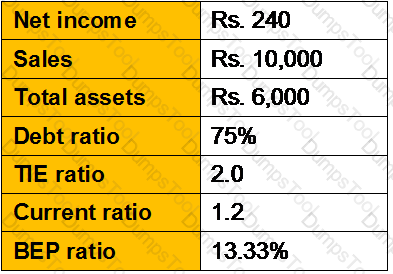

Tapley Dental Supply Company has the following data:

If Tapley could streamline operations, cut operating costs, and raise net income to Rs300, without affecting sales or the balance sheet (the additional profits will be paid out as dividends), by how much would its ROE increase?

Section A (1 Mark)

Which of the following is not one of the five core process according to Payne’s five-process model ?

Section A (1 Mark)

Income received in India in previous year is taxable in the hands of:

Section B (2 Mark)

Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has expected return of 12% and standard deviation of 17%. Rational investors will

Section A (1 Mark)

Debt investments in real estate, such as mortgages or deeds of trust, are called income property investments.

Section B (2 Mark)

Consider a one-year maturity call option and a one-year put option on the same stock, both with striking price Rs45. If the risk-free rate is 4%, the stock price is Rs48, and the put sells for Rs1.50, what should be the price of the call?

Section C (4 Mark)

As a CWM you are required to calculate the tax liability of an individual whose Taxable income is:

• $ 178650 in US dollars and he is a US citizen (single individual)

• $ 85300 in SGD and he is a citizen of Singapore

Section B (2 Mark)

Fifteen Year ago, Sandeep set up his initial allocation in her defined contribution plan by placing an equal amount in each asset class and never changed it. Over time, he increased his contribution by 3 % per year until he reached maximum amount allowed by law. Which of the following biases that Sandeep suffers from?

Section B (2 Mark)

Manav invests Rs. 500/- every 6 months towards a fund to pay for his children education. If the investment pays ROI @ 9 % per annum, compounded Semi Annually, then what will be the corpus after 10 years ?

Section B (2 Mark)

After making an investment, assume that an investor overhears a news report that has negative implications regarding the potential outcome of the investment he has just executed. How likely is he to then seek information, if he exhibits self attribution bias, that could confirm that you’ve made a bad decision?

Section C (4 Mark)

Read the senario and answer to the question.

What would be the taxable amount on gratuity received by Jogen, if he would retired from an organization where employees are not covered under Gratuity Act?

Section A (1 Mark)

Operational customer relationship management supports which of the following function?

Section B (2 Mark)

Lucy purchased a rental house a few years ago for $100,000. Total depreciation to date is $35,000. In the current year, she sells the house for $155,000 and pays $10,000 selling expenses. Calculate Lucy's gain on the sale.

Section C (4 Mark)

Vikas has an investment portfolio of Rs.100000, and a multiplier of 2. The initial portfolio mix is Rs. 50000 in stocks and Rs. 50000 in bonds. If stock market goes up by 20%, what should Vikas do under the constant mix policy?

Section B (2 Mark)

What is the size of the final unequal payment of a loan for Rs15 600 and it has monthly payments of Rs500? The interest rate is 9.92% compounded quarterly.

Section A (1 Mark)

In reality, when risk and uncertainty or incomplete information about an alternative or high degree of complexity is introduced, people or organizations may be have somewhat different from rationality. This is called ___________.

Section A (1 Mark)

Which of following is not an exclusion under a health policy?

Section B (2 Mark)

The income exemption threshold in respect of income year ending 30 June 2009 is as follows for an individual with two dependents in Mauritus is:

Section A (1 Mark)

A bank that wants to protect itself from higher credit costs due to a decrease in its credit rating might purchase _________________________.

Section A (1 Mark)

________ bias means that investors are too slow in updating their beliefs in response to evidence.

Section A (1 Mark)

While matching orders for equity trading in NSE, which one of the following gets precedence over all the others?

Section B (2 Mark)

A constant proportion portfolio insurance (CPPI) policy calls for:

Section A (1 Mark)

Mr. Vikas is now 50 years old. He has invested some amount in an annuity which will pay him from the END. of 5th year Rs. 35,000/- p.a. at the end of every year for 10 years. Rate of interest is 7% p.a. Calculate how much he has invested now?

Section C (4 Mark)

Suppose Gaurav, an investor, is looking to add to his portfolio and hears about a potential investment through a friend, Hitesh, at a local coffee shop. The conversation goes something like this:

GAURAV: Hi, Hitesh. My portfolio is really suffering right now. I could use a good long-term investment. Any ideas?

HITESH: Well, Gaurav, did you hear about the new IPO [initial public offering] pharmaceutical company called Pharma Growth (PG) that came out last week? PG is a hot new company that should be a great investment. Its president and CEO was a mover and shaker at an Internet company that did great during the tech boom, and she has Pharma Growth growing by leaps and bounds.

GAURAV: No, I didn’t hear about it. Tell me more.

HITESH: Well, the company markets a generic drug sold over the Internet for people with a stomach condition that millions of people have. PG offers online advice on digestion and stomach health, and several Wall Street firms have issued “buy” ratings on the stock.

GAURAV: Wow, sounds like a great investment!

HITESH: Well, I bought some. I think it could do great.

GAURAV: I’ll buy some, too.

Gaurav proceeds to pull out his cell phone, call his broker, and place an order for 100 shares of PG.

Which of the following biases have been exhibited by Gaurav?

Section A (1 Mark)

The most profitable credit card customers for a bank are those that:

Section C (4 Mark)

Mr. Chopra runs a Garment Factory, he is very concerned about his retirement and wants you to help him out in planning for it. His Current annual expenses are Rs. 12,00,000 which would be rising at an annual rate of 8% pre- retirement and 2% post retirement. His current age is 50 years and he wants to work till the age of 65. The expected life expectancy in his family is 75 years. Calculate the monthly contribution he must make till his retirement if the pre- retirement returns are 12% p.a. compounded monthly and post-retirement returns are 8% p.a compounded annually.

Section C (4 Mark)

Nifty is at 3200. Mr. XYZ expects large volatility in the Nifty irrespective of which direction the movement is, upwards or downwards. Mr. XYZ buys 2 ATM Nifty Call Options with a strike price of Rs. 3200 at a premium of Rs. 97.90 each, sells 1 ITM Nifty Call Option with a strike price of Rs. 3100 at a premium of Rs. 141.55 and sells 1 OTM Nifty Call Option with a strike price of Rs. 3300 at a premium of Rs. 64.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 2929

• If Nifty closes at 4325

Section A (1 Mark)

The stage in venture Capital financing where the business plan is completed and presented to a venture capital firm is called________________.

Section A (1 Mark)

The life-cycle theory of asset allocation proposes that as investors progress through life, their

Section C (4 Mark)

Company A is financed with 90 percent debt, whereas Company B, which has the same amount of total assets, is financed entirely with equity. Both companies have a marginal tax rate of 35 percent. Which of the following statements is most correct?

Section A (1 Mark)

Which part of the wealth management planning deals with efficient and optimum use of credit for the business.?

Section B (2 Mark)

Mr. Aggarwal is working in a reputed company and earning Rs. 4,50,000/- p.a. and is now 55 years old. He has invested Rs. 2,00,000/- in an annuity which will pay him after 5 years a certain amount p.a. at the beginning of every year for 10 years. Rate of interest is 8% p.a. Calculate how much he will receive at the beginning of every year after 5 years?

Section B (2 Mark)

Calculate the expected rate of return for M/S X Ltd. from the following information:

Section B (2 Mark)

The price of Sunder Ltd. is currently Rs. 40. The dividend next year is expected to be Rs. 4. Required return on the stock is 12%. Find the expected growth rate under the constant growth model.

Section C (4 Mark)

To create a common size income statement ____________ all items on the income statement by ____________.

Section A (1 Mark)

Vineet invests Rs. 5000/- per month at the beginning of the month for 10 years in Recurring Deposit account that pays 8.5% p.a interest compounded quarterly. What will be the accumulated amount in his account.

Section C (4 Mark)

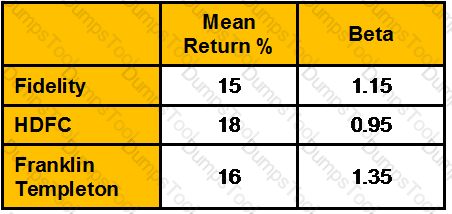

Data on following mutual funds is given below:

Risk free return is 8%. Calculate Sharpe measure.

Section A (1 Mark)

In Working Capital Finance, what should be the minimum current ratio the borrower needs to ensure the compliance under the first method of lending.

Section C (4 Mark)

Data on following mutual funds given below:

Risk free return is 8%. Calculate Treynor measure.

Section C (4 Mark)

Read the senario and answer to the question.

Nimita wants to know if she were to meet with an accident and get permanent disability in the third year of her Term Insurance policy, what amount of the premium due in the fourth year would be payable by her if the premium being paid towards the policy is Rs. 15,000 with sum assured of Rs. 50 lakh?

Section A (1 Mark)

_________________ is a method to evaluate a large volume of consumer loans quickly with minimum labor. This method is a statistical model which predicts whether the consumer will repay the loan or not.

Section A (1 Mark)

A type of CRM Dominant characteristic which applies technology across organizational boundaries with a view to optimizing company, partner and customer value is known as_______________.

Section B (2 Mark)

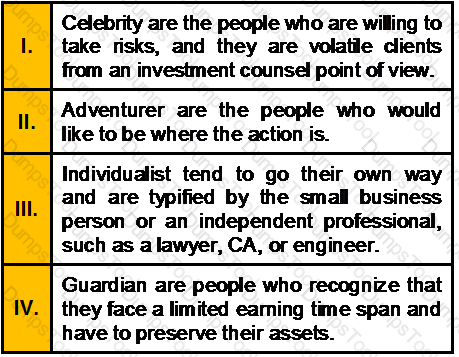

Which of the following statements are correct with regard to Bailard, Biehl, and Kaiser Five-Way Model?

Section B (2 Mark)

Lalit wants to sell a property for Rs.20 lakhs. He is earning rent from tenant Rs.2,15,000. He is spending following amounts annually on that property

The value of the property would be:

Section A (1 Mark)

Deduction under section 80QQB is allowed in respect of royalty income to:

Section A (1 Mark)

A cognitive heuristic in which a decision-maker relies upon knowledge that is readily available rather than examining other alternatives or procedures. Which of the following is most likely consistent with this bias?

Section A (1 Mark)

Passive Preserver follows a ___________ Investment Style

Section A (1 Mark)

The minimum income criteria for Personal Loans in case of Salaried employees is:

Section A (1 Mark)

We prefer a sure gain from a much larger gain that is very likely but not certain. This makes us close winning positions even if we think that they are likely to get even better.

Section A (1 Mark)

A(n)______________________ loan is a short- or medium-term loan repayable in two or more consecutive payments, usually monthly or quarterly.

Section C (4 Mark)

Read the senario and answer to the question.

Which types(s) of investment(s), would be consistent with their retirement goal?

Section C (4 Mark)

Read the senario and answer to the question.

Harish wants to know what amount is eligible for deductible u/s 24 of Income Tax for housing loan repayments in computation of his Income tax liability for AY 2010-11.

Section A (1 Mark)

Ratio of loading charge over the gross rate is called _________

Section A (1 Mark)

A draft of a will prepared by the head of the family which will decide the nature in which his properties will be distrubuted among his heirs is known as_____________________.

Section B (2 Mark)

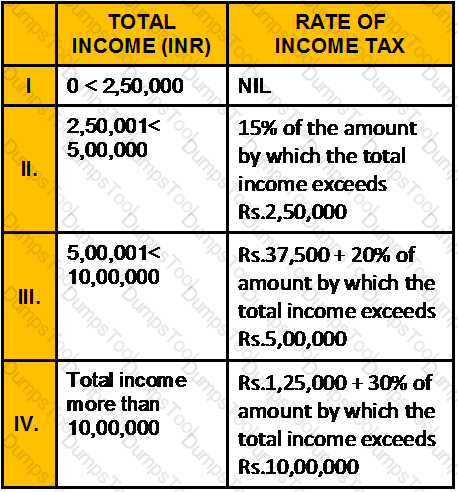

Which of the following statements is/are correct with respect for Resident Senior Citizen i.e. who is of an age of 60 years and above, but below 80 years?

Section B (2 Mark)

Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is __________ if no arbitrage opportunities exist.

Section A (1 Mark)

The proposed Fair Tax would change the U.S. tax system and instead:

Section C (4 Mark)

Suppose you have decided to sell your house and downsize by acquiring a townhouse that you have been eyeing for several years. You do not feel extreme urgency in selling your house; but the associated taxes are eating into your monthly cash flow, and you want to unload the property as soon as possible. Your real estate agent, whom you have known for many years, prices your home at Rs 90,00,000—you are shocked.

You paid Rs 250,000 for the home only 15 years ago, and the Rs 900,000 figure is almost too thrilling to believe. You place the house on the market and wait a few months, but you don’t receive any nibbles. One day, your real estate agent calls, suggesting that the two of you meet right away. When he arrives, he tells you that Pharma Growth, a company that moved into town eight years ago in conjunction with its much-publicized initial public offering (IPO), has just declared bankruptcy.

Now, 7,500 people are out of work. Your agent has been in meetings all week with his colleagues, and together they estimate that local real estate prices have taken a hit of about 10 percent across the board. Your agent tells you that you must decide the price at which you want to list your home, based on this new information. You tell him that you will think it over and get back to him shortly.

Assume your house is at the mean in terms of quality and salability.

What is your likeliest course of action if you exhibit Anchoring and Adjustment bias?

Section A (1 Mark)

The demand for insurance tends to be inelastic because of

Section B (2 Mark)

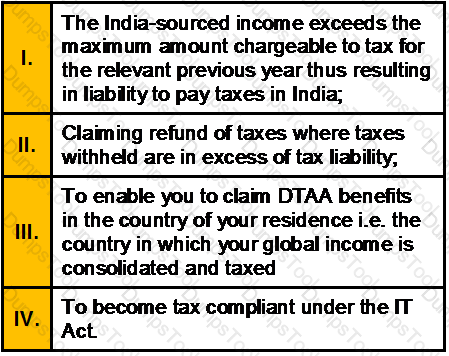

You may need to file your Returns in India under the following circumstances:

Section A (1 Mark)

Which of the following could be classified as an emotional bias?

Section C (4 Mark)

Suppose ABC Ltd. is trading at Rs. 4457 in June. An investor Mr. A buys a Rs 4500 call for Rs. 100 while shorting the stock at Rs. 4457. The net credit to the investor is Rs. 4357

What would be the Net Payoff of the Strategy?

• If ABC Ltd closes at 4145

• If ABC Ltd closes at 4983

Section C (4 Mark)

Mr. XYZ sells a Nifty Put option with a strike price of Rs. 4000 at a premium of Rs. 21.45 and buys a further OTM Nifty Put option with a strike price Rs. 3800 at a premium of Rs. 3.00 when the current Nifty is at 4191.10, with both options expiring on 31st July.

What would be the Net Payoff of the Strategy?

• If Nifty closes at 3287

• If Nifty closes at 4925

Section C (4 Mark)

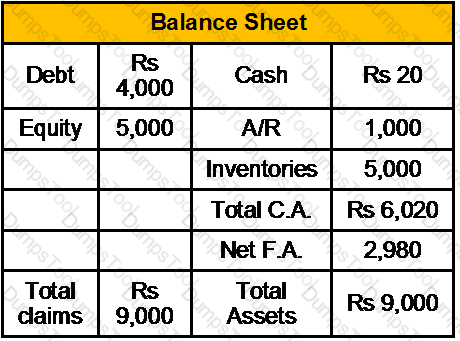

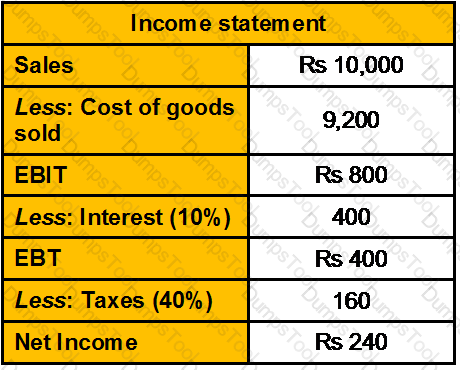

Your company had the following balance sheet and income statement information for 2003:

The industry average inventory turnover is 5. You think you can change your inventory control system so as to cause your turnover to equal the industry average, and this change is expected to have no effect on either sales or cost of goods sold. The cash generated from reducing inventories will be used to buy tax-exempt securities which have a 7 percent rate of return. What will your profit margin be after the change in inventories is reflected in the income statement?

Section A (1 Mark)

The price that the writer of a put option receives for the underlying asset if the option is exercised is called the

Section B (2 Mark)

In 2011-12, an individual receives net building society interest of £792. The equivalent gross income is:

Section B (2 Mark)

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Section A (1 Mark)

_____________ is defined as the transfer of services to private enterprise in US.

Section B (2 Mark)

Amit has just received new information regarding his investment in PLC ltd. The new information appears to be in conflict with earlier forecast of what the stock price should be at this point. He is still willing to incorporate the new information into his forecast and to revise it accordingly.

Which behavioral heuristic is Amit displaying?

Section A (1 Mark)

Shyam invests in a plan in which he has to pay Rs. 10,000/- per year Starting from the end of 5th year till the end of 12th. How much amount Should he invest today in order to meet his objective. If the interest rate is 10%p.a.?

Section C (4 Mark)

Read the senario and answer to the question.

Saxena bought agricultural land in notified urban limits of Mumbai on 15-June-1996 for Rs. 6 lakh and had been using the same for agricultural purposes. However the land was compulsorily acquired by the Government on 15-July-2003 and the compensation fixed was Rs. 25 lakh. Out of this, Rs 10 lakh was received by Saxena on 15-Jan-2005 and the balance on 06-Apr-2005. Saxena was not satisfied with the compensation and filed a suit in the court. The compensation was enhanced by Rs 8 lakh which was received on 25-Mar-2008. Which one of the following statement regarding capital gains arising from these transactions is correct:

Section A (1 Mark)

Which factor can trigger the stagnation or decline in value of a property?

Section B (2 Mark)

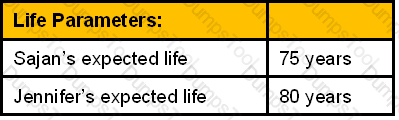

Vikash has following portfolio with related details given below:

Calculate the portfolio beta?

Section C (4 Mark)

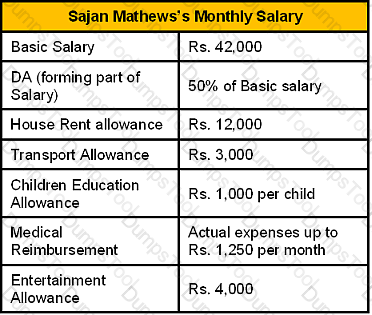

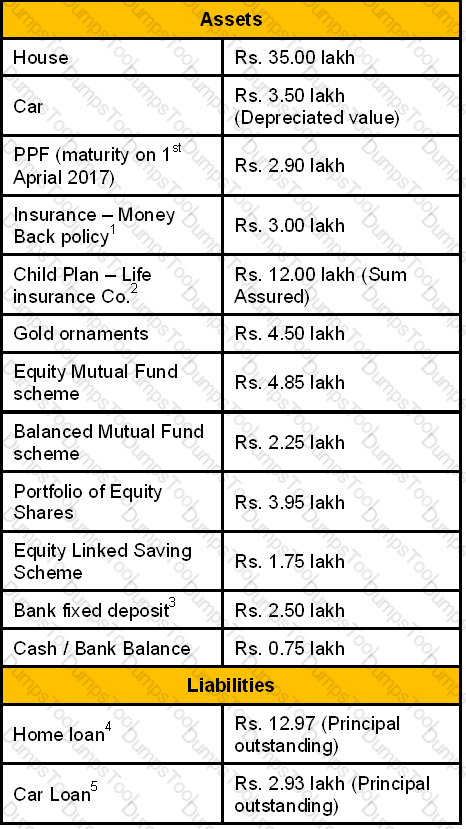

Sajan Mathews, aged 29 years (as on 2nd April, 2010), is working with a Multi National Company since December 2004. He has approached you, a CWM® for preparing his wealth plan. He is staying in his own house at Ahmedabad. His wife Jennifer, aged 31 years, is a fashion designer. She has earned a net profit of Rs. 4 lakh in FY 2008-09. They have a son, Mark of age 4 years (born on 12.02.2006), and a daughter, Stephanie (born on of 23.09.2009). Sajan is also supporting his parents staying in their own house at Surat to whom he sends Rs. 10,000 p.m. His monthly house hold expenses are Rs. 30000 p.m. (excludes his investments, payment of premia and EMIs). Sajan normally gets 5% increase in his gross salary year-on-year in the beginning of every financial year, apart from bonus. The effect for this year is yet to take place, though he has received a bonus of Rs. 3,31,680 for the year 2009-10. He has taken a family floater policy for health insurance involving an annual premium of Rs. 16268 and a total cover of Rs. 15 lakh.

Current Assets & Liabilities of the Family (As on 31st March, 2010 unless otherwise specified in foot notes)

____________

1.Purchased on 25th October, 2006, annual premium paid Rs. 14,798

2.Purchased on Mark’s 2nd birthday for a term of 15 years; annual premium Rs. 41,374

3.Subscribed on 01.09.2008 @ 10% p.a., with interest credited quarterly to his savings account; renewed at same rate for one year on 01.09.2009 without penal provision for premature withdrawal

4.Home loan of Rs. 17 lakh taken on 1st November, 2004 at a fixed interest of 7.5% p.a. for a 15 year term.

5.Car loan of Rs. 4.50 lakh taken on 1st April, 2008 at a fixed interest of 11.25% p.a. for a 4-year term.

Goals:

1.To provide for higher education of Mark and Stephanie. Initial expenses at their respective age of 18 years, Rs. 3 lakh (current cost), and subsequently Rs. 2 lakh p.a. for the next two years, and Rs. 3.5 lakh p.a. for the following 2 years.

2.Marriage expenses of Rs. 15 lakh (current cost) for each child at their respective age of 27 years.

3.Retirement corpus at the age of 58 years to sustain 70% of pre-retirement household expenses till his lifetime and 50% till stephanie’s expected life.

4.A Bigger house valued at Rs. 50 lakh today, a year from now.

5.To build a separate fund for vacation expenses of Rs. 2 lakh (at current cost) every year 10 years from now so that the corpus so built is self-sustaining till the marriage of Stephanie.

Assumptions:

Section B (2 Mark)

Total income of an individual including long-term capital gain of Rs. 50,000/- is Rs.1,60,000/-, the tax on total income for the assessment year 2012-13 shall be: CII-12-13: 852,11-12: 785,10-11:711]

Section C (4 Mark)

Consider the following information for three mutual funds

Risk free return is 7%. Calculate Treynor measure?

Section A (1 Mark)

What is the Present Value of an annuity which pays Rs. 10,000/- for 3 years at the END of each year, assuming ROI @ 7% per annum compounded annually?

Section C (4 Mark)

A 14% semiannual-pay coupon bond has six years to maturity. The bond is currently trading at par. Using a 25 basis point change in yield, the effective duration of the bond is closest to:

Section C (4 Mark)

Read the senario and answer to the question.

Whether Mrs. Deepika as a resident individual can invest in units of Mutual Funds, Venture Funds, and Promissory notes without opening the bank account in foreign country?